- United States

- /

- Biotech

- /

- NasdaqGS:SRRK

Has Scholar Rock’s Clinical Progress Sparked a Real Opportunity Following Recent 10% Price Jump?

Reviewed by Bailey Pemberton

- Wondering if Scholar Rock Holding could be an undervalued opportunity or if the recent excitement is just noise? You're not alone. Let's dig in and see what the numbers are really saying.

- The stock has been on a bit of a rollercoaster lately, climbing 10.1% over the last week but still down 30.2% year-to-date, while delivering an impressive 240.6% return over the last three years.

- Recent headlines have focused on Scholar Rock's collaboration updates and clinical progress, both fueling optimism and increasing speculation. News of promising trial results has caught investor attention, which helps explain the recent price swings.

- When it comes to valuation, Scholar Rock earns a 4 out of 6 on our value checks. This hints at potential, but also areas to watch. We'll compare the usual valuation approaches in a moment, and stick around for an even better way to judge a stock's true worth at the end of the article.

Approach 1: Scholar Rock Holding Discounted Cash Flow (DCF) Analysis

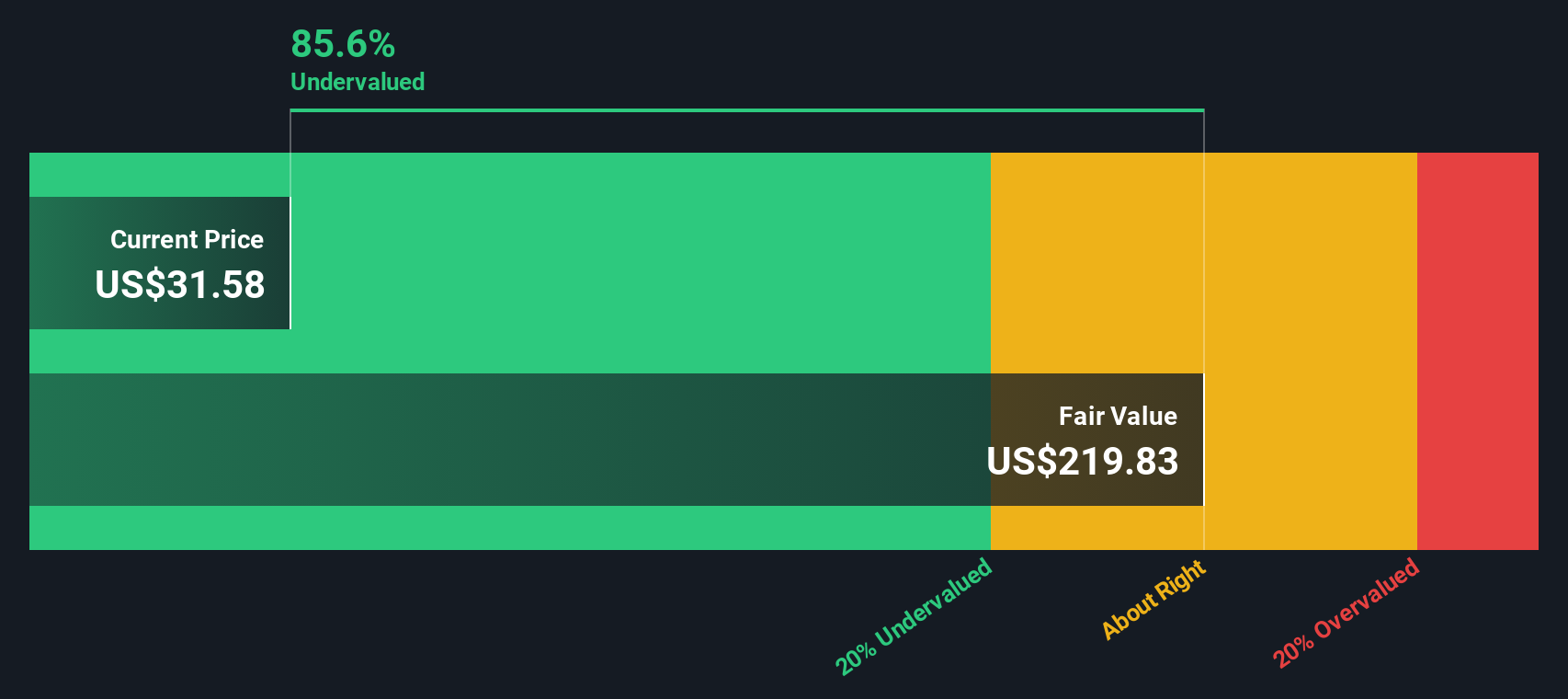

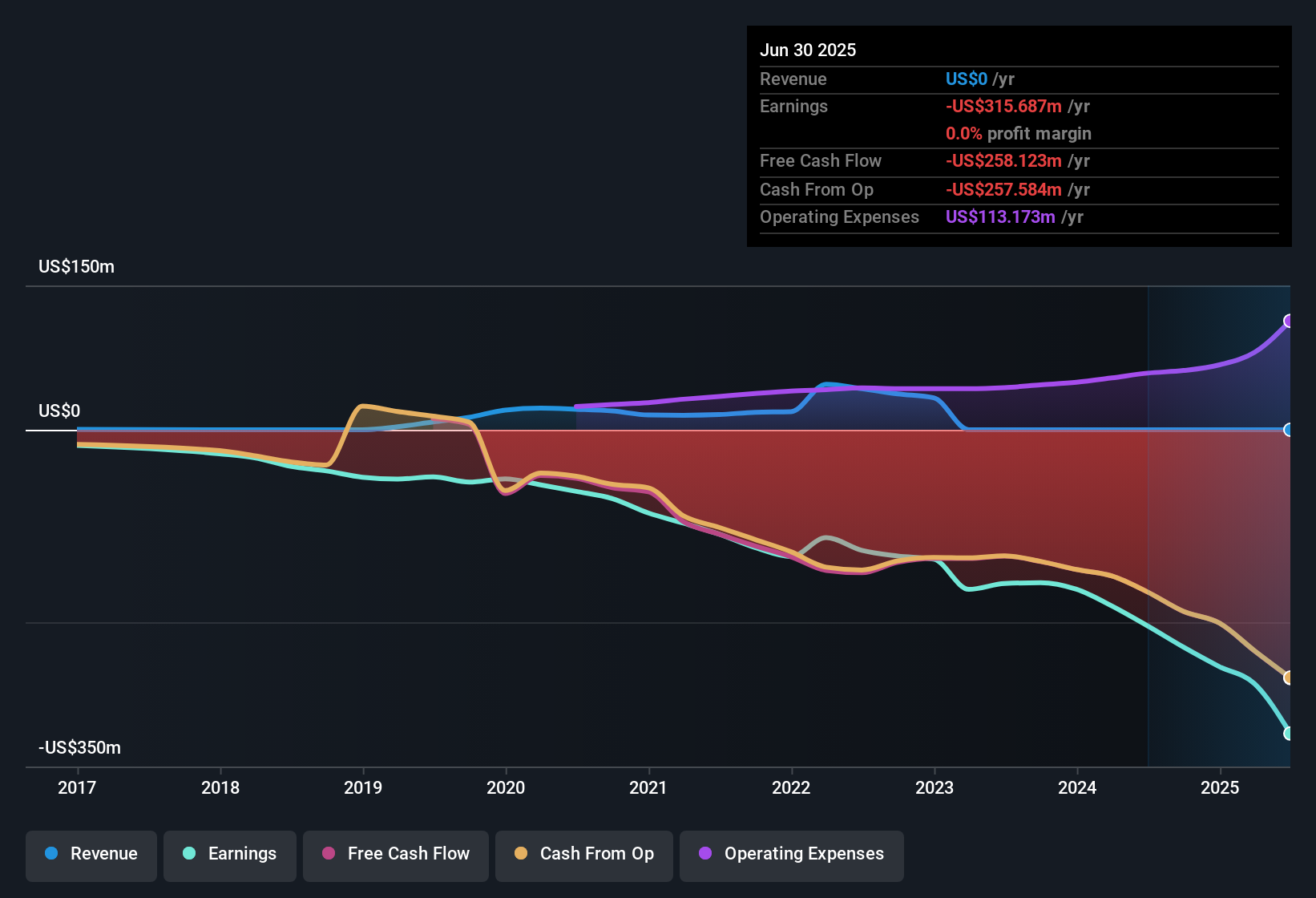

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and discounting them to today’s value using informed assumptions. For Scholar Rock Holding, this approach starts with the company’s latest reported Free Cash Flow, which was a negative $258 million. Analyst forecasts predict this turning positive within the next five years and reaching $339 million in 2029, with further growth extrapolated beyond that. By 2035, the DCF model estimates Scholar Rock’s Free Cash Flow could exceed $1.2 billion.

This analysis uses the 2 Stage Free Cash Flow to Equity method to capture both initial recovery and subsequent growth phases. Based on these projections, the estimated intrinsic value of the stock comes to $213.07 per share. Compared to the current market price, this suggests Scholar Rock is 85.5% undervalued. This represents a significant discount according to DCF analysis.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Scholar Rock Holding is undervalued by 85.5%. Track this in your watchlist or portfolio, or discover 883 more undervalued stocks based on cash flows.

Approach 2: Scholar Rock Holding Price vs Book

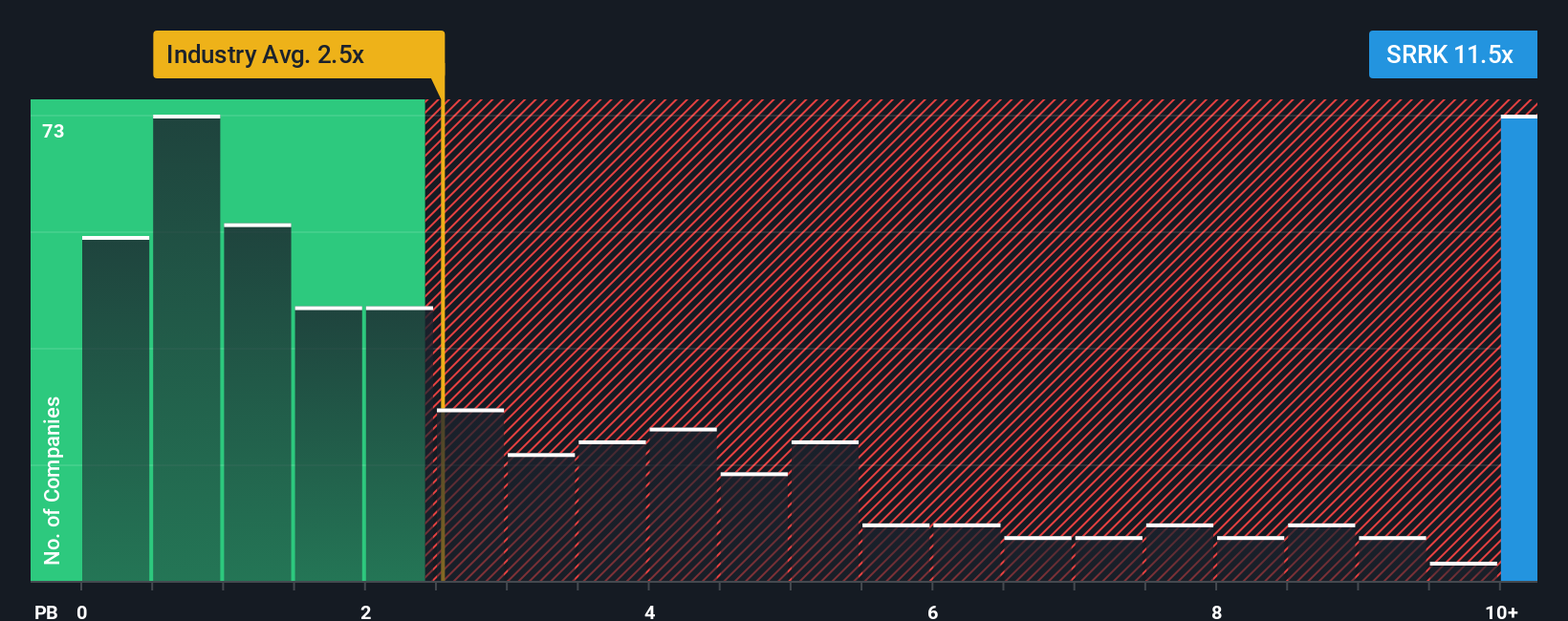

The Price-to-Book (P/B) ratio is a widely used metric for valuing biotech companies, particularly those not yet profitable. This is because book value serves as a solid foundation for evaluating companies with limited earnings or volatile profits, as is often the case in early-stage biotechs.

Growth expectations and risks play an important role in interpreting whether a P/B multiple is fair. Typically, a higher P/B may be justified if investors anticipate strong growth or if the company owns valuable intellectual property. In contrast, lower multiples can signal lower expected returns or higher risks.

Scholar Rock Holding currently trades at a P/B ratio of 12.70x, which is considerably higher than the Biotechs industry average of 2.56x. When compared to its direct peers, who average a P/B ratio of 21.39x, Scholar Rock sits below the peer group but remains well above the sector norm.

Simply Wall St's Fair Ratio works as a more nuanced benchmark, factoring in not just industry or peer comparisons but also the company’s own growth outlook, risk profile, profit margins, and size. This holistic view provides a more tailored assessment for Scholar Rock than a straightforward comparison to averages.

In this case, Scholar Rock’s Fair Ratio lines up closely with its current P/B ratio and suggests the market price is well aligned with fundamentals at this stage.

Result: ABOUT RIGHT

PB ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1403 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Scholar Rock Holding Narrative

Earlier, we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. Narratives offer a fresh, accessible way for investors to interpret a company’s story by connecting their own perspective on Scholar Rock Holding, including their assumptions about future earnings, revenue, and profit margins, to a financial forecast and a resulting fair value.

This approach goes beyond just the numbers, letting you frame your outlook and quickly see if the current market price matches your forecasted fair value. Narratives are easy to use on Simply Wall St's Community page, where millions of investors share and compare these investment stories in real time. They automatically update as new information comes out, so you can always make decisions based on the latest data, whether it is good news from a new clinical trial or a shift in industry sentiment.

For example, one Scholar Rock Narrative might reflect high optimism and project a fair value of $230 per share, while another takes a cautious view and estimates only $65 per share. This range helps highlight the diverse perspectives within the investor community.

Do you think there's more to the story for Scholar Rock Holding? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SRRK

Scholar Rock Holding

A biopharmaceutical company, focuses on the discovery, development, and delivery of medicines for the treatment of serious diseases in which signaling by protein growth factors plays a fundamental role.

Good value with adequate balance sheet.

Market Insights

Community Narratives