- United States

- /

- Life Sciences

- /

- NasdaqGS:TECH

Assessing Bio-Techne’s Opportunity After 12% Weekly Jump and Recent Industry Partnerships

Reviewed by Bailey Pemberton

- Wondering if Bio-Techne is actually good value right now? You are not alone, as plenty of investors are pausing to size up the opportunity.

- After an 11.8% jump over the past week and only a slight 0.6% gain in the last month, the stock's recent moves have sparked curiosity about its growth potential and shifting risk profile.

- Major headlines have spotlighted increased activity in the biotechnology sector, with renewed investor focus on innovation, patents, and regulatory developments. Bio-Techne itself has drawn attention for industry partnerships and acquisitions, driving much of the recent market buzz.

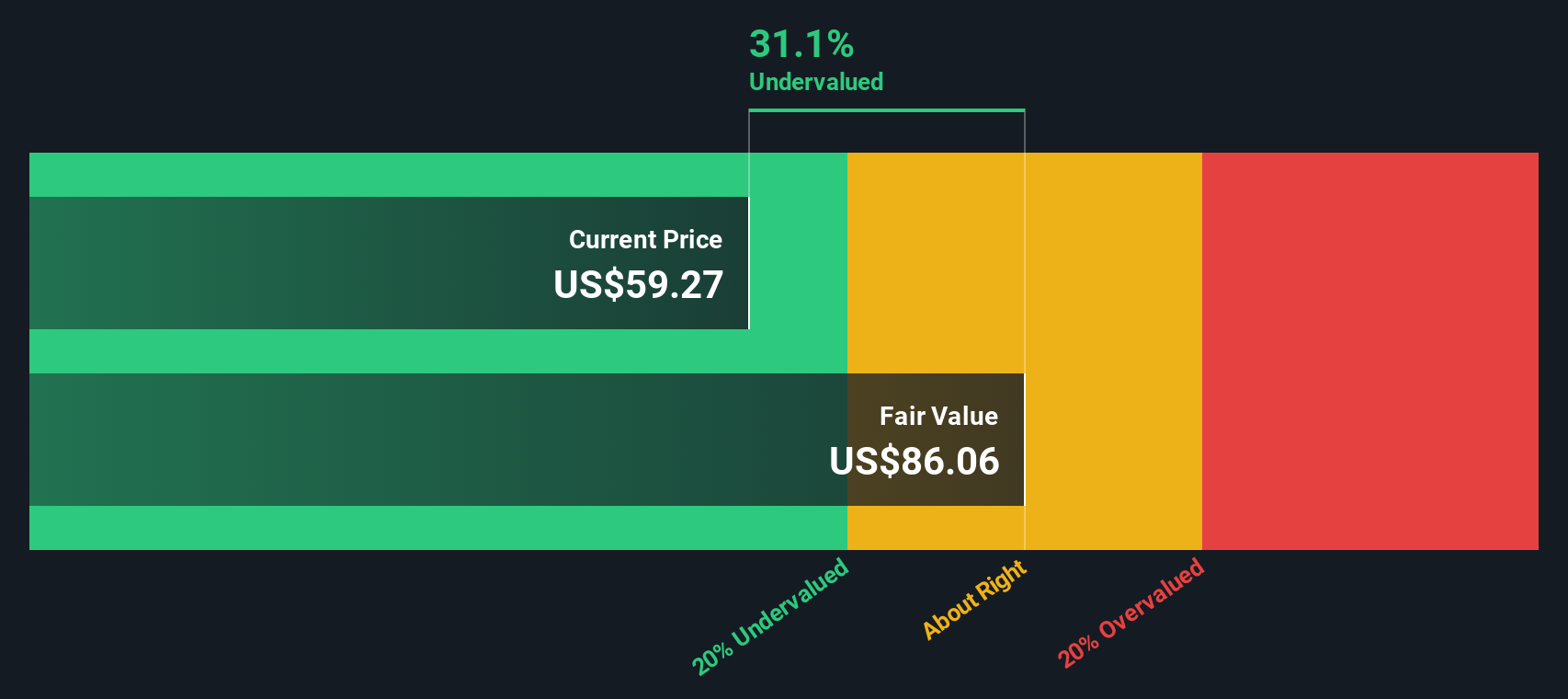

- The company's valuation score is just 1 out of 6 based on our checks, indicating it is undervalued in only one key area. Let us break down what this really means using several popular valuation approaches, and stick around for what could be a more insightful way to truly gauge its value.

Bio-Techne scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Bio-Techne Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and then discounting them back to today's dollar value. This helps investors understand what a business is worth based on its ability to generate cash in the future.

For Bio-Techne, the current Free Cash Flow (FCF) stands at $207.2 million, reflecting the company's recent ability to generate cash from its operations. Analysts project significant FCF growth over the next decade. By 2027, FCF is forecast to reach $397.4 million. Extrapolating further, the DCF model estimates that by 2035, FCF could climb to around $700.7 million, using growth estimates from multiple sources and gradual assumptions after five years as analyst estimates become less prevalent.

The DCF approach is particularly valuable when analyst forecasts are limited, as it extends the projections using reasonable assumptions to arrive at a fair value. Based on this model, the estimated intrinsic value per share for Bio-Techne is $69.85. This suggests the current share price is about 7.5% below this calculated fair value, indicating the stock is trading at a slight discount relative to its future cash flow potential.

Result: ABOUT RIGHT

Bio-Techne is fairly valued according to our Discounted Cash Flow (DCF), but this can change at a moment's notice. Track the value in your watchlist or portfolio and be alerted on when to act.

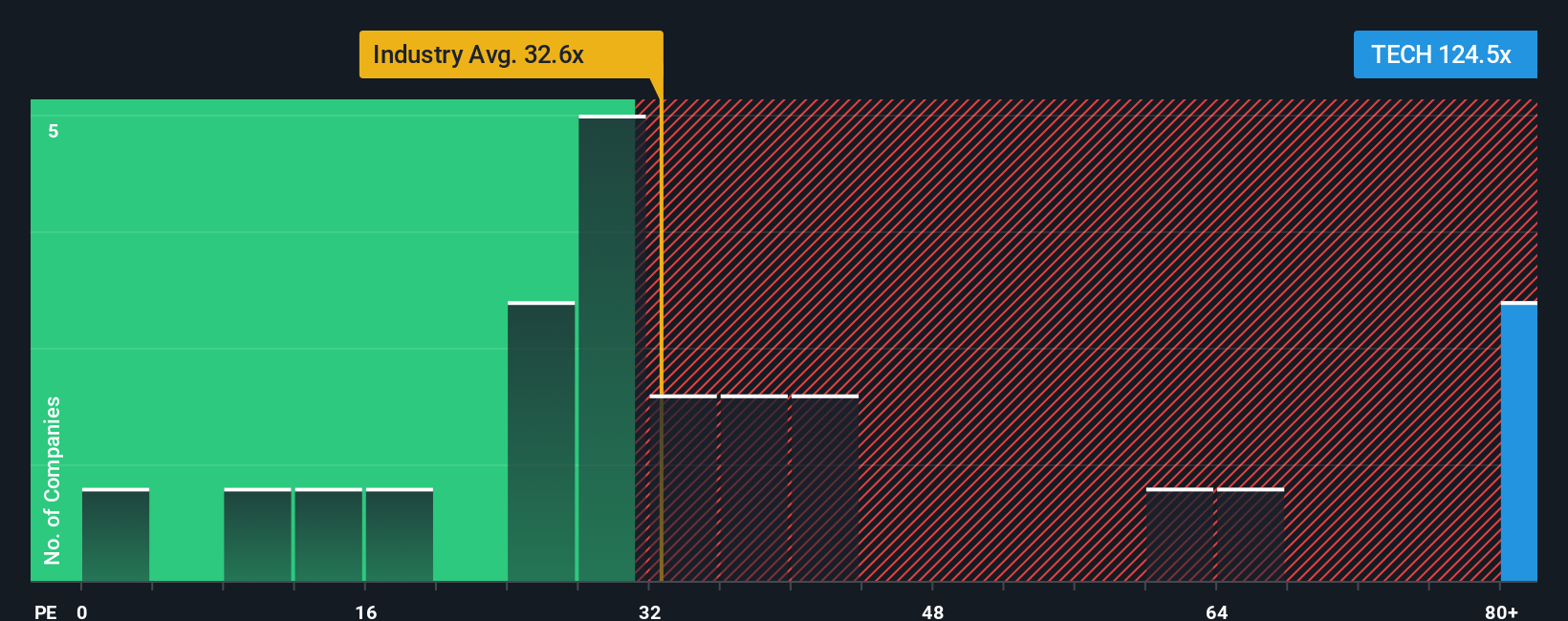

Approach 2: Bio-Techne Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used metric for valuing profitable companies like Bio-Techne because it directly links the share price to the company’s actual earnings. For stable and growing businesses, the PE ratio offers a straightforward way to gauge what investors are willing to pay for each dollar of profit.

What counts as a “normal” or “fair” PE ratio, however, depends on several factors. Companies with higher growth prospects or lower risk typically command higher PE ratios, while those facing uncertainty or slower growth may trade at lower multiples.

Currently, Bio-Techne’s PE ratio stands at 129x. This is substantially higher than both the Life Sciences industry average of 34.6x and the average of its peers at 34.6x. At first glance, this makes the stock appear expensive compared to similar companies in its sector.

To provide a more tailored assessment, Simply Wall St calculates a proprietary “Fair Ratio.” In Bio-Techne’s case, the Fair Ratio is 25.7x. The Fair Ratio goes a step beyond basic benchmarks by analyzing crucial factors such as the company’s earnings growth, profit margins, size, and risk profile. This gives investors a dynamic valuation tailored to the business rather than a one-size-fits-all comparison.

Since Bio-Techne’s current PE of 129x is well above its Fair Ratio of 25.7x, the stock appears overvalued when these factors are taken into account.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1433 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Bio-Techne Narrative

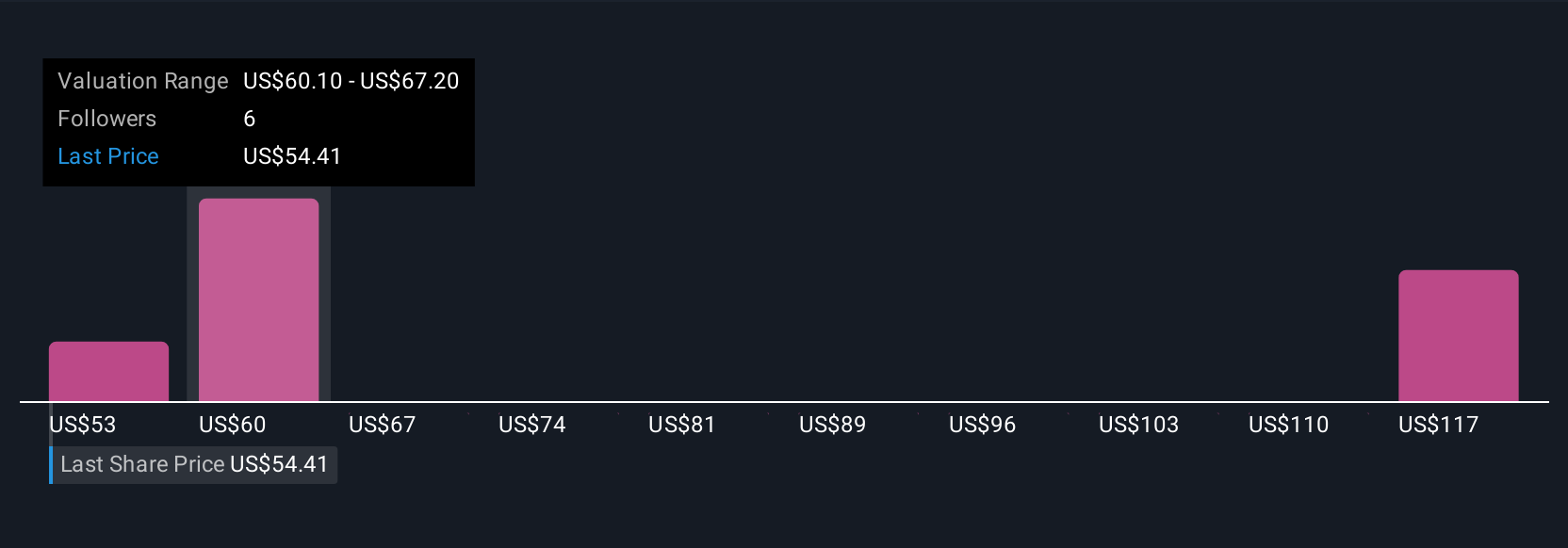

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is a simple yet powerful way to put your own story behind Bio-Techne’s numbers by combining your personal assumptions on future revenue, earnings, and profit margins to estimate a fair value for the stock.

Unlike traditional models that focus only on historic data or averages, Narratives connect Bio-Techne’s business story, your financial outlook, and a fair value calculation all in one place. They make it easy for investors to see how their expectations about products, risks, or market opportunities translate into a decision to buy, sell, or hold, by directly comparing your Fair Value to the current share price.

On Simply Wall St's Community page, used by millions of investors worldwide, anyone can create or explore Narratives for Bio-Techne, even as new information arrives, like news events or earnings updates, instantly refreshing your fair value.

For example, some investors see strong innovation and successful buybacks justifying a bullish price target of $75, while others are more cautious, citing global risks or competition, and set their fair value closer to $53. Narratives give you the tools and context to make informed investment decisions based on your unique perspective and the latest insights.

Do you think there's more to the story for Bio-Techne? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bio-Techne might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TECH

Bio-Techne

Develops, manufactures, and sells life science reagents, instruments, and services for the research, diagnostics, and bioprocessing markets worldwide.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success