- United States

- /

- Life Sciences

- /

- NasdaqGS:TEM

Tempus AI (TEM) Partners With Northwestern Medicine To Enhance AI-Powered Clinical Care

Reviewed by Simply Wall St

Tempus AI (TEM) experienced a price increase of 32% last month, which can be aligned with the significant developments in their collaboration with Northwestern Medicine. This partnership and the integration of Tempus' generative AI into clinical settings may have influenced investor sentiment positively. Concurrently, Tempus announced a notable improvement in financial performance with increased revenue and reduced losses in their latest earnings report. Broader market movements also showed strength, with rising indices amid favorable economic expectations, which could have complemented Tempus' stock rally. However, the equity offering announcement might have contradicted this positive momentum by introducing potential dilution concerns.

Every company has risks, and we've spotted 2 warning signs for Tempus AI you should know about.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

The recent 32% increase in Tempus AI's share price could signal investor confidence in the company's partnership with Northwestern Medicine and its advancements in generative AI. These collaborations and technology integrations may enhance Tempus AI's revenue streams, aligning with analysts' forecasts of 20.2% annual revenue growth. However, the announcement of an equity offering could temper long-term optimism due to concerns about potential stock dilution.

Over the last year, Tempus AI's total shareholder return was 37.13%, which surpassed the US market's 18.1% return and outshone the US Life Sciences industry's negative return of 21%. This indicates stronger relative performance in both broader and sector-specific contexts, highlighting the potential resilience and investor appeal of Tempus AI amid challenging industry trends.

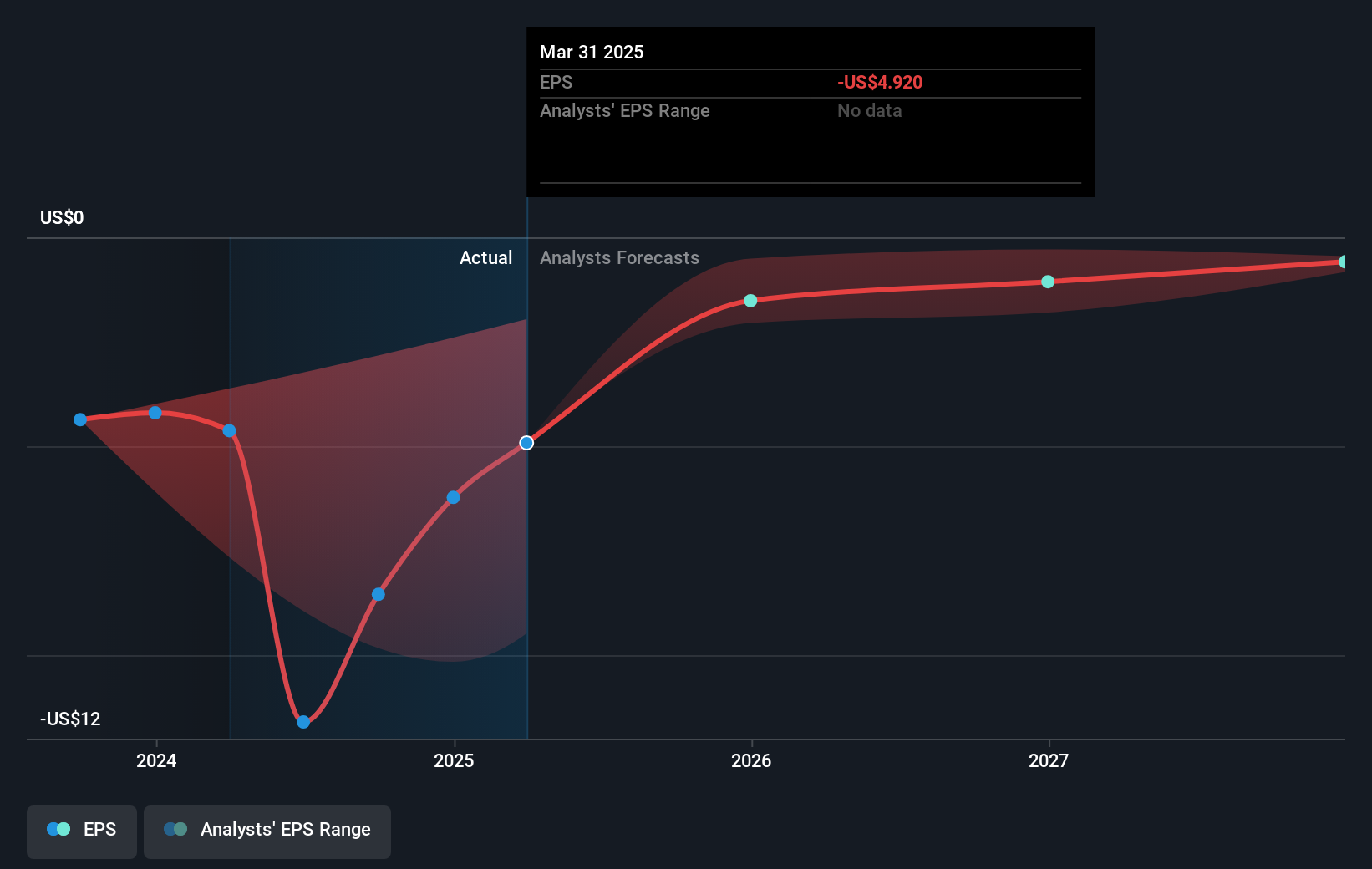

The company's ambitious revenue forecast of climbing to $2.1 billion by 2028 and an expected improvement in profit margins suggest positive long-term growth prospects. Yet, analysts predict Tempus AI will remain unprofitable over the next three years. These forecasts, combined with the current share price of $76.29 being close to the analyst price target of $71.0, imply the market is moderately optimistic but cautious about Tempus AI's ability to achieve projected earnings and margin improvements.

Our expertly prepared valuation report Tempus AI implies its share price may be too high.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tempus AI might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TEM

Fair value with limited growth.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026