- United States

- /

- Life Sciences

- /

- NasdaqGS:TECH

How Investors May Respond To Bio-Techne (TECH) Expanding Global Reach With Saguaro Distribution Deal

Reviewed by Sasha Jovanovic

- Earlier this month, Saguaro Biosciences announced a new distribution agreement with Bio-Techne to leverage Bio-Techne's global sales channels, improving worldwide access to Saguaro's suite of advanced wash-free cellular dyes.

- The alliance targets unmet needs in cell-based assays for drug profiling and cytotoxicity screening, potentially expanding Bio-Techne's presence in high-growth reagent markets and supporting further product innovation.

- We'll explore how these expanded international distribution capabilities could shift Bio-Techne's investment narrative and future growth assumptions.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Bio-Techne Investment Narrative Recap

Owning Bio-Techne means believing in the long-term demand for advanced life science tools and recurring consumables, especially as precision medicine and cell-based assays become more central to drug development. The recent Saguaro Biosciences partnership modestly supports this thesis by deepening product offerings and network reach, though it does not materially alter the near-term trajectory for the company’s largest risk: muted demand from biotech and academic customers amid funding pressures and U.S. NIH budget uncertainty.

Among other recent developments, the expanded agreement with Oxford Nanopore Technologies stands out, strengthening Bio-Techne’s footprint in genetic diagnostics. This expansion aligns with the push for deeper adoption in the growing fields of precision medicine and rare disease screening, which has become one of the most important drivers for product innovation and potential top-line growth.

In contrast, investors should be aware that ongoing challenges in biotech funding could undermine even the most robust product distribution agreements if...

Read the full narrative on Bio-Techne (it's free!)

Bio-Techne's narrative projects $1.5 billion in revenue and $250.1 million in earnings by 2028. This requires 6.5% yearly revenue growth and a $176.7 million earnings increase from $73.4 million today.

Uncover how Bio-Techne's forecasts yield a $67.08 fair value, a 8% upside to its current price.

Exploring Other Perspectives

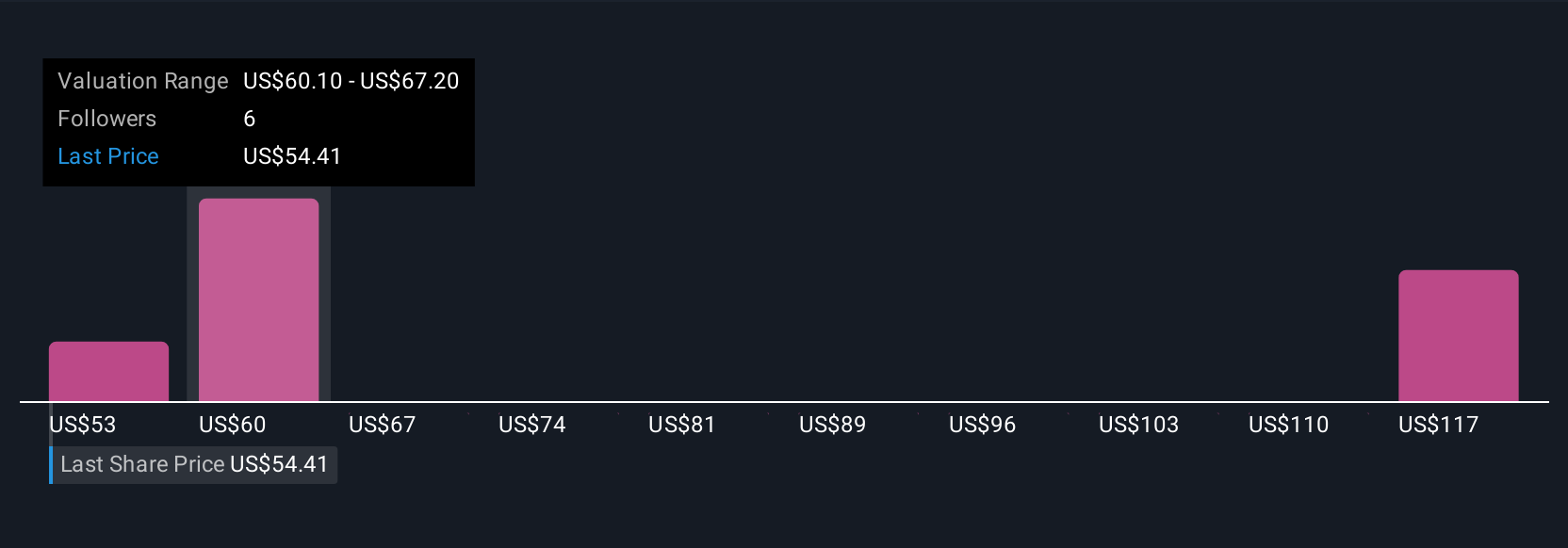

Two fair value estimates from the Simply Wall St Community span US$53 to US$67, reflecting a broad range of individual outlooks. While these views differ, growth expectations in precision medicine remain a major driver shaping future results, making it useful to explore multiple viewpoints.

Explore 2 other fair value estimates on Bio-Techne - why the stock might be worth 14% less than the current price!

Build Your Own Bio-Techne Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bio-Techne research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Bio-Techne research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bio-Techne's overall financial health at a glance.

Looking For Alternative Opportunities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bio-Techne might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TECH

Bio-Techne

Develops, manufactures, and sells life science reagents, instruments, and services for the research, diagnostics, and bioprocessing markets worldwide.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives