- United States

- /

- Biotech

- /

- NasdaqGM:SMMT

Insider Buying After Losses Could Be a Game Changer for Summit Therapeutics (SMMT)

Reviewed by Sasha Jovanovic

- Summit Therapeutics recently reported its third-quarter 2025 results, revealing a wider EBITDA loss and a further drop in EPS.

- Interestingly, several company directors purchased millions of dollars’ worth of shares shortly after the earnings release, suggesting internal optimism despite recent challenges.

- We’ll explore how insider share purchases following financial losses influence Summit Therapeutics’ investment narrative.

Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

What Is Summit Therapeutics' Investment Narrative?

To be a Summit Therapeutics shareholder, you need to believe in the company’s ability to turn scientific milestones, like the promising HARMONi trial results, into successful regulatory approvals and eventual commercial products. The most critical short-term catalyst remains the upcoming Biologics License Application (BLA) submission for ivonescimab, expected by the end of 2025. While the recent Q3 2025 report revealed deeper losses and ongoing lack of revenue, several directors’ large stock purchases following the decline could be read as a sign of internal confidence at a challenging moment. However, the combined impact of heavy losses, a significant share price drop, and reduced analyst confidence highlights the need for cautious optimism. This latest earnings miss and negative price reaction reinforce the importance of near-term progress on the pipeline to regain broader market trust.

Yet some crucial financial risks remain that investors should keep in mind.

Exploring Other Perspectives

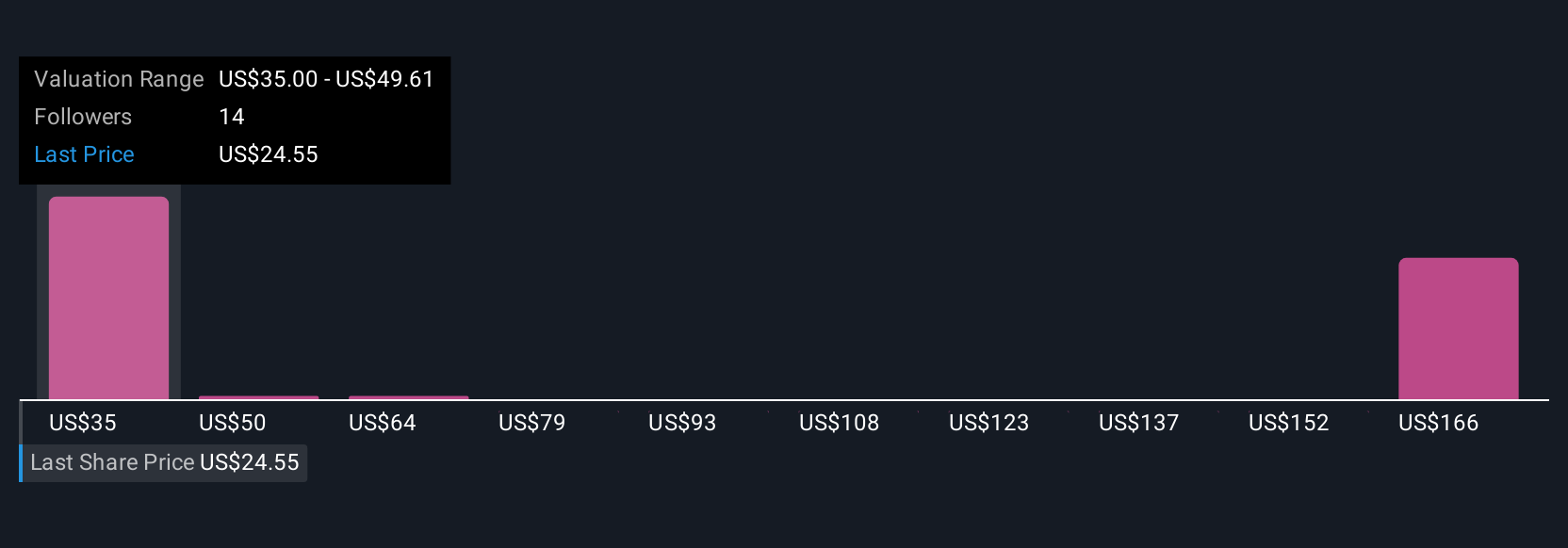

Explore 6 other fair value estimates on Summit Therapeutics - why the stock might be worth 12% less than the current price!

Build Your Own Summit Therapeutics Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Summit Therapeutics research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Summit Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Summit Therapeutics' overall financial health at a glance.

Seeking Other Investments?

Our top stock finds are flying under the radar-for now. Get in early:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:SMMT

Summit Therapeutics

A biopharmaceutical company, focuses on discovery, development, and commercialization of patient, physician, caregiver, and societal friendly medicinal therapies.

Flawless balance sheet with low risk.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026