- United States

- /

- Biotech

- /

- NasdaqCM:SLNO

How Does Wolfe Research’s Support Shape Soleno Therapeutics’ (SLNO) Credibility Amid Heightened Scrutiny?

Reviewed by Sasha Jovanovic

- Wolfe Research recently initiated coverage on Soleno Therapeutics, providing a positive outlook for ViCAT XR after concerns were raised over its safety and commercial prospects.

- This coverage comes in the wake of both a short seller report and ongoing legal investigations, reflecting heightened scrutiny and contrasting expert perspectives for investors.

- We’ll explore how Wolfe Research’s assessment of ViCAT XR’s insurance access and patient growth prospects shapes the company’s investment narrative.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Soleno Therapeutics' Investment Narrative?

For anyone considering Soleno Therapeutics as a potential investment, the story increasingly revolves around the ongoing commercialization of VYKAT XR and the company’s ability to navigate recent scrutiny. The core narrative is still focused on VYKAT XR’s adoption among patients with Prader-Willi Syndrome and insurance coverage progress, with Wolfe Research recently reaffirming positive expectations despite short-term hurdles. However, the latest investigations into Soleno’s disclosures, following a sharp price decline and a high-profile short seller report, mark a clear shift in the immediate risk landscape. Where earlier analysis pointed mainly to revenue growth potential and profitability milestones, current catalysts now rest more on restoring investor confidence, managing regulatory scrutiny, and stabilizing prescriber and patient sentiment. As these new challenges unfold, the material impact of litigation and perception risks could potentially outweigh near-term commercial gains.

In contrast to coverage gains, unresolved questions around disclosure practices should not be overlooked by investors.

Exploring Other Perspectives

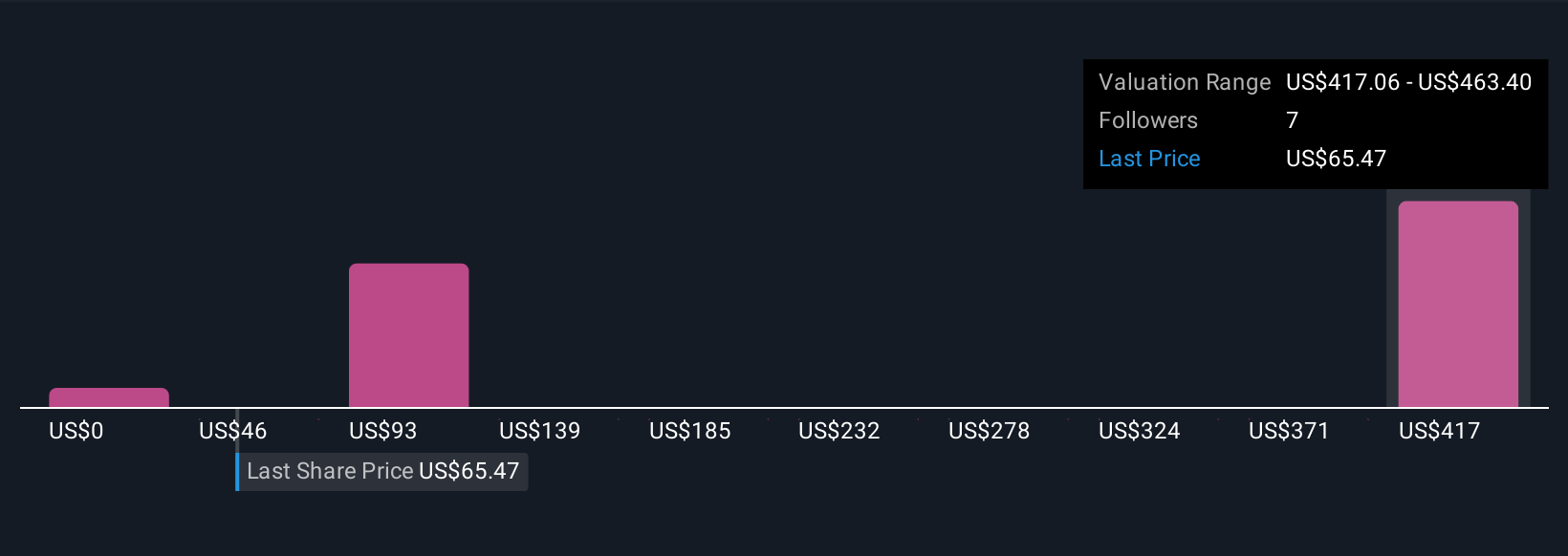

Explore 3 other fair value estimates on Soleno Therapeutics - why the stock might be worth over 8x more than the current price!

Build Your Own Soleno Therapeutics Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Soleno Therapeutics research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Soleno Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Soleno Therapeutics' overall financial health at a glance.

Ready For A Different Approach?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:SLNO

Soleno Therapeutics

A clinical-stage biopharmaceutical company, focuses on the development and commercialization of novel therapeutics for the treatment of rare diseases.

High growth potential with adequate balance sheet.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026