- United States

- /

- Biotech

- /

- NasdaqGS:SRRK

Scholar Rock’s Apitegromab FDA Progress Might Change The Case For Investing In SRRK

Reviewed by Sasha Jovanovic

- Scholar Rock Holding Corporation reported a US$102.22 million net loss for the third quarter ended September 30, 2025, with plans to resubmit the biologics license application for apitegromab following constructive discussions with the FDA.

- This regulatory update highlights Scholar Rock's intention to accelerate the U.S. launch of apitegromab in 2026 by leveraging an additional fill-finish facility.

- We’ll explore how Scholar Rock's positive momentum toward FDA approval for apitegromab could shape its investment narrative going forward.

Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is Scholar Rock Holding's Investment Narrative?

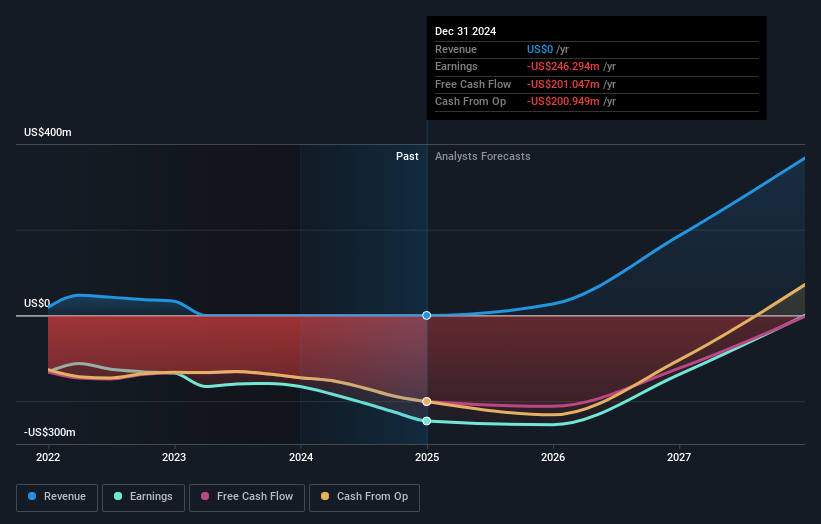

For Scholar Rock, the investment story has always centered around the high stakes of getting apitegromab, its lead therapy for spinal muscular atrophy, approved and commercialized. The recent net loss of US$102.22 million in the third quarter, driven by increased operating expenses, only intensifies the pressure to deliver a breakthrough. However, the constructive FDA meeting and plans to resubmit the Biologics License Application, together with a fresh focus on using a new fill-finish facility, move the timeline for a potential US launch to 2026 and help ease some regulatory uncertainty. Short-term, this update appears material: it increases the visibility of regulatory approval as the critical catalyst and reduces some risks connected to manufacturing. Yet, the company's continued lack of revenue and widening losses keep financial sustainability front and center as the main concern for investors.

On the flip side, Scholar Rock’s ongoing operating losses remain a key issue to watch.

Exploring Other Perspectives

Explore another fair value estimate on Scholar Rock Holding - why the stock might be worth just $46.55!

Build Your Own Scholar Rock Holding Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Scholar Rock Holding research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Scholar Rock Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Scholar Rock Holding's overall financial health at a glance.

Contemplating Other Strategies?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SRRK

Scholar Rock Holding

A biopharmaceutical company, focuses on the discovery, development, and delivery of medicines for the treatment of serious diseases in which signaling by protein growth factors plays a fundamental role.

Good value with adequate balance sheet.

Market Insights

Community Narratives