- United States

- /

- Biotech

- /

- NasdaqGS:SPRO

Spero Therapeutics, Inc. (NASDAQ:SPRO) Held Back By Insufficient Growth Even After Shares Climb 26%

Spero Therapeutics, Inc. (NASDAQ:SPRO) shareholders would be excited to see that the share price has had a great month, posting a 26% gain and recovering from prior weakness. The last 30 days bring the annual gain to a very sharp 82%.

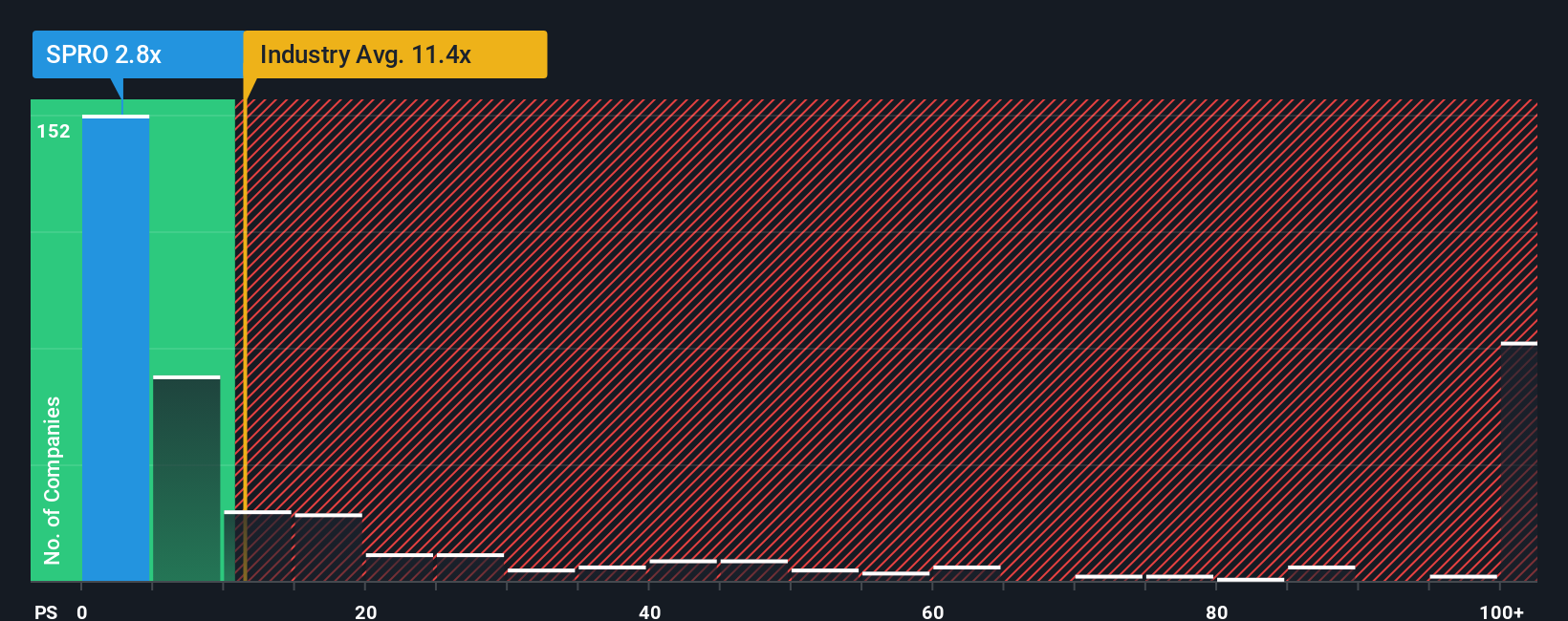

In spite of the firm bounce in price, Spero Therapeutics' price-to-sales (or "P/S") ratio of 2.8x might still make it look like a strong buy right now compared to the wider Biotechs industry in the United States, where around half of the companies have P/S ratios above 11.4x and even P/S above 88x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

See our latest analysis for Spero Therapeutics

How Has Spero Therapeutics Performed Recently?

Spero Therapeutics could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Keen to find out how analysts think Spero Therapeutics' future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For Spero Therapeutics?

The only time you'd be truly comfortable seeing a P/S as depressed as Spero Therapeutics' is when the company's growth is on track to lag the industry decidedly.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 59%. In spite of this, the company still managed to deliver immense revenue growth over the last three years. So while the company has done a great job in the past, it's somewhat concerning to see revenue growth decline so harshly.

Shifting to the future, estimates from the only analyst covering the company suggest revenue growth is heading into negative territory, declining 33% per annum over the next three years. That's not great when the rest of the industry is expected to grow by 132% per year.

With this in consideration, we find it intriguing that Spero Therapeutics' P/S is closely matching its industry peers. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

What Does Spero Therapeutics' P/S Mean For Investors?

Shares in Spero Therapeutics have risen appreciably however, its P/S is still subdued. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

It's clear to see that Spero Therapeutics maintains its low P/S on the weakness of its forecast for sliding revenue, as expected. As other companies in the industry are forecasting revenue growth, Spero Therapeutics' poor outlook justifies its low P/S ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Before you take the next step, you should know about the 2 warning signs for Spero Therapeutics (1 makes us a bit uncomfortable!) that we have uncovered.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:SPRO

Spero Therapeutics

A clinical-stage biopharmaceutical company, focuses on identifying and developing novel treatments for multi-drug resistant (MDR) bacterial infections and rare diseases in the United States.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives