- United States

- /

- Biotech

- /

- NasdaqGS:SRPT

Is Sarepta Therapeutics Set for a Comeback After 24% Jump on Gene Therapy Progress?

Reviewed by Bailey Pemberton

Let’s be honest: if you’re following Sarepta Therapeutics stock, it probably feels a bit like riding a rollercoaster. After falling sharply over the last year, with shares down about 82.6% in twelve months, Sarepta has recently shown signs of life. In just the past month, the stock is up 24.2%, and even the last week has brought in a small gain of 1.3%. That kind of whiplash makes it tough to know whether you’re catching a bargain or stepping into a value trap.

What’s behind this big swing? Sarepta recently saw a wave of optimism after progress was reported on its gene therapy pipeline, bringing back some of the growth expectations that had faded over the past several quarters. Investors have started to reconsider the company’s long-term potential, and some are speculating that the worst of the risk re-pricing may be over.

Here’s the interesting twist: when you break down the numbers, Sarepta’s valuation score sits at a 5 out of 6 based on undervaluation checks, which suggests it’s undervalued on most traditional measures. But are those metrics telling the full story, or is there more to unravel beneath the surface?

Let’s dig into how these valuation checks work, and why they matter if you’re deciding whether Sarepta deserves a spot in your portfolio. And if you’re looking for the smartest way to understand what the stock is worth, stick around because there’s an even more insightful method at the end of this article.

Why Sarepta Therapeutics is lagging behind its peers

Approach 1: Sarepta Therapeutics Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a common approach for estimating a company's intrinsic value by projecting its future cash flows and discounting them back to today’s dollars. In Sarepta Therapeutics' case, analysts and modelers have forecasted the company's Free Cash Flow (FCF) over the next several years, capturing expected swings from current negative values to future gains as the company grows.

At the moment, Sarepta generates an annual free cash outflow of $414 Million, reflecting heavy investment and research typical for biotech firms. Looking forward, projections suggest Sarepta could turn things around dramatically, with FCF expected to reach up to $277 Million by 2035. Analysts provide detailed annual forecasts up to 2029; further estimates are extrapolated based on recent performance.

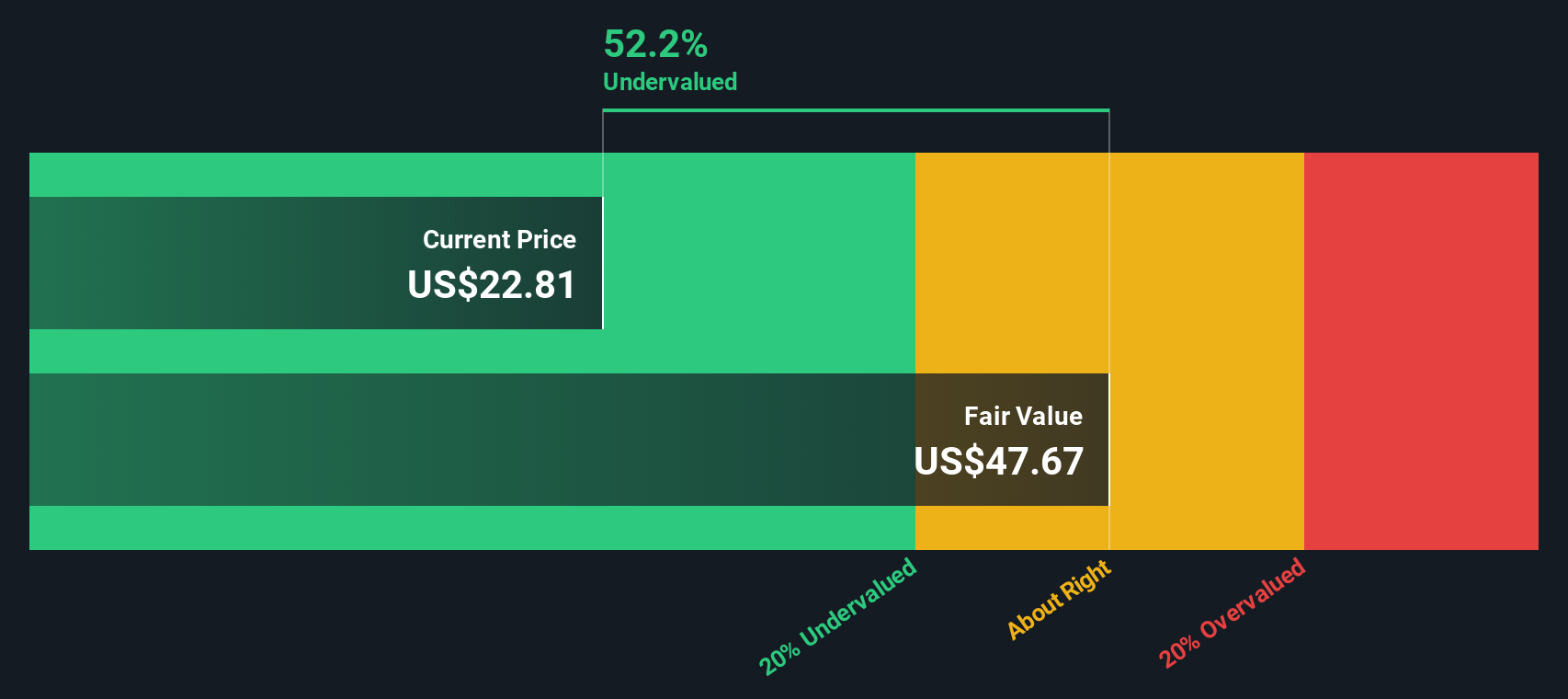

Bringing all of those future cash flows back to present-day terms, the DCF model estimates a fair value of $47.67 per share. This is 52.2% higher than where the stock trades today, signaling that Sarepta appears undervalued by a notable margin.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Sarepta Therapeutics is undervalued by 52.2%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Sarepta Therapeutics Price vs Sales

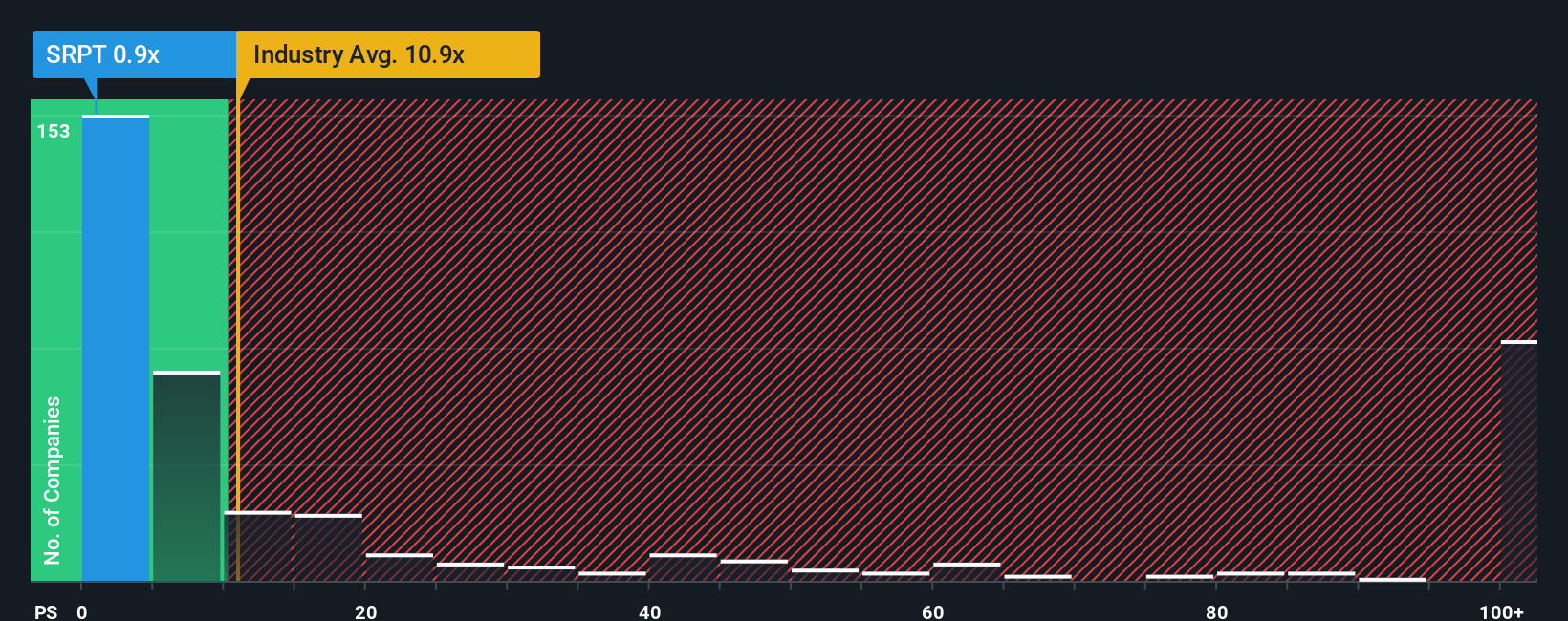

For biotech companies like Sarepta Therapeutics, where profits can be inconsistent as pipelines develop, the Price-to-Sales (P/S) ratio is a solid yardstick for valuation. This ratio compares the company’s market value to its revenues, providing a clearer perspective when earnings might be skewed by high research costs or early-stage investments.

It’s important to remember that growth expectations and the level of risk dramatically shape what’s considered a “normal” or “fair” multiple for any company. Higher anticipated growth or lower risk generally justifies a higher P/S ratio, while increased risk or uncertain growth can pull that fair value down.

At present, Sarepta trades at a P/S ratio of 0.9x, which is far below both the biotech industry average of 10.9x and its peer group’s average of 19.8x. However, raw comparisons like these can be misleading without accounting for unique company characteristics. This is where the Simply Wall St “Fair Ratio” comes in, a proprietary benchmark that adjusts for factors such as Sarepta’s actual revenue growth, profit margins, industry nuances, market cap, and risks. This tailored approach gives a more balanced and realistic view than a simple peer or industry average.

Based on these considerations, Sarepta’s Fair Ratio sits at 1.2x. Since the current P/S is also around this mark, the stock appears reasonably valued on this metric.

Result: ABOUT RIGHT

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Sarepta Therapeutics Narrative

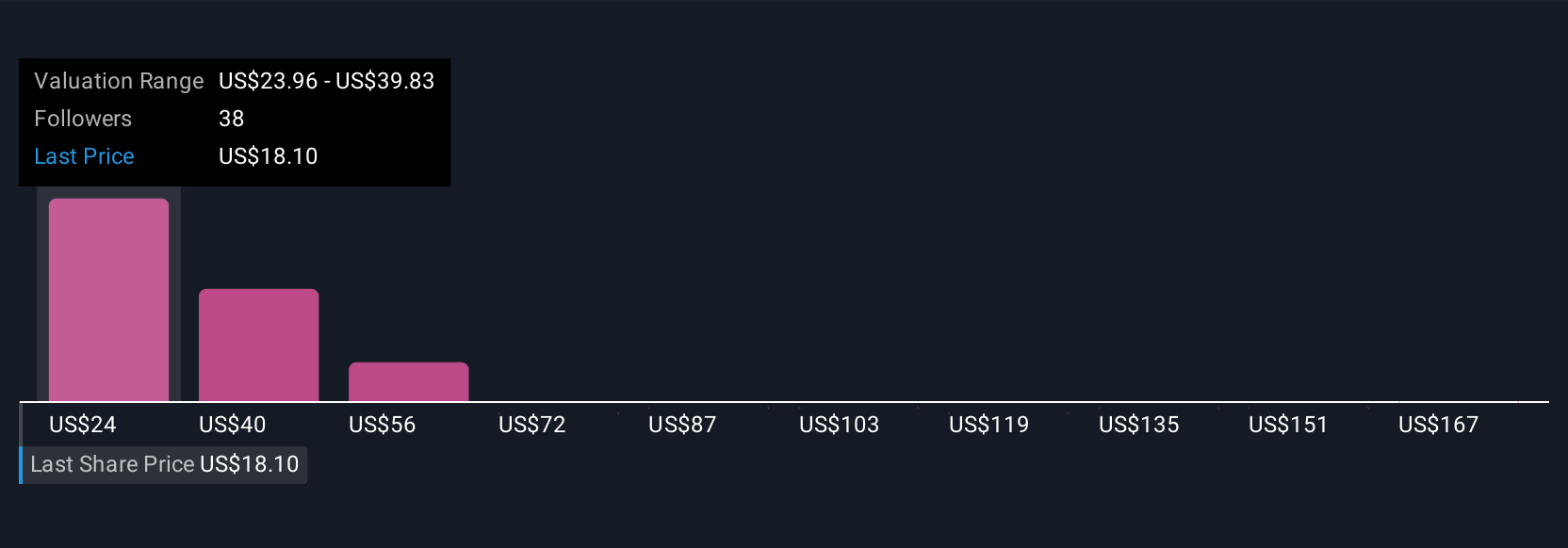

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a way to capture the story behind Sarepta Therapeutics, including the "why" and "how" you believe the company will succeed or struggle, along with your specific expectations for its future revenue, earnings, and profit margins. Instead of being just a set of numbers, Narratives connect your perspective on key catalysts, risks, and industry changes directly to a tailored financial forecast and a clear fair value estimate.

Narratives are an intuitive feature, available on Simply Wall St's platform within the Community page, that help millions of investors crystallize and share their investment thesis. They empower you to decide exactly when to buy or sell Sarepta by comparing your Fair Value, rooted in your scenario, to the current price. Narratives also evolve as news or earnings reports come in, so your view always stays up-to-date with the latest information.

For example, some investors see Sarepta’s earnings reaching $542.6 million by 2028 with a fair value of $80 per share, anticipating a strong Elevidys recovery and diversified growth. Others expect earnings to drop to -$111.3 million and set a more cautious fair value of just $5, citing ongoing safety concerns and regulatory hurdles. This range shows how Narratives let every investor ground their decisions in their own convictions and understanding of the company's future.

Do you think there's more to the story for Sarepta Therapeutics? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SRPT

Sarepta Therapeutics

A commercial-stage biopharmaceutical company, focuses on the discovery and development of RNA-targeted therapeutics, gene therapies, and other genetic therapeutic modalities for the treatment of rare diseases.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives