- United States

- /

- Biotech

- /

- NasdaqGS:SYRE

Does Positive Phase 1 Data for SPY003 Change the Bull Case for Spyre Therapeutics (SYRE)?

Reviewed by Sasha Jovanovic

- Spyre Therapeutics recently announced positive interim Phase 1 results for its lead investigational antibody, SPY003, highlighting an approximately 85-day half-life and favorable safety outcomes.

- The newly reported data supports the potential for quarterly or twice-annual maintenance dosing, reinforcing confidence in Spyre’s development prospects for inflammatory bowel disease therapies.

- We'll now explore how the promising Phase 1 results for SPY003 may influence Spyre Therapeutics' investment narrative and growth outlook.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Spyre Therapeutics' Investment Narrative?

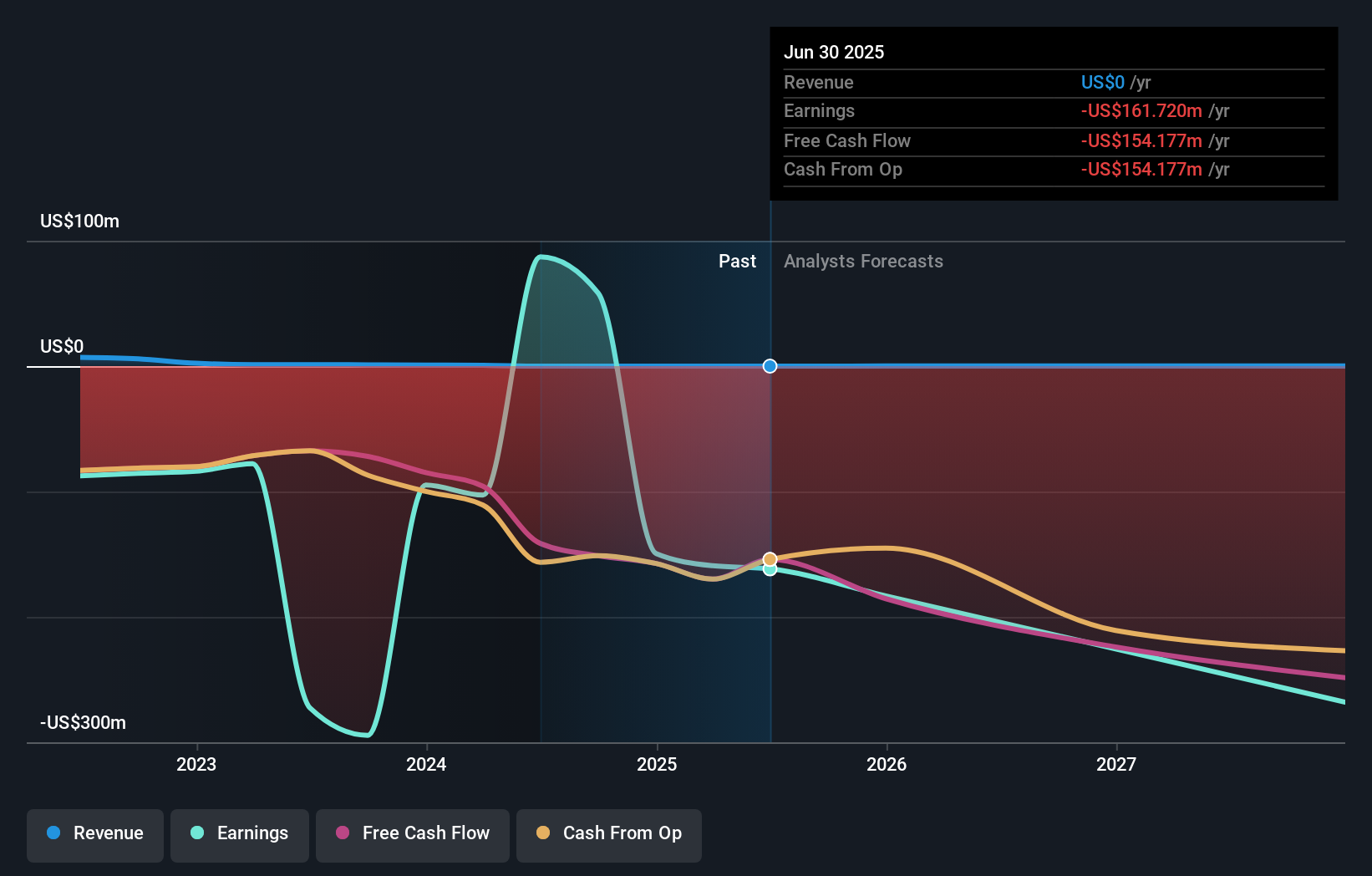

For shareholders in Spyre Therapeutics, the core belief driving investment centers on whether the company can translate its innovative IBD pipeline, especially SPY003, into meaningful clinical and commercial milestones. The recent disclosure of positive interim Phase 1 results for SPY003, showing favorable safety and an 85-day half-life, gives fresh confidence in the program and its quarterly or twice-yearly dosing promise. This strengthens the short-term catalysts, particularly as SPY003 advances toward the Phase 2 SKYLINE trial, and helps counter some earlier skepticism about near-term progress. That said, Spyre remains unprofitable, faces ongoing dilution, and, despite its strong cash runway, is still dependent on future trial outcomes and regulatory review. While the company’s losses are narrowing, regulatory and execution risks are likely to stay front of mind, making clinical data the focal point for the stock’s immediate direction. Yet, even the most promising data leaves open the possibility of regulatory setbacks, a risk current and future shareholders should keep in mind.

Our valuation report here indicates Spyre Therapeutics may be overvalued.Exploring Other Perspectives

Explore 2 other fair value estimates on Spyre Therapeutics - why the stock might be worth less than half the current price!

Build Your Own Spyre Therapeutics Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Spyre Therapeutics research is our analysis highlighting 1 key reward and 5 important warning signs that could impact your investment decision.

- Our free Spyre Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Spyre Therapeutics' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SYRE

Spyre Therapeutics

A clinical stage biotechnology company, focuses on developing therapeutics for patients living with inflammatory bowel disease (IBD).

Flawless balance sheet with moderate risk.

Market Insights

Community Narratives