- United States

- /

- Biotech

- /

- NasdaqGS:SNDX

Examining Syndax Pharmaceuticals (SNDX) Valuation After Recent Share Price Swings

Reviewed by Simply Wall St

Syndax Pharmaceuticals (SNDX) shares have experienced volatility this month, ending the latest trading session at $13.53. Investors are weighing recent trends alongside longer-term performance, making it a name to watch.

See our latest analysis for Syndax Pharmaceuticals.

Syndax’s share price saw a swift pullback over the past month, down nearly 10 percent, but that follows a remarkable 40 percent surge over the previous quarter. Even so, momentum is still lagging over the long run, with a one-year total shareholder return of minus 28 percent. This underscores both the volatility and shifting sentiment around the stock.

Curious about how other healthcare and biotech stocks are performing? Discover See the full list for free.

Given the stock’s recent swings and a price well below most analyst targets, investors may be wondering whether the market is currently undervaluing Syndax Pharmaceuticals or if its future potential is already reflected in its valuation, leaving little room for a buying opportunity.

Most Popular Narrative: 63% Undervalued

Syndax Pharmaceuticals closed at $13.53, well below the most popular narrative's fair value estimate of $36.55. This wide gap comes as optimism builds around future regulatory catalysts and expanding market opportunities.

Ongoing shift to earlier-line use of Revuforj and increasing post-transplant maintenance therapy materially lengthen average treatment duration and patient retention. Both these factors act as strong multipliers for net revenue and future earnings.

What is the secret sauce behind this significant fair value jump? The narrative is betting on rapid sales growth, much higher margins, and a valuation multiple typically seen in fast-rising companies. Want to know how bullish analyst projections fit together to create such a dramatic upside? Dive into the full story to unpack the financial assumptions driving this valuation gap.

Result: Fair Value of $36.55 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, unexpected regulatory setbacks or slower than anticipated adoption of Revuforj and Niktimvo could quickly undermine this upbeat outlook.

Find out about the key risks to this Syndax Pharmaceuticals narrative.

Another View: What Do Valuation Multiples Say?

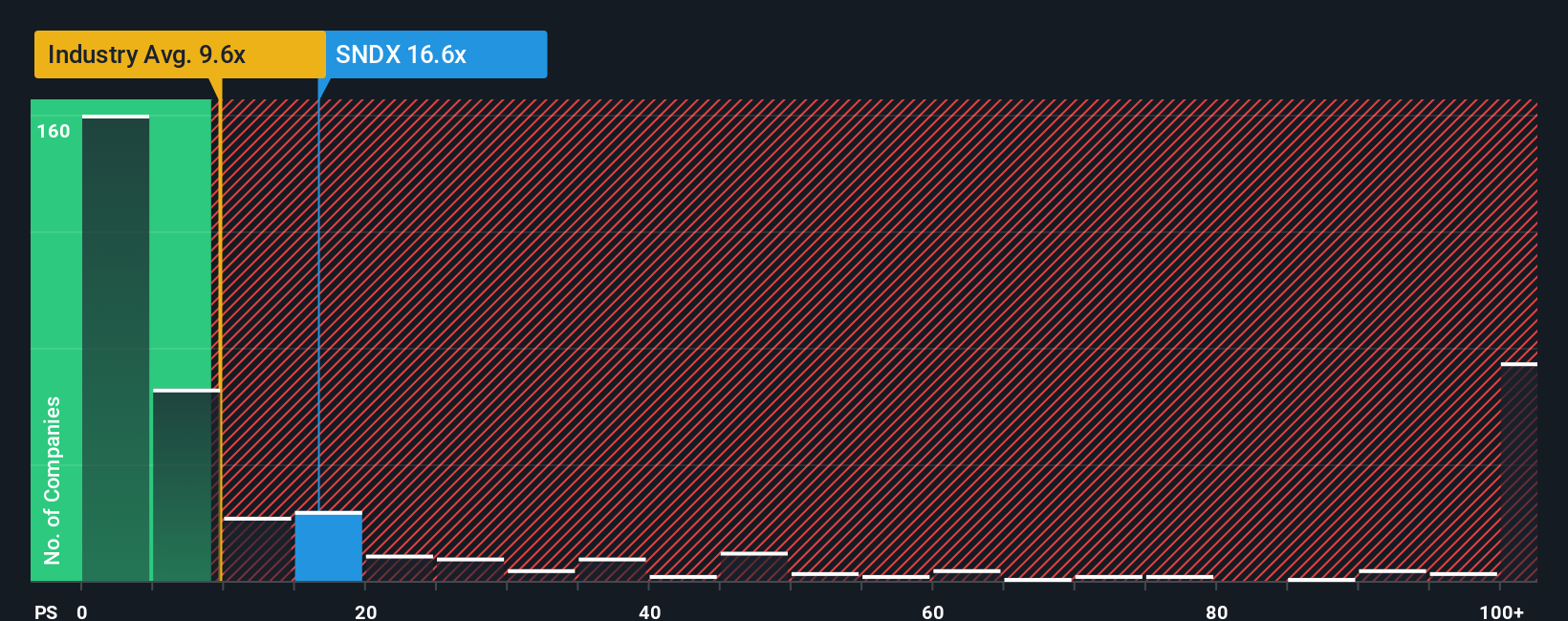

Looking at the numbers from another angle, Syndax Pharmaceuticals is currently trading at a price-to-sales ratio of 15x. That is much steeper than both the US Biotechs industry average of 10.8x and the peer average of 5.6x. In addition, the ratio is dramatically higher than the computed fair ratio, which sits at only 0.2x. This wide gap suggests that, despite analyst optimism, the market may be pricing in a lot of future success already. This poses real questions about valuation risk for anyone considering a new entry here.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Syndax Pharmaceuticals Narrative

If you have a different perspective or want to draw your own conclusions from the financials and forecasts, you can build your own Syndax Pharmaceuticals narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Syndax Pharmaceuticals.

Looking for more investment ideas?

Unlock smarter opportunities and never let an exciting trend pass you by. The right screener can help you spot tomorrow's winners among today's overlooked stocks.

- Capture growth in health and technology by searching through these 33 healthcare AI stocks, where forward-thinking companies are reshaping patient care with groundbreaking AI innovations.

- Target consistent returns in your portfolio by evaluating these 17 dividend stocks with yields > 3%, which highlights stocks offering yields greater than 3 percent for those seeking reliable passive income.

- Tap into the explosive world of digital assets by tracking these 80 cryptocurrency and blockchain stocks, revealing stocks at the forefront of cryptocurrency and blockchain advancements.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SNDX

Syndax Pharmaceuticals

A commercial-stage biopharmaceutical company, develops therapies for the treatment of cancer.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives