- United States

- /

- Pharma

- /

- NasdaqGS:TARS

Tarsus Pharmaceuticals (TARS): Losses Deepen 39.9% Annually, Bullish Growth Narrative Faces Profitability Test

Reviewed by Simply Wall St

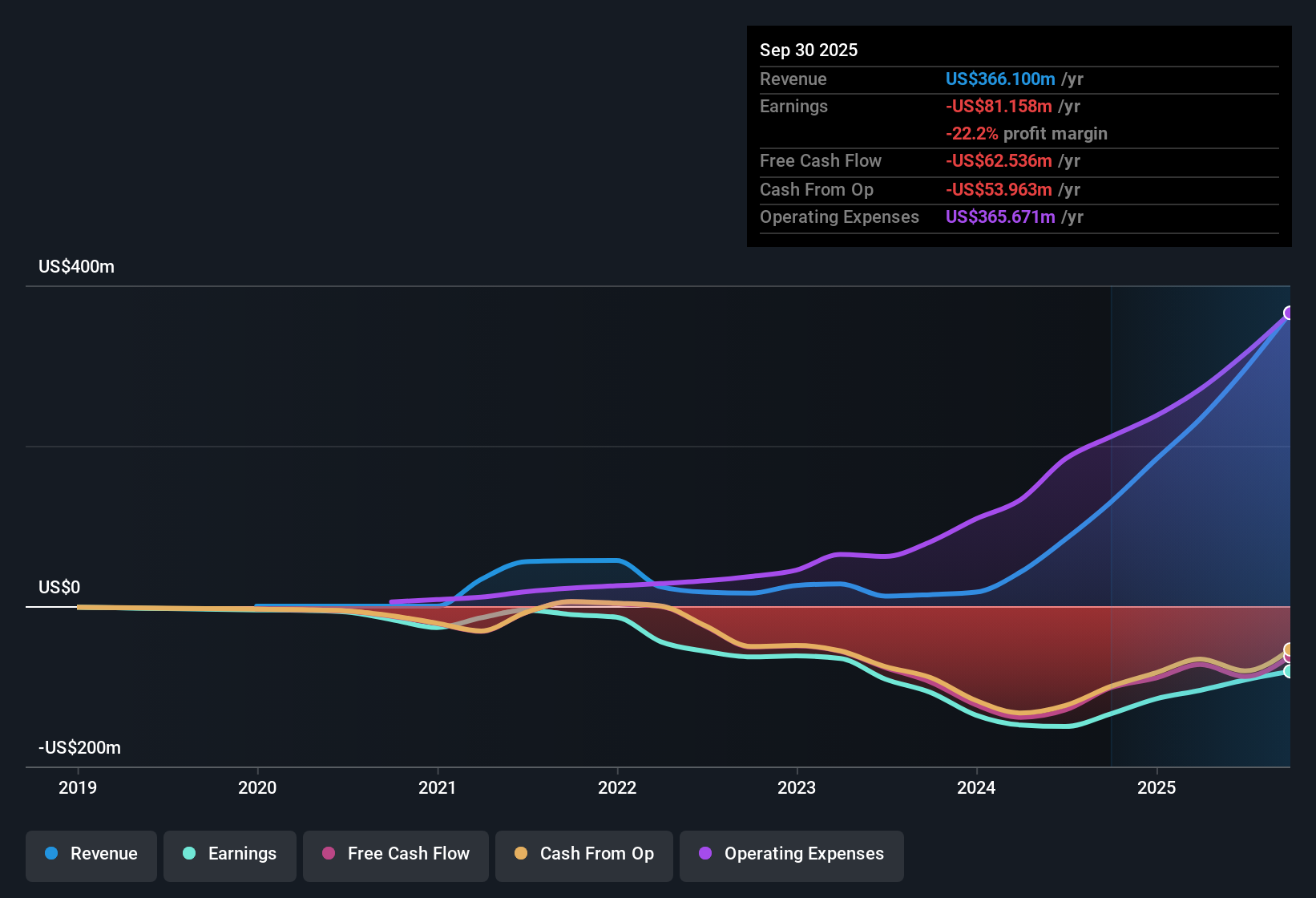

Tarsus Pharmaceuticals (TARS) remains unprofitable, with annual losses having deepened at a rate of 39.9% per year over the past five years and no improvement in net profit margins in the latest period. Looking forward, revenue is forecast to grow 20.8% per year, outpacing the broader US market’s 10.5% growth. Earnings are projected to surge 115.27% annually, positioning the company for a potential move to profitability within the next three years. Investors watching Tarsus are weighing these rapid expected growth metrics against its historic trend of widening losses as they anticipate how upcoming quarters might shift the earnings narrative.

See our full analysis for Tarsus Pharmaceuticals.Now it’s time to see how the numbers play out against the broader market narratives, comparing investor expectations with the latest results from Tarsus Pharmaceuticals.

See what the community is saying about Tarsus Pharmaceuticals

Margin Shift: From -31.1% to 28.0% in Analyst Forecasts

- Profit margins are projected to swing from -31.1% today to 28.0% in roughly three years, according to analysts’ consensus. This signals a dramatic margin turnaround anchored in expectations for higher sales and improved operational leverage.

- Analysts' consensus view points out a powerful catalyst in the North American market:

- Broader insurance coverage now spans 90% of US plans, directly lowering reimbursement headwinds and supporting a more durable profit expansion as margins recover.

- However, heavy spending on sales and direct-to-consumer campaigns is required to drive prescription growth. If these expenses outpace structural costs, it could blunt the margin upside analysts anticipate.

- To see the full consensus narrative on how Tarsus could transition from steep losses to margin leadership, dig deeper with the detailed forecast narrative: 📊 Read the full Tarsus Pharmaceuticals Consensus Narrative.

Revenue Runs Ahead of Industry, But Concentration Risk Looms

- Annualized revenue growth of 20.8% for Tarsus outpaces the US pharmaceutical industry’s historical average of 10.5%. This outperformance is heavily tethered to the adoption of a single product, XDEMVY, leaving the company exposed if patient or physician buy-in stalls.

- According to the analysts' consensus narrative:

- Rapid direct-to-consumer efforts and demographic tailwinds (aging population, prevalence of Demodex) are set to boost the addressable market and drive future top-line growth.

- However, any faltering in XDEMVY uptake, increased sales force expenses, or sluggish secondary pipeline progress could quickly flip the growth story into a cautionary tale, especially given limited diversification at this stage.

Valuation Tension: Discounted Cash Flow Points to Deep Upside

- Tarsus trades at $68.20, well below its DCF fair value of $300.40. Its price-to-sales ratio (9.8x) is steep compared to the US pharma industry average (4.2x) and is only attractive relative to higher-priced peers (18.4x).

- The analysts' consensus narrative emphasizes that, even factoring in the consensus price target of $84.38, the current share price offers a roughly 24% implied upside. To justify this, investors must believe Tarsus can reach $846.8 million in annual revenues and a PE of 19.9x by 2028, both aggressive assumptions that add pressure to deliver on ambitious growth promises.

- This valuation gap creates an opportunity if forecasts are met, but the premium to industry averages means risk is elevated if execution on growth or profitability slips.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Tarsus Pharmaceuticals on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a fresh take on the figures? Put your unique view into a narrative and get started shaping your outlook in just minutes. Do it your way

A great starting point for your Tarsus Pharmaceuticals research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Tarsus Pharmaceuticals’ heavy dependence on a single product and aggressive growth targets make its story riskier compared to companies with more reliable track records.

If consistent execution is a priority for you, use our stable growth stocks screener (2072 results) to quickly find businesses delivering steady growth and minimizing those single-product risks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tarsus Pharmaceuticals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TARS

Tarsus Pharmaceuticals

A commercial stage biopharmaceutical company, focuses on the development and commercialization of therapeutic candidates for eye care in the United States.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives