- United States

- /

- Biotech

- /

- NasdaqCM:SYBX

Synlogic (NASDAQ:SYBX) Share Prices Have Dropped 67% In The Last Three Years

It is doubtless a positive to see that the Synlogic, Inc. (NASDAQ:SYBX) share price has gained some 73% in the last three months. But over the last three years we've seen a quite serious decline. Indeed, the share price is down a tragic 67% in the last three years. Some might say the recent bounce is to be expected after such a bad drop. The rise has some hopeful, but turnarounds are often precarious.

See our latest analysis for Synlogic

Synlogic recorded just US$1,776,000 in revenue over the last twelve months, which isn't really enough for us to consider it to have a proven product. We can't help wondering why it's publicly listed so early in its journey. Are venture capitalists not interested? So it seems shareholders are too busy dreaming about the progress to come than dwelling on the current (lack of) revenue. It seems likely some shareholders believe that Synlogic has the funding to invent a new product before too long.

We think companies that have neither significant revenues nor profits are pretty high risk. There is usually a significant chance that they will need more money for business development, putting them at the mercy of capital markets to raise equity. So the share price itself impacts the value of the shares (as it determines the cost of capital). While some such companies go on to make revenue, profits, and generate value, others get hyped up by hopeful naifs before eventually going bankrupt. Some Synlogic investors have already had a taste of the bitterness stocks like this can leave in the mouth.

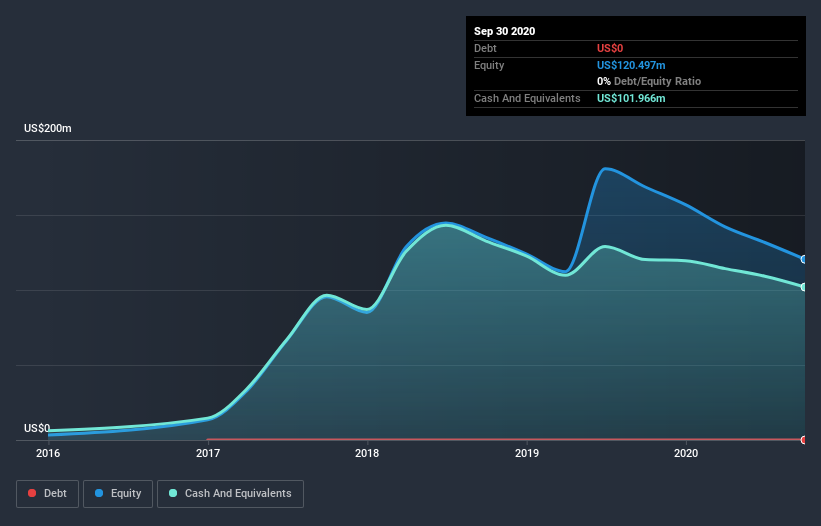

When it last reported its balance sheet in September 2020, Synlogic had cash in excess of all liabilities of US$74m. While that's nothing to panic about, there is some possibility the company will raise more capital, especially if profits are not imminent. With the share price down 19% per year, over 3 years , it seems likely that the need for cash is weighing on investors' minds. The image below shows how Synlogic's balance sheet has changed over time; if you want to see the precise values, simply click on the image.

In reality it's hard to have much certainty when valuing a business that has neither revenue or profit. What if insiders are ditching the stock hand over fist? I'd like that just about as much as I like to drink milk and fruit juice mixed together. You can click here to see if there are insiders selling.

A Different Perspective

Over the last year Synlogic shareholders have received a TSR of 18%. It's always nice to make money but this return falls short of the market return which was about 22% for the year. On the bright side, that's certainly better than the yearly loss of about 19% endured over the last three years, implying that the company is doing better recently. It could well be that the business is stabilizing. It's always interesting to track share price performance over the longer term. But to understand Synlogic better, we need to consider many other factors. Even so, be aware that Synlogic is showing 4 warning signs in our investment analysis , you should know about...

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

When trading Synlogic or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqCM:SYBX

Synlogic

A biopharmaceutical company, engages in the discovery and development of synthetic biotics to treat metabolic diseases in the United States.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives