- United States

- /

- Pharma

- /

- NasdaqGS:TARS

Tarsus Pharmaceuticals (TARS) Is Up 6.1% After Analyst Upgrades Highlight XDEMVY Sales Momentum

Reviewed by Sasha Jovanovic

- In recent days, analysts issued upgrades and initiated positive coverage for Tarsus Pharmaceuticals, highlighting rapid commercialization of XDEMVY, the only approved treatment for Demodex blepharitis.

- An important insight is that analyst optimism centers around XDEMVY’s accelerating sales growth and significant untapped patient potential in the U.S. market.

- We’ll examine how renewed analyst confidence in XDEMVY’s rollout may influence Tarsus Pharmaceuticals’ growth and earnings outlook going forward.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Tarsus Pharmaceuticals Investment Narrative Recap

To believe in Tarsus Pharmaceuticals as a shareholder today, you have to be confident in the sustained, rapid adoption of XDEMVY, the company’s only approved product, within the large and still-untapped U.S. patient population, as well as the ability to translate near-term sales momentum into long-term profitability. While the string of analyst upgrades points to optimism about XDEMVY’s accelerating rollout, this doesn’t materially reduce the biggest short-term risk: heavy reliance on a single drug and whether uptake will remain strong enough to outpace high expenses.

Among company updates, Tarsus’s recent revenue guidance for full year 2025, forecasting annual revenue between US$440 million and US$445 million, stands out. This announcement directly relates to the catalysts fueling analyst outlooks and will be closely watched for signals that actual XDEMVY adoption matches bullish expectations highlighted by the new coverage.

Yet, even with broad analyst support, investors should be aware that if physician or patient uptake falls short in coming quarters, especially given existing cost pressures…

Read the full narrative on Tarsus Pharmaceuticals (it's free!)

Tarsus Pharmaceuticals' narrative projects $846.8 million in revenue and $237.0 million in earnings by 2028. This outlook requires 42.0% annual revenue growth and a $329.0 million increase in earnings from the current level of -$92.0 million.

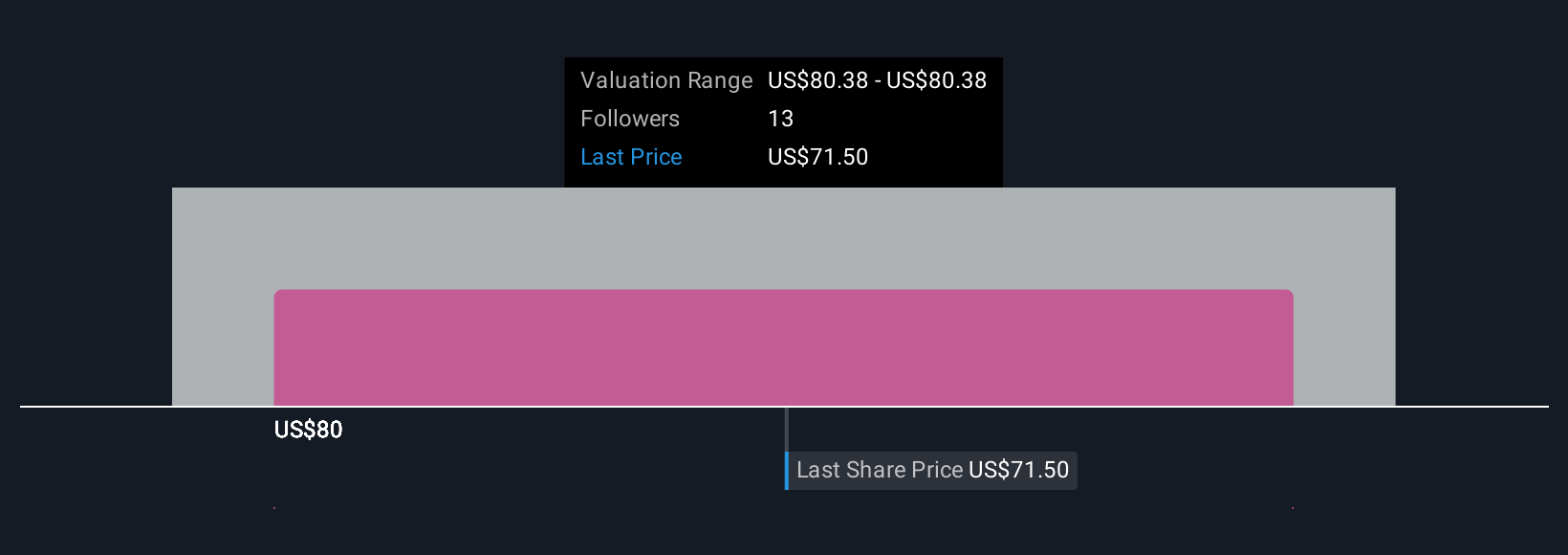

Uncover how Tarsus Pharmaceuticals' forecasts yield a $84.25 fair value, a 9% upside to its current price.

Exploring Other Perspectives

Two voices in the Simply Wall St Community estimate Tarsus Pharmaceuticals’ fair value from US$84.25 up to a striking US$392.35 per share. With such divergence across individual outlooks and ongoing focus on single-product adoption rates, you can compare several alternate viewpoints to see how opinions might shift as new results come in.

Explore 2 other fair value estimates on Tarsus Pharmaceuticals - why the stock might be worth just $84.25!

Build Your Own Tarsus Pharmaceuticals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Tarsus Pharmaceuticals research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Tarsus Pharmaceuticals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Tarsus Pharmaceuticals' overall financial health at a glance.

Seeking Other Investments?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tarsus Pharmaceuticals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TARS

Tarsus Pharmaceuticals

A commercial stage biopharmaceutical company, focuses on the development and commercialization of therapeutic candidates for eye care in the United States.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives