- United States

- /

- Life Sciences

- /

- NasdaqGS:TEM

Does Tempus AI’s Valuation Match the Hype After Its Clinical Data Partnership Expansion?

Reviewed by Bailey Pemberton

If you’ve been watching Tempus AI’s wild trajectory lately, you’re not alone. This is one stock that’s been impossible to ignore. Whether you’re tempted to jump in or nervously weighing your next move, it’s crucial to know what’s driving all this activity and what it tells us about value. Over the past month, Tempus AI’s share price has leapt by 10.3%, though the past week brought a dip of -2.8%. But that’s just noise compared to the staggering 152.8% year-to-date return and a 91.5% gain over the past year. Clearly, something significant is happening.

Recent news helps connect the dots. Investors have responded enthusiastically to reports of Tempus AI expanding its clinical data partnerships, further strengthening its position as a leader in precision medicine. In addition, the market seems to be rapidly pricing in optimism about the company’s AI-driven diagnostics platform and its potential to disrupt the healthcare space. The buzz is loud, and volatility reflects both opportunity and a shifting perception of risk as Tempus AI seeks to deliver on that promise.

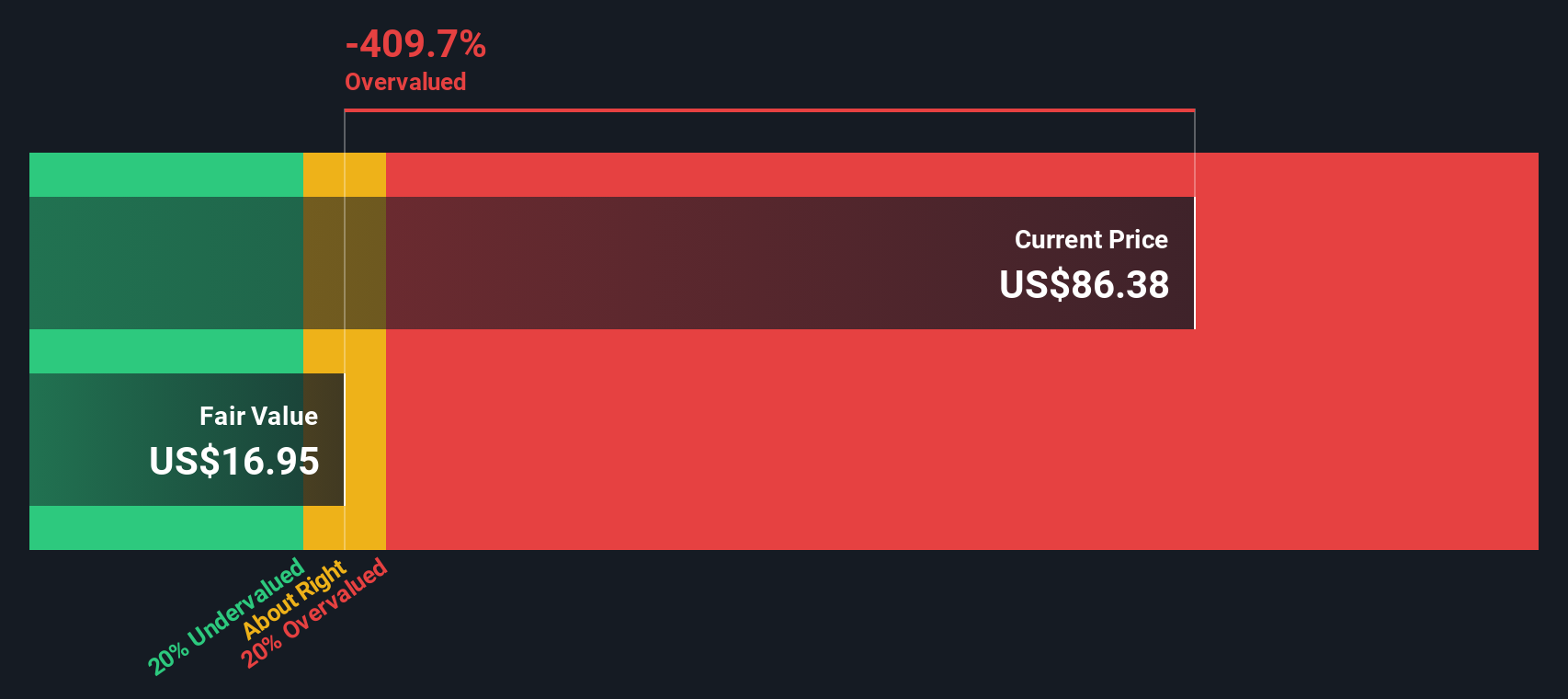

But does this hefty price surge mean Tempus AI is overvalued, or could Wall Street still be underestimating the company’s future? According to our proprietary valuation framework, Tempus AI currently scores a 2 out of 6 on undervaluation checks. In other words, the stock may rest on a foundation of excitement, but most traditional metrics do not yet flag it as deeply undervalued.

Let’s dig into those numbers. Next, I’ll break down the main valuation methods analysts use to gauge Tempus AI, and toward the end, we’ll tackle a smarter, more nuanced approach that could outshine the standard playbook.

Tempus AI scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Tempus AI Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows, then discounting them back to today’s dollars. This approach helps investors look past market noise to focus on what the business could truly be worth if it continues on its current track.

In Tempus AI’s case, the model projects rapid cash flow growth over the next decade. While the company’s latest reported Free Cash Flow is negative at -$90.10 Million, analysts expect a dramatic turnaround, estimating Free Cash Flow to reach $21.1 Million in 2026 before ramping up steeply each year. By 2029, projections hit $766.6 Million and, by 2035, Simply Wall St’s extrapolation suggests more than $1.6 Billion in discounted Free Cash Flow. All figures are in US dollars, and these numbers capture the blend of analyst short- to mid-term forecasts and algorithmic long-term scenarios.

According to this DCF analysis, Tempus AI’s fair value is $284.44 per share. Given current prices, this implies a striking 69.6% discount from underlying value. This indicates that, despite the huge recent rally, the market might still be underestimating the company’s long-term cash-generating potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Tempus AI is undervalued by 69.6%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

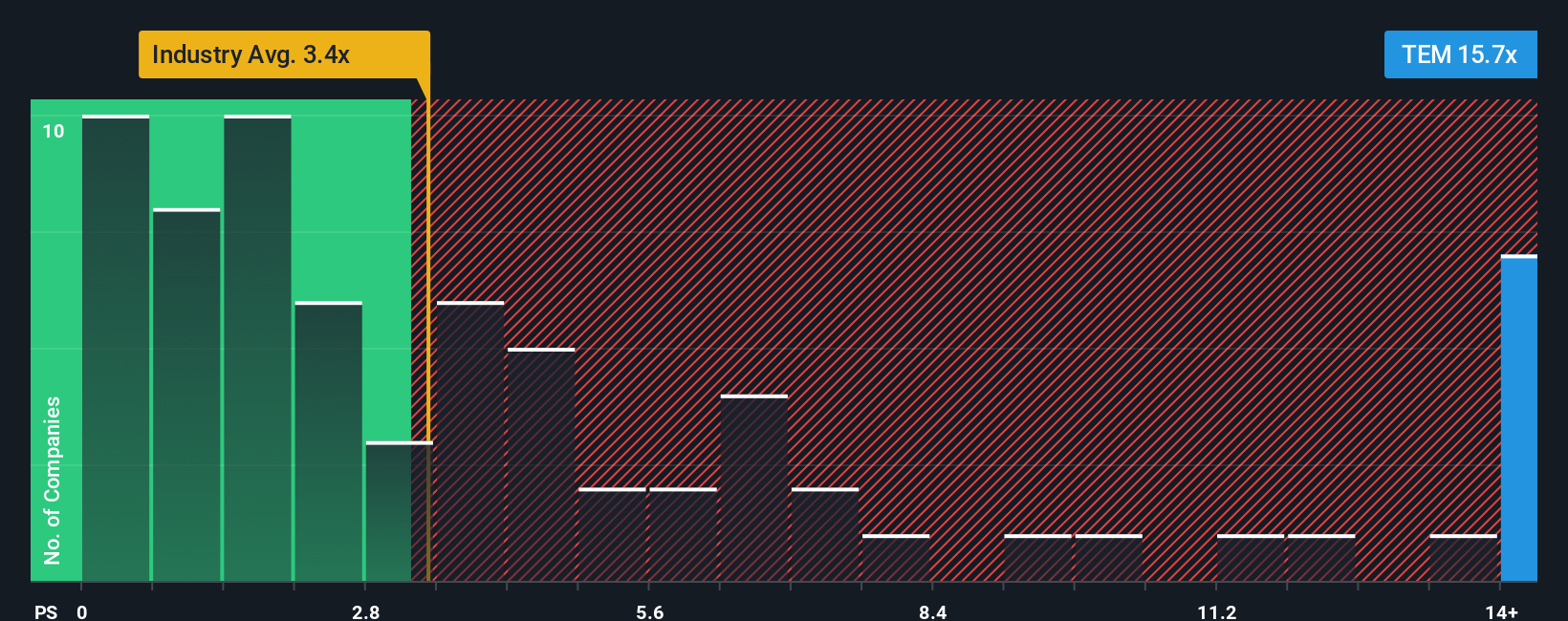

Approach 2: Tempus AI Price vs Sales

For many companies in growth mode, the Price-to-Sales (P/S) ratio is a go-to valuation tool. Because Tempus AI is not profitable yet, traditional metrics like Price-to-Earnings are not as meaningful. The P/S ratio gives a clear read on how much investors are willing to pay for every dollar of reported revenue. This is especially handy when future profit potential matters more than current margins.

Growth and risk play significant roles in shaping what counts as a “normal” or “fair” P/S ratio. If the market believes a company will grow fast and manage risk well, investors are often willing to pay a higher multiple. On the other hand, slow expected growth or elevated risks can bring that number down toward peer or industry norms.

Currently, Tempus AI trades at a P/S ratio of 15.8, which is much higher than the Life Sciences industry average of 3.5 and its peer group average of 4.7. Simply Wall St’s proprietary “Fair Ratio,” which considers Tempus AI’s earnings growth forecasts, margin profile, risks, industry sector, and market cap, is calculated at 9.6. This tailored benchmark provides more context than relying solely on peers or the broader sector, as it reflects the company's unique situation and more specific future prospects.

The takeaway is clear. With a current P/S of 15.8 and a Fair Ratio of 9.6, the valuation is markedly above what fundamentals would suggest, even for a fast-growing, high-potential company like Tempus AI. This indicates investors are paying a significant premium, possibly more than the underlying financials justify at this stage.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Tempus AI Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. Rather than just relying on financial ratios or analyst estimates, a Narrative is your personal investment story for Tempus AI. It expresses why you believe in the company’s future and outlines the fair value and performance you expect based on your own assumptions about revenue, profit margins, and risks.

Narratives connect the company's story to a transparent forecast and a calculated fair value, making it easy for anyone to see how beliefs about the business drive investment decisions. This tool is intuitive and accessible directly on the Simply Wall St Community page, where millions of investors use Narratives to guide their buy or sell choices by comparing Fair Value to current prices.

The best part is, Narratives are dynamic and update as soon as new earnings, news, or market developments emerge, helping you keep your analysis current. For example, some investors recently valued Tempus AI as high as $90, reflecting excitement over rapid AI adoption and strong clinical partnerships. Others set much lower targets, around $60, due to concerns about competition and reimbursement risks. Narratives reveal how different viewpoints shape fair values so you can invest smarter, with your story in focus.

Do you think there's more to the story for Tempus AI? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tempus AI might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TEM

Slightly overvalued with limited growth.

Similar Companies

Market Insights

Community Narratives