- United States

- /

- Biotech

- /

- NasdaqGS:SRRK

Scholar Rock (SRRK): Evaluating Valuation Following This Week’s 30% Share Price Surge

Reviewed by Simply Wall St

See our latest analysis for Scholar Rock Holding.

After a challenging start to the year, Scholar Rock Holding’s recent share price rally has reignited optimism, as investors respond to renewed focus on its biotech pipeline and shifting risk sentiment. Despite a year-to-date decline, the stock boasts a strong 1-year total shareholder return of 41% and an exceptional 3-year total return over 330%. This suggests momentum could be building again.

If rapid moves in biotech catch your attention, this is a great moment to discover other standout healthcare stocks with See the full list for free.

Yet with shares still trading at a roughly 26% discount to the average analyst price target, it raises the question: Is Scholar Rock Holding undervalued right now, or is the market already pricing in all of its future growth?

Price-to-Book Ratio of 15.4x: Is it justified?

Scholar Rock Holding’s current price-to-book (P/B) ratio is 15.4x, well above the US Biotechs industry average of 2.5x. This positions the stock as expensive relative to peers on this metric, even after the recent price surge.

The price-to-book ratio measures the market’s valuation of a company compared to its net assets. In the biotech sector, where companies often remain unprofitable for extended periods, investors may be willing to pay a premium P/B for companies with promising pipelines or unique technology. For Scholar Rock Holding, such a high multiple implies strong market confidence in future breakthroughs or commercial success.

Comparatively, SRRK’s premium is stark. It trades significantly higher than most of its industry on a P/B basis. However, when measured against its peer group (average 20.6x), Scholar Rock Holding offers slightly better value, reflecting a niche position between broad industry averages and direct competitors. There is insufficient data for a fair value ratio benchmark, which means the market could still adjust as more results come through.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book of 15.4x (OVERVALUED)

However, setbacks in clinical trials or slower than expected revenue growth could quickly change investor sentiment and challenge the stock's recent momentum.

Find out about the key risks to this Scholar Rock Holding narrative.

Another View: Discounted Cash Flow Highlights Deep Value

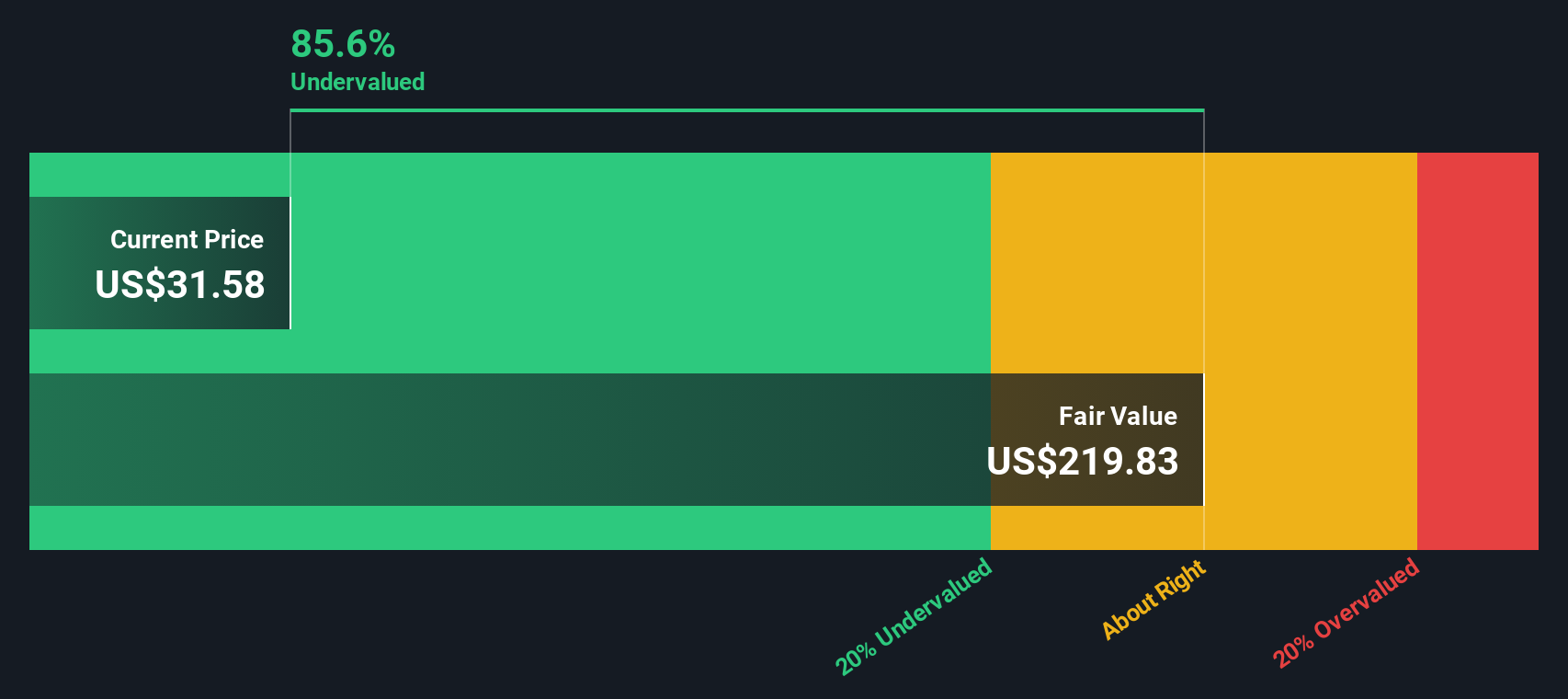

While Scholar Rock appears expensive based on its price-to-book ratio, our DCF model estimates the stock is trading at an 82.6% discount to its calculated fair value ($37.41 vs $215.21). This suggests the market may be overlooking long-term growth potential or is pricing in considerable risk. Is the pessimism warranted, or does the current price offer a hidden opportunity?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Scholar Rock Holding for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 874 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Scholar Rock Holding Narrative

If you want to dig deeper or think a different story could emerge, you can build your own perspective on Scholar Rock Holding in just a few minutes with Do it your way.

A great starting point for your Scholar Rock Holding research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Opportunities?

Hundreds of stocks are making moves daily. Pinpoint top opportunities and get an edge before the market catches on by using Simply Wall Street’s screeners below.

- Uncover undervalued companies trading at attractive prices by reviewing these 874 undervalued stocks based on cash flows. This can help you position yourself ahead of the crowd.

- Supercharge your portfolio by targeting rapid growth potential with these 24 AI penny stocks, where innovation in artificial intelligence may drive untapped upside.

- Boost your income stream by selecting from these 16 dividend stocks with yields > 3%, which offers reliable yields and robust fundamentals for long-term wealth building.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SRRK

Scholar Rock Holding

A biopharmaceutical company, focuses on the discovery, development, and delivery of medicines for the treatment of serious diseases in which signaling by protein growth factors plays a fundamental role.

Good value with adequate balance sheet.

Market Insights

Community Narratives