- United States

- /

- Biotech

- /

- NasdaqGS:STOK

Stoke Therapeutics (STOK): A Fresh Look at Valuation Following Strong Long-Term Zorevunersen Study Results

Reviewed by Kshitija Bhandaru

Stoke Therapeutics (STOK) has drawn fresh attention after unveiling new long-term clinical data for its lead therapy candidate, zorevunersen, at the 54th Child Neurology Society Annual Meeting. Results highlighted consistent cognitive, behavioral, and overall clinical gains for Dravet syndrome patients.

See our latest analysis for Stoke Therapeutics.

Stoke Therapeutics has enjoyed a powerful rally this year as optimism swelled around the company’s lead therapy and a series of strategic shifts, including a newly minted CEO. With the latest clinical updates for zorevunersen, the 1-month share price return of 29% and year-to-date surge of 168% highlight building momentum. Over the past year, total shareholder return stands at nearly 155%, recapturing investor attention and positioning the company among biotech’s most notable movers. However, the long-term five-year total return remains negative.

Curious what other biotech innovators are catching a bid? You can see the full universe of emerging healthcare stocks and research opportunities with our See the full list for free.

With shares surging after positive clinical news and leadership changes, investors now face a familiar crossroads. Is Stoke Therapeutics undervalued with more upside to come, or has the market already priced in future growth?

Price-to-Earnings of 31.5x: Is it justified?

Stoke Therapeutics currently trades at a price-to-earnings (P/E) ratio of 31.5x, which positions its valuation well above both industry peers and broader market averages. This elevated P/E signals that investors are paying a significant premium for each dollar of the company's earnings at the recent closing price of $30.19 per share.

The price-to-earnings ratio is a widely used benchmark in assessing how much investors are willing to pay for future profit streams relative to current earnings. In biotech, a higher P/E can sometimes reflect confidence in future drug pipelines or earnings growth, but can also indicate elevated expectations that may be challenging to sustain if the earnings outlook weakens.

For Stoke Therapeutics, the P/E of 31.5x clearly surpasses the US Biotechs industry average of 16.6x and the estimated fair P/E ratio of 12.1x. This sharp difference suggests the market is overpricing expected future profits relative to sector norms and what quantitative models would indicate as fair value. Should results disappoint, the share price could move quickly to align with more typical industry or fair-value levels.

Explore the SWS fair ratio for Stoke Therapeutics

Result: Price-to-Earnings of 31.5x (OVERVALUED)

However, disappointing future earnings or setbacks in clinical trials remain key risks that could quickly reverse recent enthusiasm and share price momentum.

Find out about the key risks to this Stoke Therapeutics narrative.

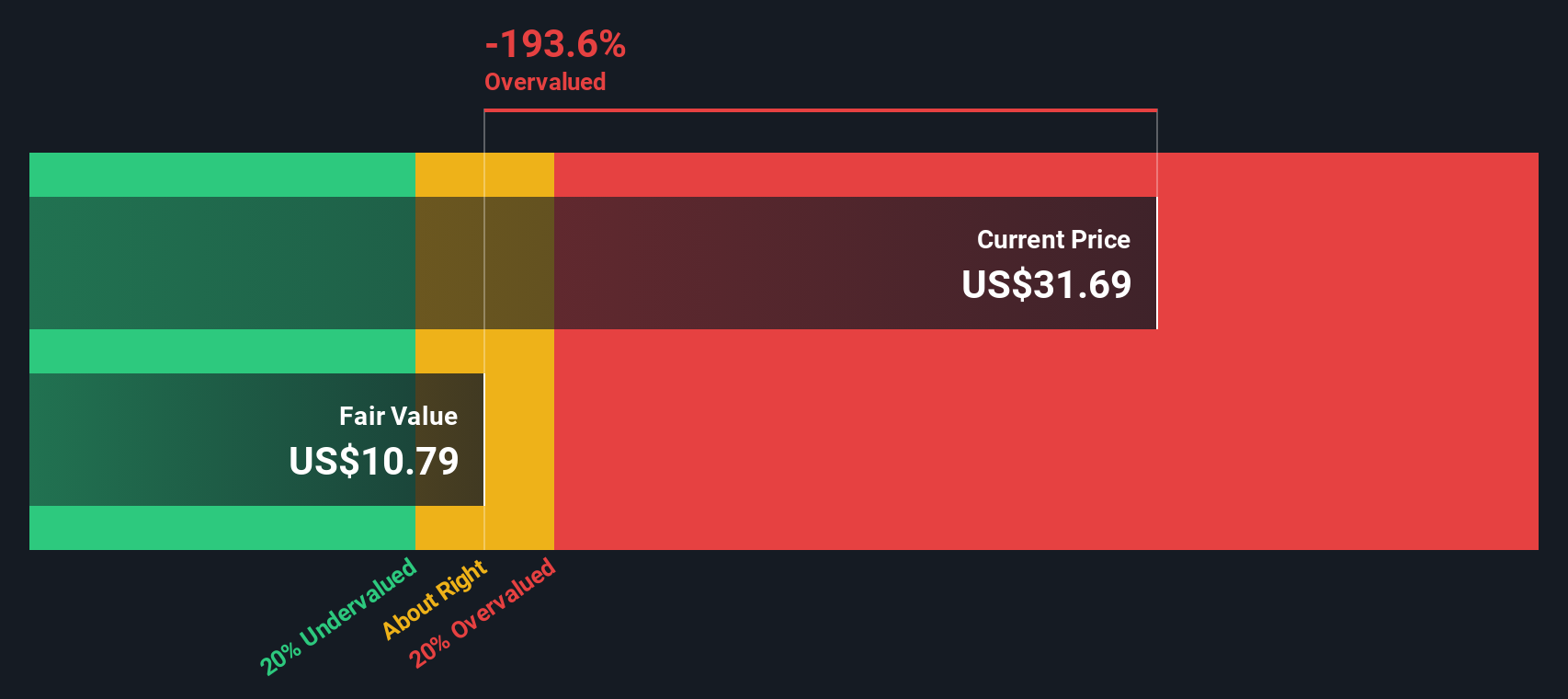

Another View: Discounted Cash Flow Says Overvalued

Looking through the lens of our SWS DCF model, Stoke Therapeutics appears significantly overvalued. The intrinsic value is $10.96 per share, well below the current market price of $30.19. This signals that the stock may be trading on overly optimistic expectations. Could the market be missing bigger risks, or is the clinical upside being underestimated by the model?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Stoke Therapeutics for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Stoke Therapeutics Narrative

If you think differently or want to dig deeper, you can craft your own analysis and perspective in just a few minutes: Do it your way

A great starting point for your Stoke Therapeutics research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Staying ahead means acting fast on opportunities. Don’t let the best new stock trends pass you by when your next top pick could be closer than you think.

- Target consistent income streams by tapping into these 19 dividend stocks with yields > 3% which offers yields above 3% for steady portfolio growth.

- Unlock powerful artificial intelligence potential with these 24 AI penny stocks that are set to reshape industries and drive future returns.

- Accelerate your search for deep value opportunities through these 892 undervalued stocks based on cash flows, highlighting stocks trading below their intrinsic worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:STOK

Stoke Therapeutics

An early-stage biopharmaceutical company, engages in the development of treatments for severe genetic diseases by upregulating protein expression.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives