- United States

- /

- Biotech

- /

- NasdaqGM:SMMT

Summit Therapeutics (SMMT): Evaluating Valuation After Fresh Analyst Optimism on Ivonescimab and HARMONi-3 Trial

Reviewed by Simply Wall St

Summit Therapeutics (SMMT) is back on investors’ radar after fresh bullish commentary from Cantor Fitzgerald and a rating upgrade from Barclays, both zeroing in on ivonescimab and the upcoming HARMONi-3 phase 3 trial.

See our latest analysis for Summit Therapeutics.

The bullish focus on ivonescimab and HARMONi-3 has coincided with a 7.61% one-month share price return to $17.82, while the three-year total shareholder return of 385.56% underscores how momentum has transformed longer-term sentiment.

If this kind of speculative biotech story interests you, it could be worth exploring other potential movers among healthcare stocks to see what else fits your risk appetite.

With shares still trading at a steep discount to consensus targets despite a multiyear surge, the question now is whether Summit Therapeutics remains mispriced by a skeptical market or if ivonescimab optimism already captures future growth.

Price-to-Book of 71.5x: Is it justified?

On a price-to-book basis, Summit Therapeutics looks richly valued at $17.82 per share compared to both biotech peers and the wider US market.

The price-to-book ratio compares a company’s market value to its net assets, and it is often used for asset light or early stage biotechs with limited revenue. In SMMT’s case, an elevated multiple suggests investors are paying a substantial premium over the company’s current book value, effectively front loading expectations for future pipeline success rather than current fundamentals.

That premium is stark when set against benchmarks. SMMT’s price-to-book ratio of 71.5 times dwarfs the US biotechs industry average of 2.6 times and also sits far above a peer group average of 11.4 times, indicating the stock trades at a dramatically richer valuation than comparable names.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-book of 71.5x (OVERVALUED)

However, setbacks in HARMONi-3 or weaker than expected ivonescimab data could quickly compress multiples and challenge the current optimism around Summit’s valuation.

Find out about the key risks to this Summit Therapeutics narrative.

Another View: DCF Flags Deep Undervaluation

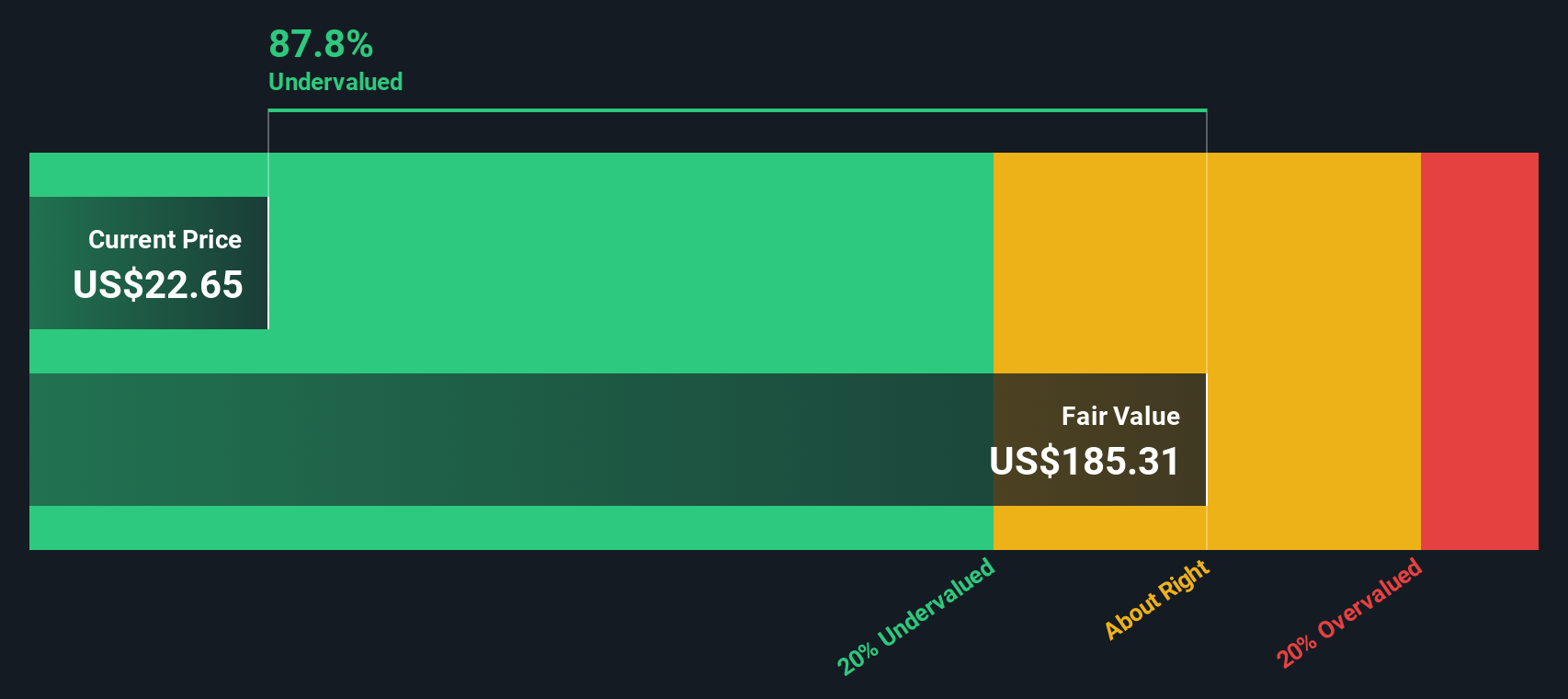

While the price-to-book ratio suggests overvaluation, our DCF model points in the opposite direction, indicating that SMMT is trading about 88.7% below its estimated fair value of $158.24. If the cash flow story is even roughly right, is the market being too cautious or simply early?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Summit Therapeutics for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 914 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Summit Therapeutics Narrative

If you prefer to dig into the numbers yourself and shape your own view of Summit’s trajectory, you can build a custom narrative in minutes: Do it your way.

A great starting point for your Summit Therapeutics research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Before you move on, lock in your next potential winners using the Simply Wall Street Screener, so fresh opportunities do not slip past unnoticed.

- Target higher potential returns by focusing on companies that look attractively priced relative to future cash flows with these 914 undervalued stocks based on cash flows that already clear key fundamentals.

- Ride the next wave of innovation by scanning for smaller, fast moving names using these 3624 penny stocks with strong financials that combine speculative upside with real business traction.

- Strengthen the income side of your portfolio by zeroing in on reliable payers through these 13 dividend stocks with yields > 3% that offer yields above 3% with sustainable support.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:SMMT

Summit Therapeutics

A biopharmaceutical company, focuses on discovery, development, and commercialization of patient, physician, caregiver, and societal friendly medicinal therapies.

Flawless balance sheet and slightly overvalued.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion