- United States

- /

- Biotech

- /

- NasdaqGS:SRPT

Sarepta Therapeutics (SRPT) Restructures After ELEVIDYS Setbacks and Regulatory Scrutiny Is the Investment Thesis Shifting

Reviewed by Simply Wall St

- In recent weeks, Sarepta Therapeutics reported its second quarter 2025 results, disclosed a class action lawsuit related to ELEVIDYS safety concerns, and saw the European Medicines Agency recommend refusing marketing authorization for the gene therapy amid patient safety issues and regulatory scrutiny.

- The company is undergoing significant restructuring, including workforce reductions and a black box warning on ELEVIDYS, while also filing a US$77.05 million shelf registration tied to employee stock offerings.

- We’ll explore how heightened regulatory scrutiny linked to patient safety concerns reshapes Sarepta's investment narrative and outlook.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 19 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Sarepta Therapeutics Investment Narrative Recap

To own Sarepta Therapeutics today, investors need confidence that ELEVIDYS can overcome recent regulatory and safety setbacks to retain its commercial viability, despite intensified scrutiny. The news of patient deaths and subsequent regulatory actions have become the central short-term catalyst and risk, raising concerns around continued market access, patient uptake, and the timeline for any broader commercial expansion.

Among recent developments, Sarepta’s second quarter 2025 results revealed substantial revenue growth year-on-year, but these gains now contend with heightened uncertainty from regulatory headwinds following the EMA's recommendation against ELEVIDYS’ authorization. This earnings performance sets a challenging backdrop as investors weigh whether the current pace of commercial gains can be sustained amid trial pauses and ongoing investigations.

In contrast, one particularly important risk for investors to watch is...

Read the full narrative on Sarepta Therapeutics (it's free!)

Sarepta Therapeutics' outlook projects $1.4 billion in revenue and $104.1 million in earnings by 2028. This assumes an annual revenue decline of 18.2% and an earnings increase of $162.1 million from the current earnings of -$58.0 million.

Uncover how Sarepta Therapeutics' forecasts yield a $23.52 fair value, a 8% upside to its current price.

Exploring Other Perspectives

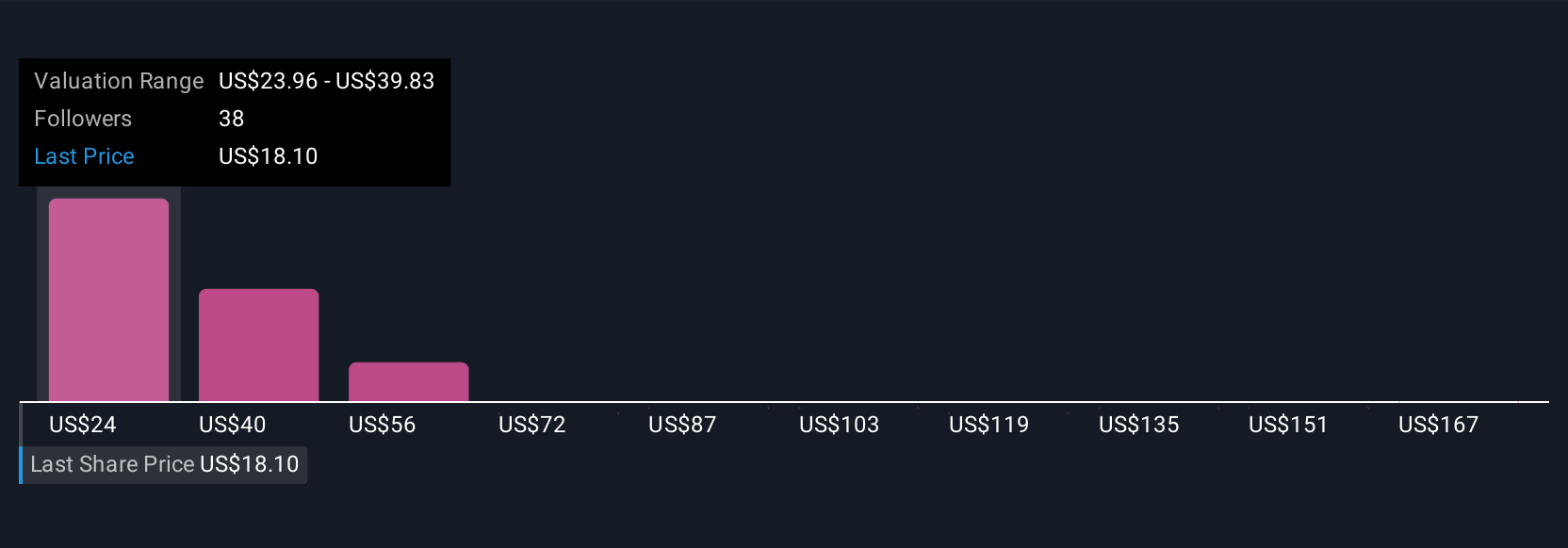

The Simply Wall St Community’s fair value estimates for Sarepta range widely, from US$23.52 to US$182.67, sourced from 10 independent contributors. With ongoing regulatory investigations into ELEVIDYS’ safety, views on potential recovery or further risks remain divided, consider these contrasting opinions when forming your own outlook.

Explore 10 other fair value estimates on Sarepta Therapeutics - why the stock might be worth over 8x more than the current price!

Build Your Own Sarepta Therapeutics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sarepta Therapeutics research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Sarepta Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sarepta Therapeutics' overall financial health at a glance.

Interested In Other Possibilities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 27 companies in the world exploring or producing it. Find the list for free.

- AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SRPT

Sarepta Therapeutics

A commercial-stage biopharmaceutical company, focuses on the discovery and development of RNA-targeted therapeutics, gene therapies, and other genetic therapeutic modalities for the treatment of rare diseases.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives