- United States

- /

- Biotech

- /

- NasdaqGS:SRPT

Is Sarepta Therapeutics a Bargain After Its Recent 85% Stock Slide in 2025?

Reviewed by Bailey Pemberton

- Ever wondered if Sarepta Therapeutics might finally be trading at a price that matches its potential? Let’s dig into what the numbers and the story say about its value right now.

- The stock has seen a 6.7% jump in the last week. However, this comes after steeper declines of 15.3% over the past month and nearly 85% year-to-date. This makes the current price feel especially intriguing or risky, depending on your outlook.

- Recent headlines have centered on Sarepta’s evolving lineup of gene therapy candidates as well as regulatory developments that have caught the eye of both bulls and bears. These news items have added fuel to the volatility, and investors are watching closely for any knock-on effects that could reshape the company's growth trajectory.

- On our valuation scorecard, Sarepta Therapeutics currently earns a 5 out of 6 on key undervaluation checks. Next, we’ll break down what goes into that score. Stay with us until the end for a deeper look at a smarter way to assess value that even seasoned investors might overlook.

Find out why Sarepta Therapeutics's -82.0% return over the last year is lagging behind its peers.

Approach 1: Sarepta Therapeutics Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's value by projecting its expected future cash flows and discounting them to their present value. This provides an informed estimate of intrinsic worth. For Sarepta Therapeutics, this model uses recent free cash flow figures and builds out a prediction of how those numbers might grow or shrink in the coming years. It incorporates analyst forecasts where available and extends the projections based on reasonable assumptions.

Currently, Sarepta reported a trailing twelve-month Free Cash Flow (FCF) of -$360 million. Analyst projections suggest a significant turnaround, with FCF expected to move into positive territory and reach $266.7 million by 2026. FCF is further projected to rise to $279 million by 2035. While analysts provide figures for the early years, later projections are based on extrapolation, which makes them more speculative but still aligned with industry patterns. All figures are stated in US dollars.

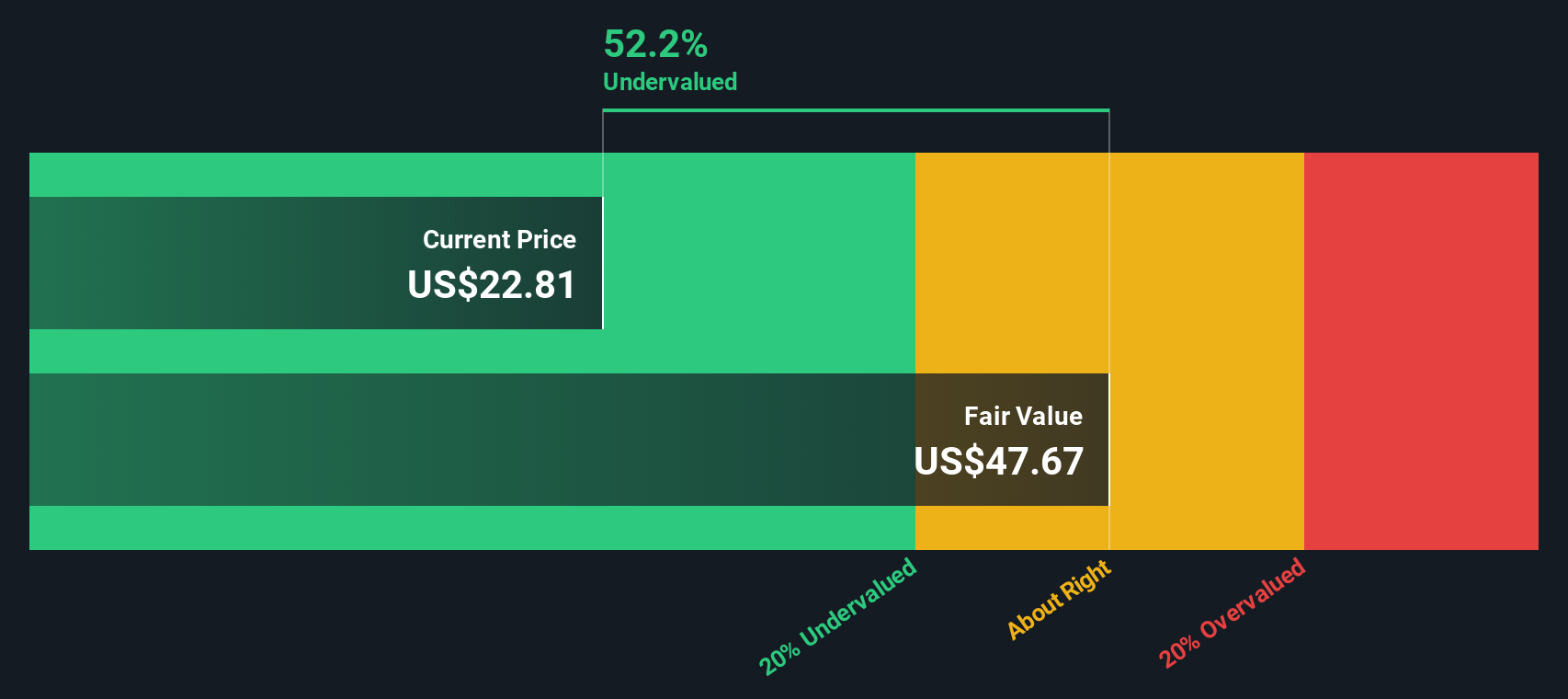

Based on this data, the DCF model estimates Sarepta's fair value at $44.00 per share. Compared to its current trading price, this suggests the stock is around 57.3% undervalued, indicating there may be a substantial margin of safety for prospective investors considering potential upside.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Sarepta Therapeutics is undervalued by 57.3%. Track this in your watchlist or portfolio, or discover 878 more undervalued stocks based on cash flows.

Approach 2: Sarepta Therapeutics Price vs Sales

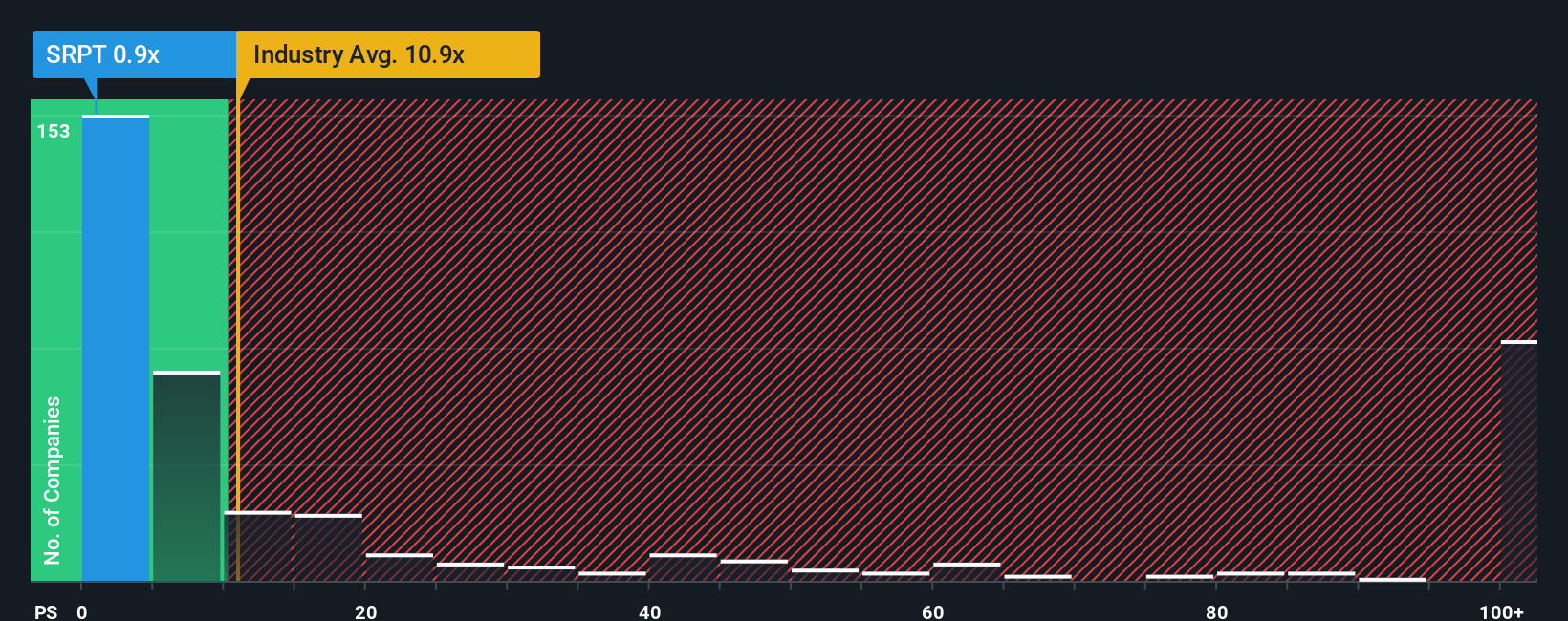

The Price-to-Sales (PS) ratio is a useful valuation measure for companies like Sarepta Therapeutics, especially when positive earnings are not yet consistent or the business is transitioning toward profitability. The PS ratio gives investors a view on how much they are paying for every dollar of sales. This makes it highly relevant for biotechs that often reinvest heavily in growth and research before producing steady profits.

What constitutes a “fair” PS ratio can vary widely based on expected growth and the level of risk unique to each company. Faster-growing or lower-risk businesses, for example, can often command a higher multiple. For Sarepta Therapeutics, the current PS ratio is 0.82x, notably lower than the biotech industry average of 11.14x and also below the average of its peers at 18.54x.

Simply Wall St also calculates a proprietary Fair Ratio for Sarepta, a forward-looking benchmark designed to reflect not only industry and company size, but also profit margins, risks, and future growth prospects. Unlike a simple comparison to other companies, the Fair Ratio is tailored to Sarepta’s specific situation and offers a more personalized assessment of whether the stock’s market valuation is justified. The Fair Ratio for Sarepta is 1.31x.

Comparing the Fair Ratio of 1.31x with the company’s actual PS ratio of 0.82x, Sarepta Therapeutics currently screens as undervalued by this measure. This suggests the market may be underestimating its future sales potential or growth story.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1405 companies where insiders are betting big on explosive growth.

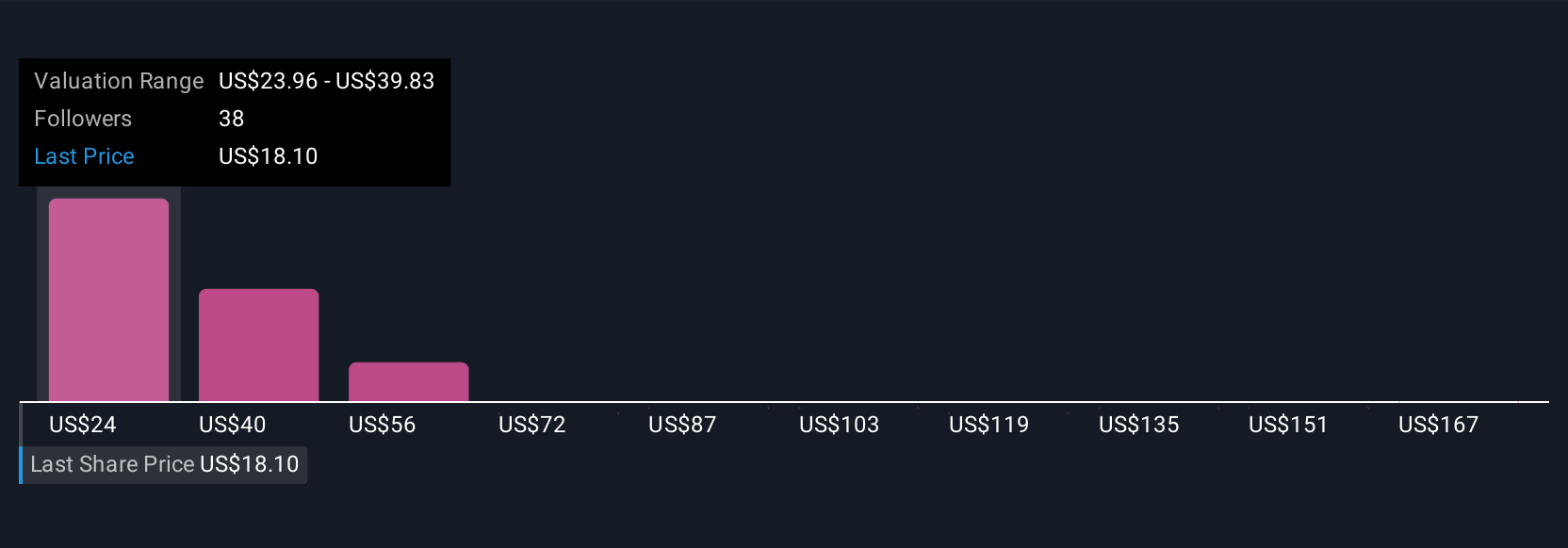

Upgrade Your Decision Making: Choose your Sarepta Therapeutics Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. Narratives are the story behind the numbers; your unique perspective about Sarepta Therapeutics, linking your expectations for key drivers like future revenue, margins, and fair value to what actually moves the business.

With a Narrative, you connect the company’s bigger picture, industry context, and key events to financial forecasts and a corresponding fair value. This approach makes your investment logic explicit and gives you a clear, living roadmap for when to buy or sell by comparing your Narrative’s Fair Value to Sarepta’s current share price.

Millions of investors use Narratives on Simply Wall St’s Community page because they are easy to build, update automatically as new news or earnings are released, and let you respond to changing information in real time.

For Sarepta, for example, one investor may build a bullish Narrative assuming robust patient uptake and operational improvements and arrive at a fair value of $80 per share, while a more cautious investor, concerned about safety events or regulatory delays, may see fair value as low as $5. Narratives help you clarify where you stand and make smarter, story-driven decisions.

Do you think there's more to the story for Sarepta Therapeutics? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SRPT

Sarepta Therapeutics

A commercial-stage biopharmaceutical company, focuses on the discovery and development of RNA-targeted therapeutics, gene therapies, and other genetic therapeutic modalities for the treatment of rare diseases.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives