- United States

- /

- Biotech

- /

- NasdaqCM:SLNO

Soleno Therapeutics (SLNO): Evaluating Valuation Following $100 Million Buyback and Return to Profitability

Reviewed by Simply Wall St

Soleno Therapeutics, Inc. has announced a $100 million accelerated share buyback program, signaling a clear show of confidence from management. This move comes after the company moved into profitability in its recent quarterly results.

See our latest analysis for Soleno Therapeutics.

This buyback announcement follows an earnings surprise that turned heads, with Soleno Therapeutics flipping from losses to a solid profit last quarter. The stock price initially surged on the news, but recent market momentum has faded. Its 1-year total shareholder return is slightly negative, while the last three years still show an extraordinary 4,197% gain. Even after the pullback, investor optimism remains as management doubles down on value with the repurchase program.

If you're searching for your next growth story or want to spot similar opportunities, consider branching out and discovering fast growing stocks with high insider ownership

With shares pulling back despite a leap into profitability and management launching a bold repurchase, investors may wonder if Soleno Therapeutics is a bargain for future growth or if all the upside is already reflected in the price.

Price-to-Sales Ratio of 26.9x: Is it justified?

Soleno Therapeutics is currently trading with a price-to-sales (P/S) ratio of 26.9x, which is significantly higher than both its industry peers and its own estimated fair value benchmarks. With the stock last closing at $49.42, this premium valuation stands out among U.S. biotech companies.

The P/S ratio measures how much investors are willing to pay for every dollar of the company’s revenue. In the biotech sector, where consistent profits can take years to achieve, this metric is important for evaluating whether the market is pricing in too much growth or potential before it materializes.

Compared to the U.S. biotech industry average of 11x, Soleno’s P/S ratio appears expensive. It also trades above the peer group’s average ratio of 19.5x and the calculated fair price-to-sales ratio of 21.4x. This suggests that expectations for the company’s future are especially elevated and could be tough to sustain if growth falters.

Explore the SWS fair ratio for Soleno Therapeutics

Result: Price-to-Sales Ratio of 26.9x (OVERVALUED)

However, investors should note that any slowdown in revenue growth or failure to meet lofty expectations could quickly change sentiment around Soleno Therapeutics.

Find out about the key risks to this Soleno Therapeutics narrative.

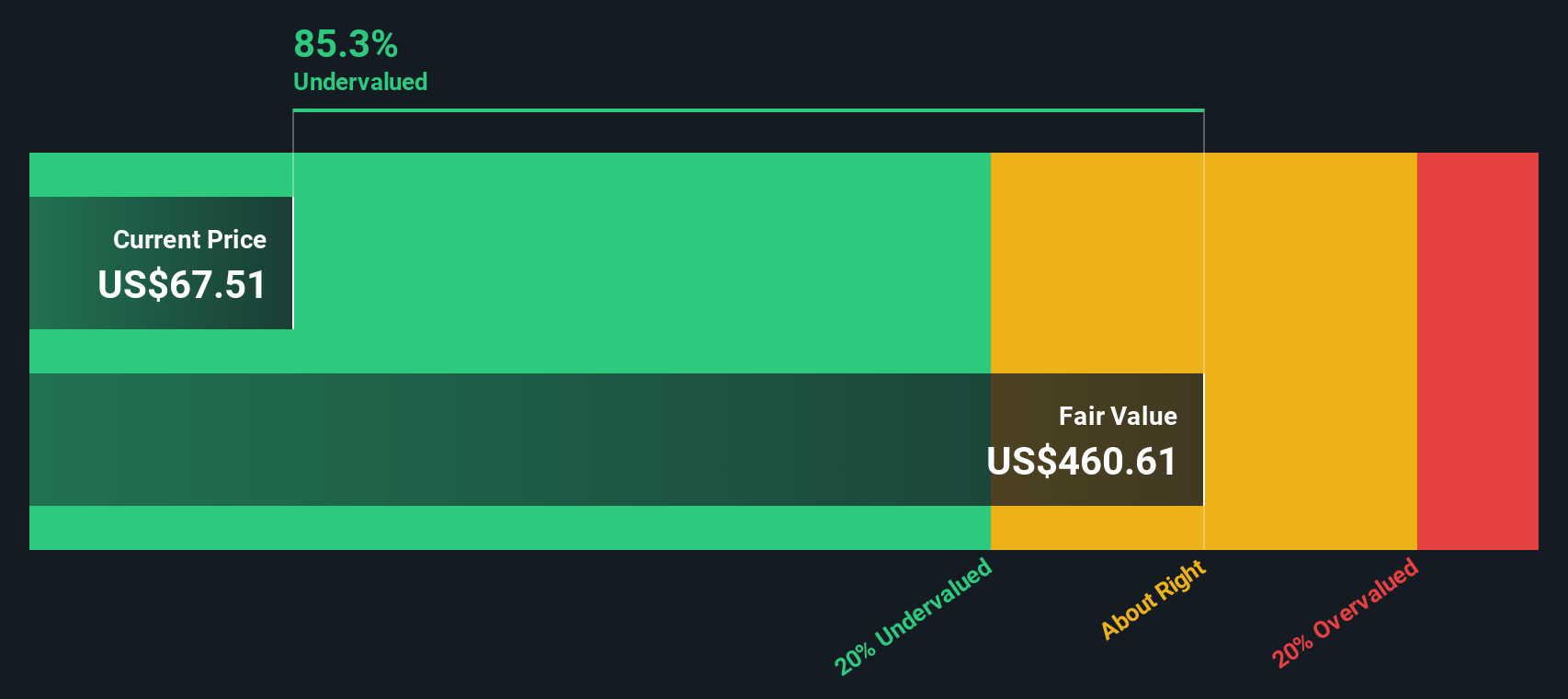

Another View: The SWS DCF Model Shows Undervaluation

While the stock's high price-to-sales ratio makes it look expensive, our SWS DCF model provides a very different perspective. According to this method, Soleno Therapeutics is trading at nearly 90% below its estimated fair value. Could the market be overlooking something significant, or is this simply a quirk in the numbers?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Soleno Therapeutics for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 886 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Soleno Therapeutics Narrative

Keep in mind, if you have a different perspective or want to dive deeper on your own, you can quickly shape your own view using the tools available. Do it your way

A great starting point for your Soleno Therapeutics research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t stop at one opportunity when the market is packed with compelling finds. Let Simply Wall Street’s powerful screener help you pinpoint tomorrow’s winners before everyone else.

- Unlock the next wave of medical innovation by checking out these 32 healthcare AI stocks, where companies are transforming healthcare with cutting-edge artificial intelligence.

- Boost your search for solid long-term income by exploring these 16 dividend stocks with yields > 3%, featuring businesses with reliable yields greater than 3%.

- Catch the momentum in digital assets with these 82 cryptocurrency and blockchain stocks, highlighting pioneers at the forefront of cryptocurrency and blockchain breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:SLNO

Soleno Therapeutics

A clinical-stage biopharmaceutical company, focuses on the development and commercialization of novel therapeutics for the treatment of rare diseases.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives