- United States

- /

- Biotech

- /

- NasdaqGS:SYRE

Why Spyre Therapeutics (SYRE) Is Up 9.1% After Dosing First Patient in Phase 2 SPY072 Trial

Reviewed by Sasha Jovanovic

- Spyre Therapeutics announced that the first patient has been dosed in its Phase 2 SKYWAY basket trial evaluating SPY072 for the treatment of rheumatoid arthritis, psoriatic arthritis, and axial spondyloarthritis.

- This trial features an antibody engineered for extended half-life and potent TL1A inhibition, aiming to address unmet needs in autoimmune diseases affecting over 3 million people in the United States.

- We’ll explore how advancing to Phase 2 trials for SPY072 strengthens Spyre Therapeutics’ investment narrative in immunology innovation.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

What Is Spyre Therapeutics' Investment Narrative?

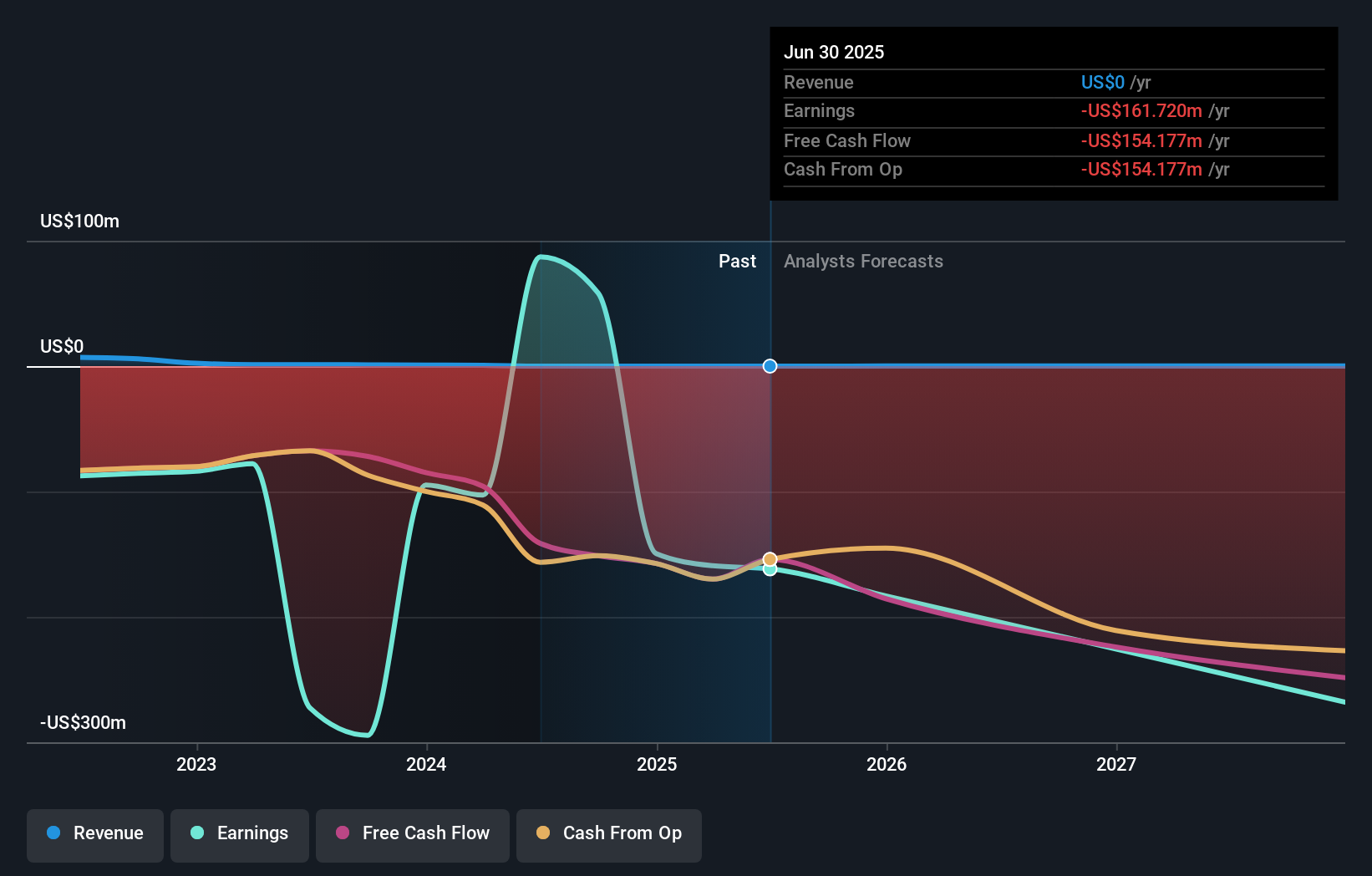

For shareholders in Spyre Therapeutics, belief in the company rests on the potential for its antibody pipeline, most notably SPY072, to reshape treatment standards across significant autoimmune conditions. With the recent Phase 2 trial dosing for SPY072, Spyre attempts to address a large, underserved market, making this news a near-term catalyst with the power to shift investor focus, at least temporarily, toward clinical progress. While topline data are not expected until 2026, early progress in recruitment and trial execution could relieve some pressure from ongoing clinical and regulatory risks. However, with Spyre still posting losses, lacking material revenue, and not forecast to turn profitable within three years, financial uncertainties remain a central risk. The market’s reaction so far points to cautious optimism, but it does little to erase the need for strong trial outcomes and operational discipline going forward. Yet, beneath the promising clinical news, investors should still weigh the persistent risk of ongoing losses.

In light of our recent valuation report, it seems possible that Spyre Therapeutics is trading beyond its estimated value.Exploring Other Perspectives

Explore 2 other fair value estimates on Spyre Therapeutics - why the stock might be worth over 3x more than the current price!

Build Your Own Spyre Therapeutics Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Spyre Therapeutics research is our analysis highlighting 1 key reward and 5 important warning signs that could impact your investment decision.

- Our free Spyre Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Spyre Therapeutics' overall financial health at a glance.

Looking For Alternative Opportunities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 31 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SYRE

Spyre Therapeutics

A clinical stage biotechnology company, focuses on developing therapeutics for patients living with inflammatory bowel disease (IBD).

Flawless balance sheet with moderate risk.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success