- United States

- /

- Biotech

- /

- NasdaqGS:STOK

Could Endpoint Choices in the EMPEROR Trial Reveal a Strategic Shift for Stoke Therapeutics (STOK)?

Reviewed by Sasha Jovanovic

- Biogen Inc. and Stoke Therapeutics recently announced the publication of final results from the two-year BUTTERFLY natural history study in Dravet syndrome, highlighting the persistent developmental and seizure challenges faced by children and adolescents despite current treatments.

- This research not only underscores the urgent unmet need for disease-modifying therapies but also validates the relevance of primary and secondary endpoints in Stoke's ongoing Phase 3 EMPEROR trial for zorevunersen.

- Let's explore how the alignment of clinical study endpoints spotlights Stoke’s potential role in addressing Dravet syndrome’s longstanding therapeutic gap.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Stoke Therapeutics' Investment Narrative?

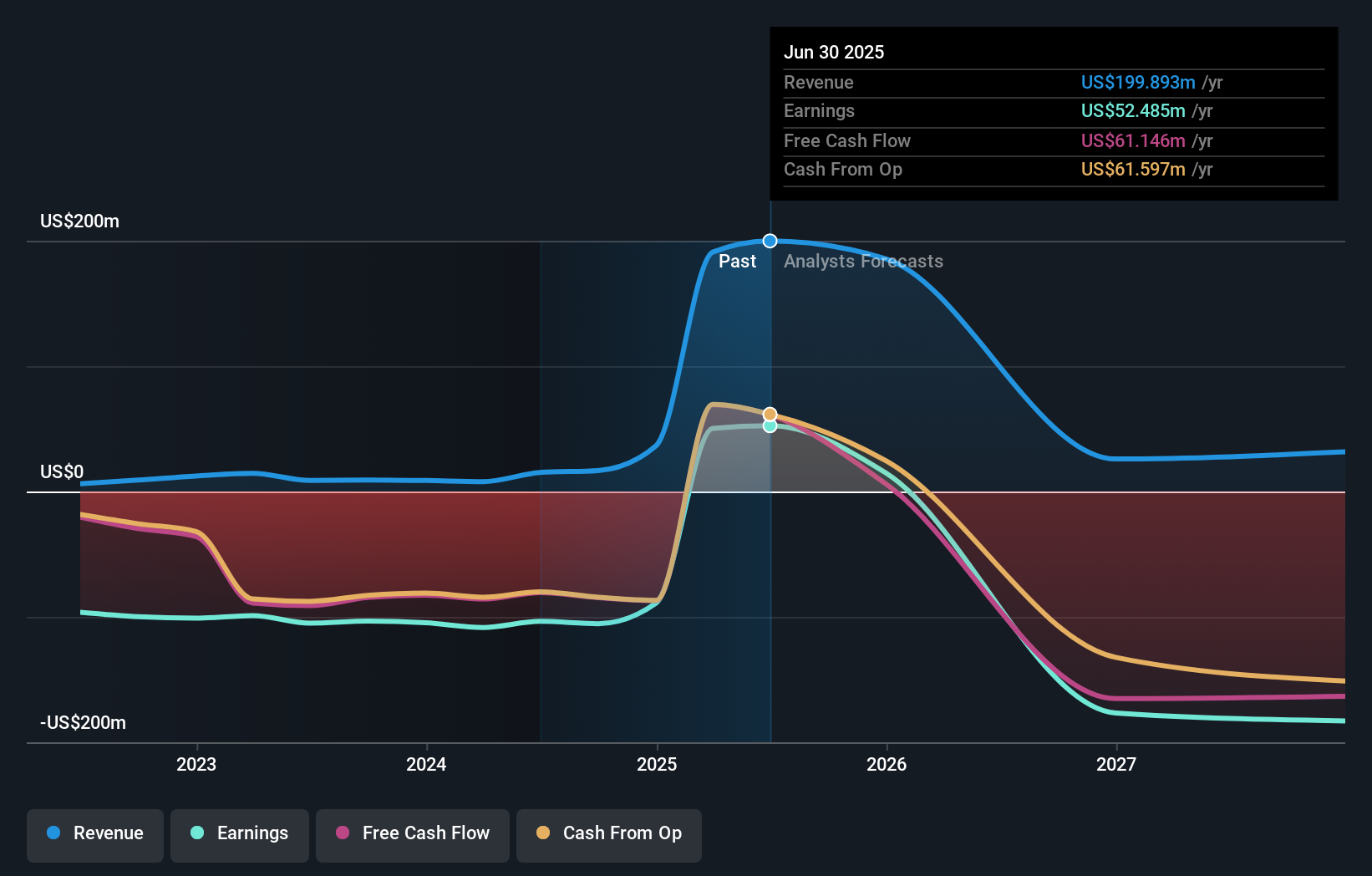

For Stoke Therapeutics, the investment case is closely tied to expectations for zorevunersen, its potential first-in-class therapy for Dravet syndrome. The recent publication of the BUTTERFLY study underscores just how persistent and life-altering the deficits are for patients, even with current treatments. This fresh validation of clinical trial endpoints matters because it underpins the relevance of outcome measures in the pivotal EMPEROR Phase 3 study, arguably the most important short-term catalyst for the stock. While the new findings shine a brighter spotlight on the unmet need, they don't materially shift near-term risk: success still depends on positive Phase 3 results, regulatory approval, and future market adoption. Investors should also weigh high valuation multiples, a relatively inexperienced management team, and forecasts for declining revenue and earnings over the next three years as ongoing concerns. Ultimately, the new data sharpens the focus on both the promise and the risks at play right now. Yet, with the management team’s limited average tenure, leadership continuity remains an important detail to watch.

Stoke Therapeutics' shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 3 other fair value estimates on Stoke Therapeutics - why the stock might be worth less than half the current price!

Build Your Own Stoke Therapeutics Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Stoke Therapeutics research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Stoke Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Stoke Therapeutics' overall financial health at a glance.

Looking For Alternative Opportunities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:STOK

Stoke Therapeutics

An early-stage biopharmaceutical company, engages in the development of treatments for severe genetic diseases by upregulating protein expression.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives