- United States

- /

- Pharma

- /

- NasdaqGM:SUPN

What Do Supernus’s Surging 2025 Returns Signal After Regulatory Progress?

Reviewed by Bailey Pemberton

Thinking about what to do with your Supernus Pharmaceuticals shares? You’re not alone. With the stock closing recently at $52.02, investors are buzzing about its next move. Over just the last week, Supernus has notched a 4.5% gain, extending its strong track record. The stock is up 42.8% year-to-date, 53.9% over the past year, and a remarkable 183.5% in five years. Those are eye-catching numbers, and they have prompted a wave of optimism that the market might finally be recognizing the company’s potential.

Behind these impressive returns, news of regulatory progress, product pipeline updates, and strategic acquisitions has kept Supernus in the spotlight. Investors seem more comfortable than ever with the company’s growth outlook, and a recent wave of more positive sentiment has added fuel to the rally. But has the excitement gone too far, or is there still room for upside?

One way to cut through the noise is to look at valuation. Using six objective checks, Supernus earns a valuation score of 2, meaning it appears undervalued by two out of six measures. In the next section, we will break down each of these approaches, their strengths and weaknesses, and what they say about Supernus right now. Stick around, though, because we will also look at a smarter, more comprehensive way to judge if Supernus is truly a buy.

Supernus Pharmaceuticals scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Supernus Pharmaceuticals Discounted Cash Flow (DCF) Analysis

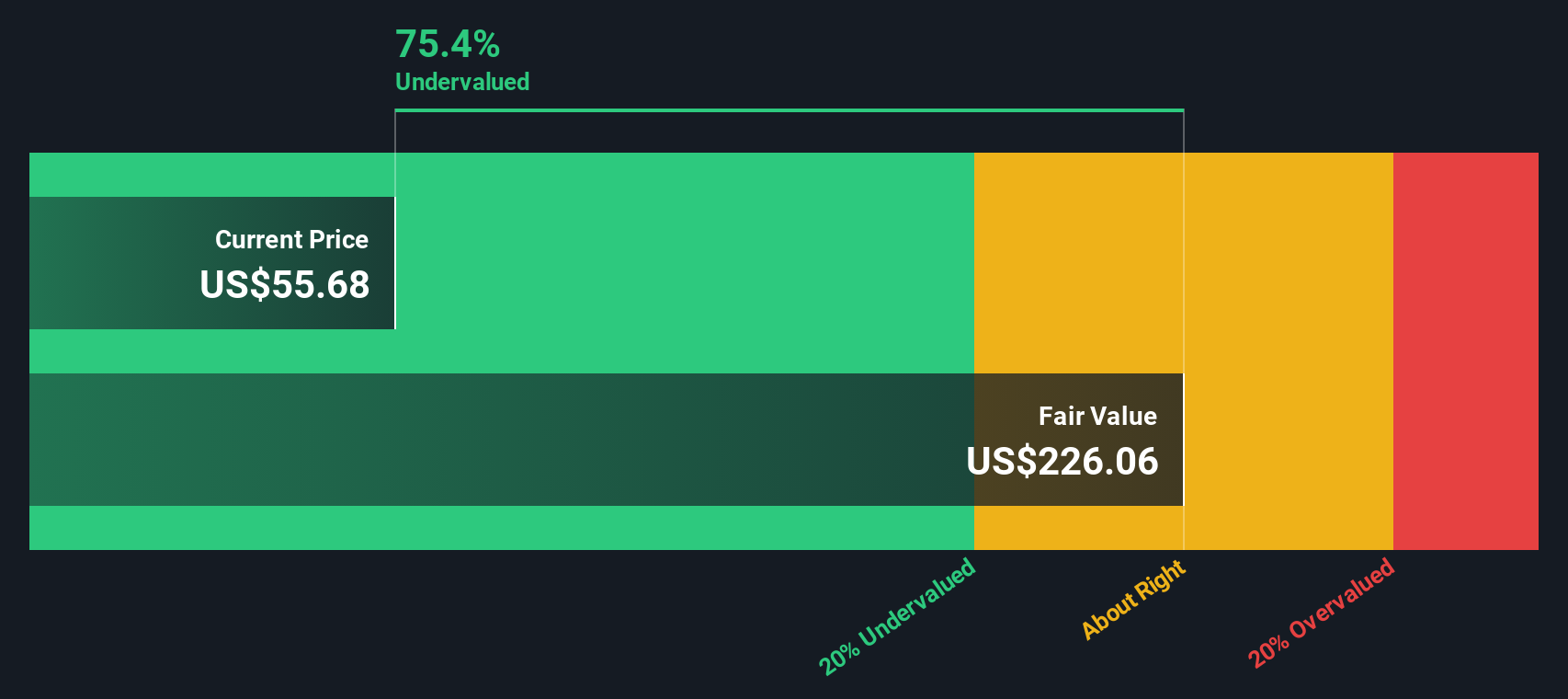

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them back to today's dollars. This gives investors a sense of what the business is really worth if held over the long term. For Supernus Pharmaceuticals, this approach starts with its latest twelve-month Free Cash Flow (FCF) of $186.3 million and factors in both analyst forecasts and longer-term projections.

According to analysts, FCF is expected to climb steadily over the next few years, reaching $408.2 million by 2029. Beyond that, further growth is extrapolated, showing a broad expansion in cash generation over the next decade. All figures are reported in US dollars.

When today's share price is compared to the DCF-calculated fair value of $226.06, Supernus appears deeply undervalued. The implied discount is about 77.0%, meaning the market currently prices the company far below what its future cash flows suggest it is worth.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Supernus Pharmaceuticals is undervalued by 77.0%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

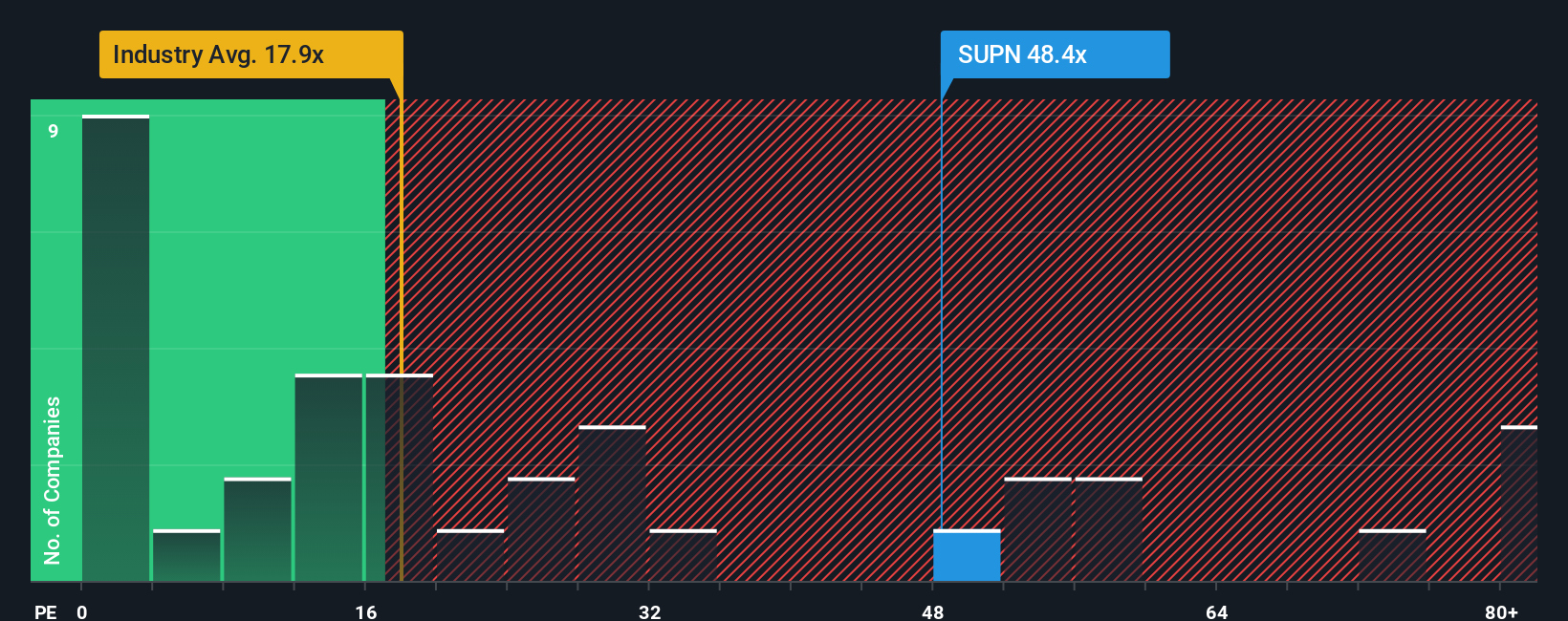

Approach 2: Supernus Pharmaceuticals Price vs Earnings (PE)

The Price-to-Earnings (PE) ratio is often the go-to metric for valuing established, profitable companies. It gives investors a quick snapshot of how much they are paying for each dollar of earnings, making it especially relevant for a business like Supernus Pharmaceuticals, which has shown consistent profitability.

PE ratios are far from one-size-fits-all, though. A company's growth prospects and risk profile play a big part in what counts as a “normal” or “fair” PE. Fast-growing or lower-risk companies typically warrant higher multiples, while slower growth or higher uncertainty should mean lower ones.

Supernus currently trades at a PE of 45x, which is well above the industry average of 18.5x and the peer average of 25.4x. That kind of premium might seem high at first glance, but it does not tell the full story.

Enter the Simply Wall St Fair Ratio, a proprietary yardstick that calculates how much investors should be willing to pay for Supernus, factoring in not just industry averages but also the company’s growth outlook, margins, scale, and risk profile. This makes it more insightful than simply comparing to peers or industry benchmarks.

For Supernus Pharmaceuticals, the Fair Ratio is 26.6x. This is still well below the actual PE of 45x, meaning the stock is currently trading on a premium that outpaces what would be justified by company-specific fundamentals and risks.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

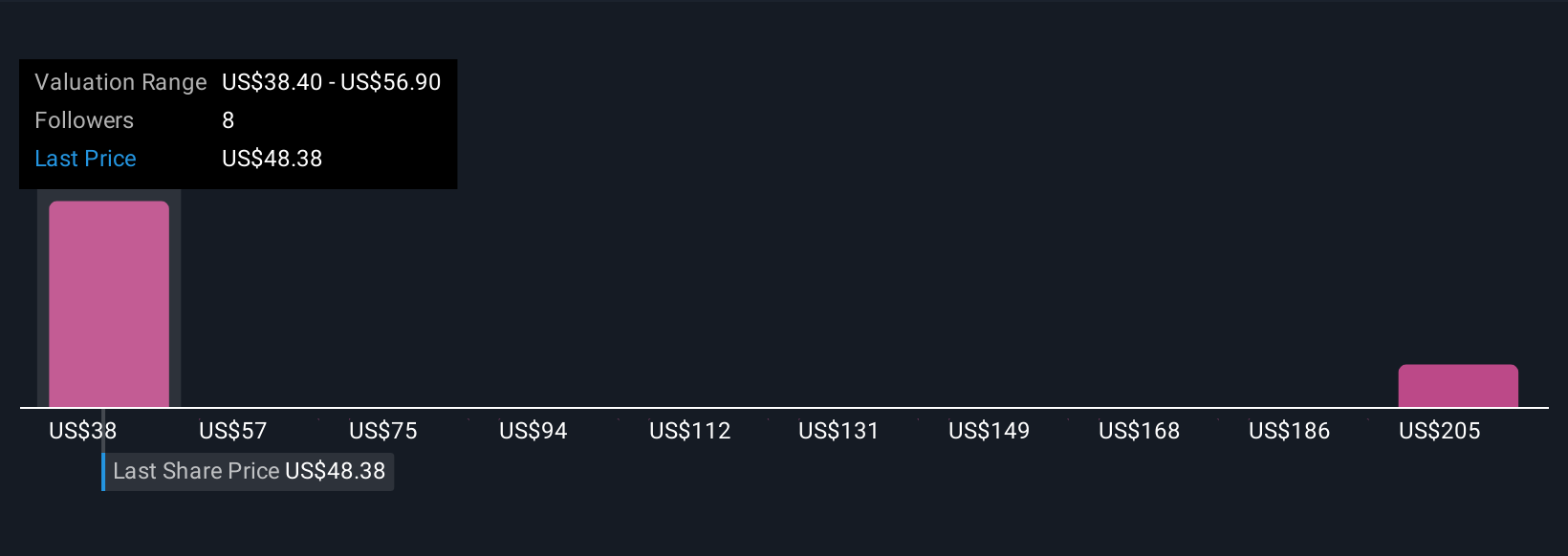

Upgrade Your Decision Making: Choose your Supernus Pharmaceuticals Narrative

Earlier, we mentioned an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is your personal story and outlook for a company. It connects what you believe about Supernus Pharmaceuticals’s future, such as sales, margins, and growth, to a clear financial forecast and a fair value estimate. Narratives turn investing from just crunching numbers into a dynamic, easy-to-use tool available right inside the Simply Wall St platform’s Community page, already used by millions of investors. With Narratives, you can see at a glance whether today’s price is above or below your fair value, helping you decide when to buy or sell. They are also automatically updated as new earnings or news arrive, so your investment thesis stays current. For example, while one investor might see Supernus as worth $65 per share based on aggressive growth of drugs like Qelbree and ONAPGO, another might estimate a more cautious $36 due to concerns about competition or regulatory risk. Both investors can track how real world events shift the story and whether their investment decision still holds.

Do you think there's more to the story for Supernus Pharmaceuticals? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:SUPN

Supernus Pharmaceuticals

A biopharmaceutical company, develops and commercializes products for the treatment of central nervous system (CNS) diseases in the United States.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives