- United States

- /

- Life Sciences

- /

- NasdaqGS:TEM

Tempus AI (TEM): Valuation in Focus After New Lymphoma Partnership and Breakthrough Cancer Research Reveal

Reviewed by Simply Wall St

Tempus AI (TEM) announced a multi-year partnership with the Institute for Follicular Lymphoma Innovation, expanding its research in precision medicine and biomarker discovery for lymphoma. This collaboration comes shortly after the company showcased key cancer immunotherapy findings at SITC 2025.

See our latest analysis for Tempus AI.

Tempus AI’s quick succession of high-profile collaborations and breakthrough clinical presentations has turned heads, but the real story is in the numbers. Even with a recent 30-day share price decline of 25.5%, momentum over the year remains exceptionally strong, as shown by its nearly doubling share price year-to-date and a one-year total shareholder return of 30.7%. This is evidence that the market is rewarding both the company’s growth story and strategic moves in precision oncology.

If you’re inspired by Tempus AI’s leap into new research frontiers, take a moment to discover more innovative healthcare stocks with our See the full list for free.

With shares still trading at a notable discount to analyst price targets after a year of rapid growth, investors must decide if Tempus AI is a bargain ripe for the taking or if the market has already factored in its future gains.

Most Popular Narrative: 21.4% Undervalued

Tempus AI’s most-watched narrative points to a striking valuation gap, with a fair value estimate of $87.17 against a last close of $68.48. The narrative is based on aggressive projected growth and a premium multiple that sets bold expectations for the future.

“Strong growth in testing volumes and biopharma partnerships positions Tempus AI for durable revenue gains, supported by differentiated technology and a growing data advantage. Expanding clinical-genomic offerings and disciplined cost management drive improving profitability, while rising AI adoption and regulatory clarity provide long-term growth opportunities.”

Want to know what turbocharges this ambitious valuation? The underlying assumptions hinge on explosive sales momentum and margin expansion that outpaces rivals. Curious which high-conviction figures fuel analysts’ confidence and where the narrative expects profits to soar? Dive in to see how future projections shake up the fair price calculation.

Result: Fair Value of $87.17 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising competition and regulatory uncertainties could challenge Tempus AI’s ability to sustain projected growth. This could potentially alter the current undervalued narrative.

Find out about the key risks to this Tempus AI narrative.

Another View: A Closer Look at Value Ratios

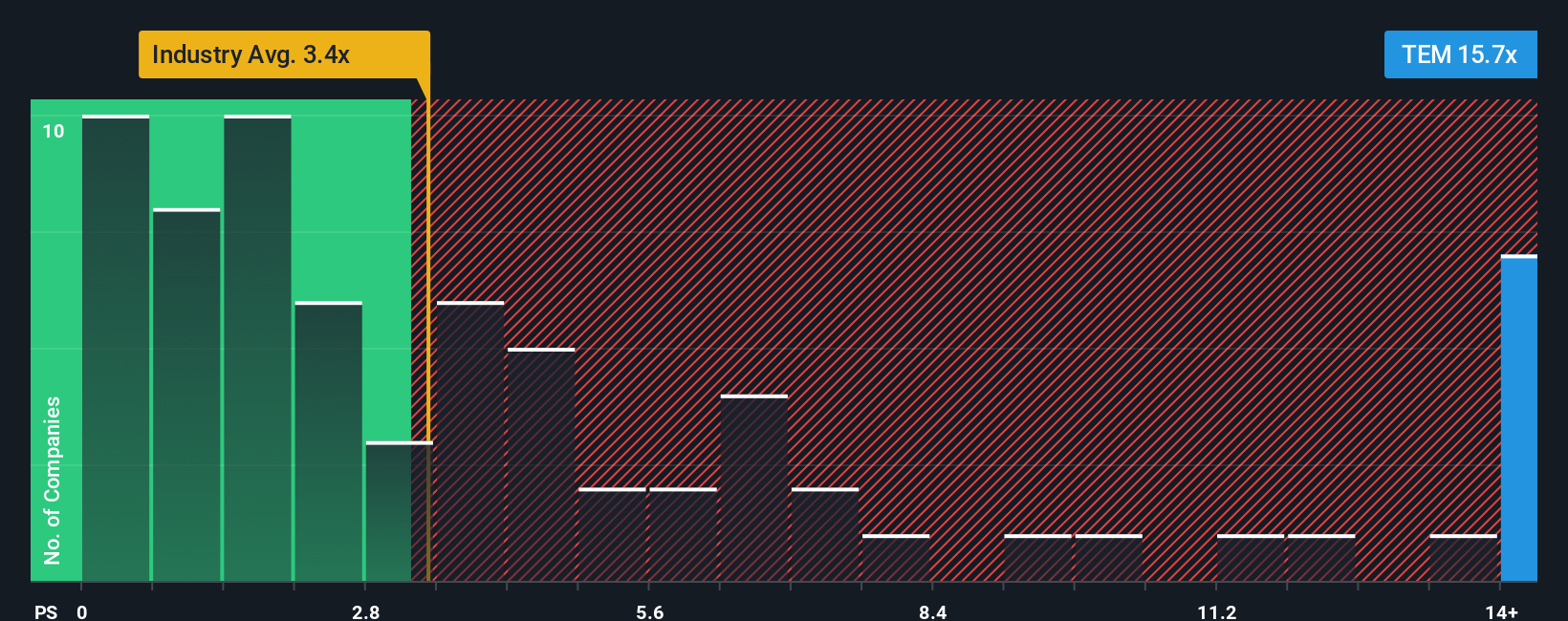

While Tempus AI’s growth story fuels bullish fair value estimates, its price-to-sales ratio tells a more cautious tale. At 11x, this is more than double the Life Sciences industry average of 3.4x and well above its peers at 5.2x. Even compared to a fair ratio of 9.1x, shares appear expensive, highlighting potential valuation risk if expectations cool. Will optimism persist, or could the market pivot to a more conservative outlook?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Tempus AI Narrative

If you see these numbers differently or want to chart your own course, you can build a unique Tempus AI narrative in just a few minutes. Do it your way

A great starting point for your Tempus AI research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors always have their eye on what’s next. Don’t let big market moves or under-the-radar opportunities pass you by. These powerful screeners can point you toward your next winning stock.

- Ride the surge in artificial intelligence by checking out these 25 AI penny stocks to uncover businesses powering tomorrow’s most disruptive tech shifts.

- Zero in on cash-generating companies offering exceptional value with these 879 undervalued stocks based on cash flows and spot overlooked stocks before the crowd catches on.

- Boost your passive income potential as you browse these 16 dividend stocks with yields > 3% to find steady-yielding investments with robust financials and sustainable dividends.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tempus AI might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TEM

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives