- United States

- /

- Biotech

- /

- NasdaqGS:SRPT

Sarepta Therapeutics (SRPT) Is Up 14.6% After FDA Clears ELEVIDYS Shipments Amid Legal Scrutiny

Reviewed by Simply Wall St

- In recent days, Sarepta Therapeutics announced the resumption of ELEVIDYS gene therapy shipments for ambulatory Duchenne patients following FDA clearance, after previous market pauses due to safety concerns and reports of patient deaths.

- While the company reported strong second-quarter results and resumed deliveries, it continues to face ongoing regulatory scrutiny and multiple class action lawsuits tied to ELEVIDYS safety disclosures.

- We'll examine how FDA approval to restart ELEVIDYS shipments impacts Sarepta's investment outlook amid ongoing legal and regulatory headwinds.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Sarepta Therapeutics Investment Narrative Recap

To be a Sarepta Therapeutics shareholder, you have to believe in the long-term promise of gene therapy for Duchenne muscular dystrophy and in the company’s ability to address evolving regulatory and safety scrutiny. The recent FDA clearance for resuming ELEVIDYS shipments to ambulatory patients removes a key near-term overhang, but continued monitoring of safety and class action litigation remains the biggest business risk. For now, the FDA’s decision appears material to short-term momentum while not eliminating ongoing legal uncertainties.

Among the recent updates, the second-quarter earnings report is especially relevant: Sarepta delivered US$611.09 million in quarterly revenue, a sharp increase over the prior year, supported by resuming ELEVIDYS sales. However, this operational and financial rebound remains closely tied to future regulatory decisions and product acceptance, both of which are shaped by evolving safety data and ongoing legal issues.

However, investors should be aware that several class action lawsuits alleging misleading safety communications are still unresolved and...

Read the full narrative on Sarepta Therapeutics (it's free!)

Sarepta Therapeutics' outlook anticipates $1.3 billion in revenue and $82.3 million in earnings by 2028. This scenario is based on an annual revenue decline of 16.1% and an earnings increase of $330.7 million from the current -$248.4 million.

Uncover how Sarepta Therapeutics' forecasts yield a $22.16 fair value, a 22% upside to its current price.

Exploring Other Perspectives

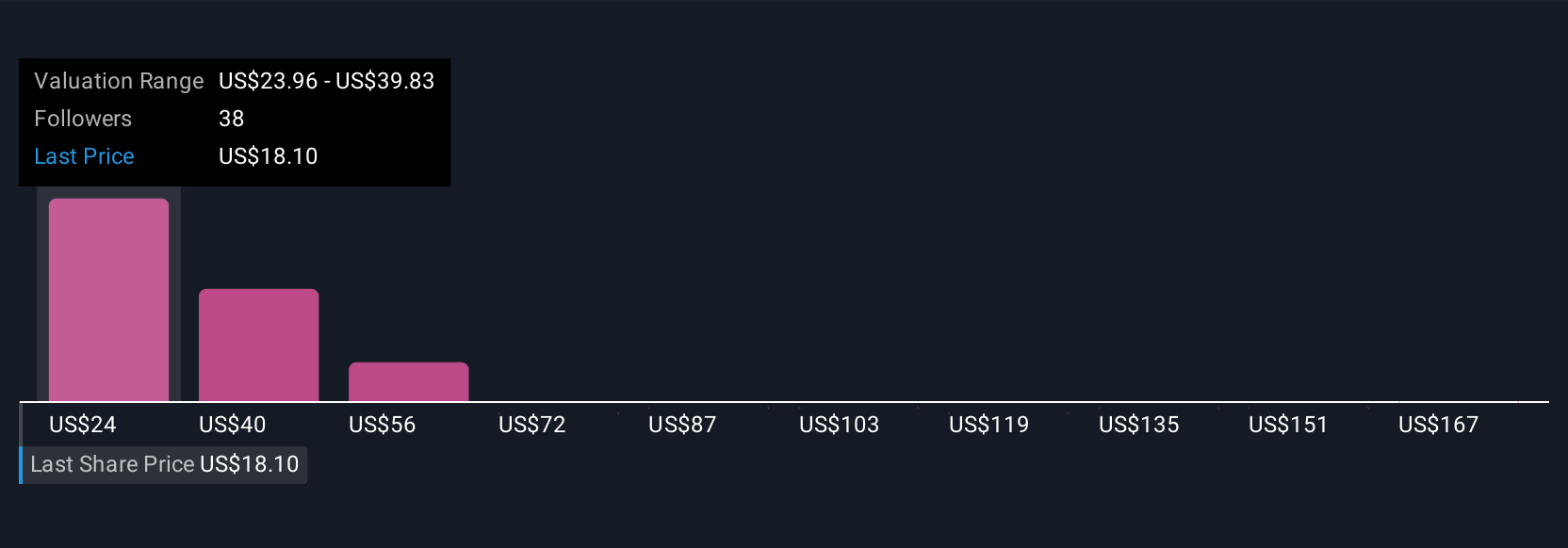

Ten fair value estimates from the Simply Wall St Community span a broad range from US$22.16 to US$182.67 per share. Given this diversity of opinion, especially as regulatory risks and safety concerns remain in focus, it is clear that future outcomes could vary widely depending on the risks that play out.

Explore 10 other fair value estimates on Sarepta Therapeutics - why the stock might be worth just $22.16!

Build Your Own Sarepta Therapeutics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sarepta Therapeutics research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Sarepta Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sarepta Therapeutics' overall financial health at a glance.

Searching For A Fresh Perspective?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The latest GPUs need a type of rare earth metal called Terbium and there are only 26 companies in the world exploring or producing it. Find the list for free.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SRPT

Sarepta Therapeutics

A commercial-stage biopharmaceutical company, focuses on the discovery and development of RNA-targeted therapeutics, gene therapies, and other genetic therapeutic modalities for the treatment of rare diseases.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives