- United States

- /

- Biotech

- /

- NasdaqCM:SLNO

A Look at Soleno Therapeutics (SLNO) Valuation Following $100 Million Share Buyback Announcement

Reviewed by Simply Wall St

Soleno Therapeutics (SLNO) has just announced a $100 million accelerated share repurchase agreement with Jefferies LLC. The company aims to buy back a sizable chunk of its common stock over the coming months. This move highlights management’s confidence in the company’s long-term outlook.

See our latest analysis for Soleno Therapeutics.

Soleno Therapeutics’ announcement comes after a period of volatility, with the share price down over 28% in the past month and more than 34% in the past quarter. Despite this pressure, its long-term story remains dramatic, with a three-year total shareholder return exceeding 4,300%. Momentum may be cooling. However, management’s recent buyback move suggests they believe in the company’s resilience and growth potential.

If you’re tracking firms making bold moves, this is an ideal time to discover See the full list for free.

Given the recent buyback, notable valuation disconnects, and strong growth signals, the key question is whether Soleno Therapeutics is undervalued at current levels or if the market has already accounted for its future growth potential.

Price-to-Sales of 25x: Is it justified?

Soleno Therapeutics is trading at a price-to-sales ratio of 25x, while the last close price was $45.91. This is significantly higher than both its industry and peer averages, raising questions around whether the current premium is warranted.

The price-to-sales ratio represents what investors are willing to pay for each dollar of the company’s revenue. This is a common metric for fast-growing biotech firms that are not yet profitable. For Soleno, a high ratio signals strong expectations around future growth but also implies that the market is pricing in ambitious long-term results.

Compared to the US Biotechs industry average of 11.6x and a peer average of 21.8x, Soleno’s price-to-sales ratio stands out as much more expensive. Even against an estimated “fair” price-to-sales ratio of 21x, the current multiple is elevated. This suggests the market sees potential for exceptional future expansion, but may also be overreaching based on present fundamentals.

Explore the SWS fair ratio for Soleno Therapeutics

Result: Price-to-Sales of 25x (OVERVALUED)

However, slowing revenue growth or a failure to translate clinical potential into commercial results could pose significant risks to Soleno’s elevated valuation.

Find out about the key risks to this Soleno Therapeutics narrative.

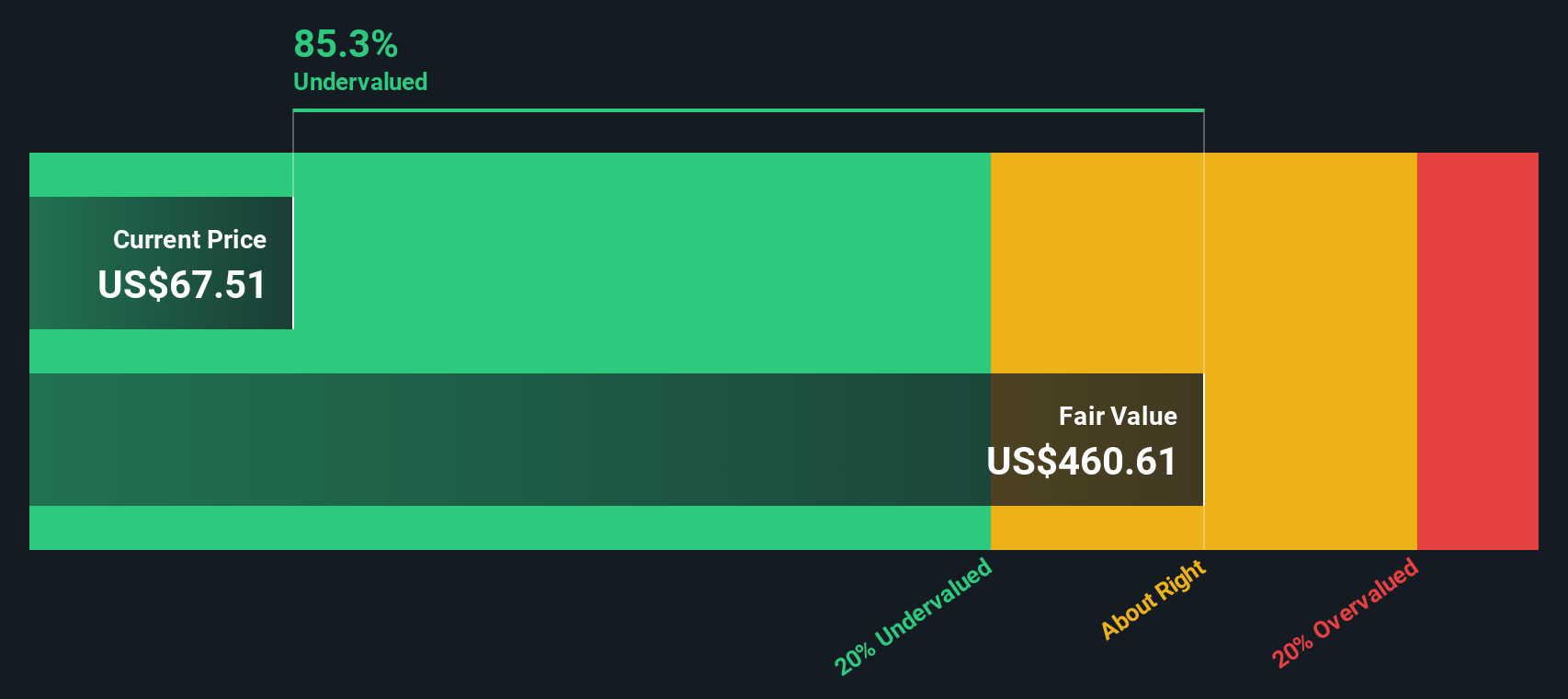

Another View: DCF Model Paints a Different Picture

While the high price-to-sales ratio suggests Soleno Therapeutics might be overvalued, our DCF model tells a different story. According to the SWS DCF analysis, the stock is trading significantly below its fair value estimate of $435.23 per share. Is the market missing something big, or are expectations simply too high?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Soleno Therapeutics for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 918 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Soleno Therapeutics Narrative

If you have a different perspective or want to dive into the numbers yourself, it only takes a few minutes to assemble your own view. Do it your way

A great starting point for your Soleno Therapeutics research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never settle for just one opportunity. Stay ahead by searching for tomorrow’s big movers, high-yield plays, and the latest AI breakthroughs now.

- Unlock high-potential opportunities at the market’s edge with these 3579 penny stocks with strong financials, which combine growth and value with unique upside stories.

- Collect steady passive income by checking out these 14 dividend stocks with yields > 3% to see which companies are rewarding shareholders with robust dividend yields.

- Position yourself at the forefront of innovation as you scan these 26 AI penny stocks to uncover companies whose artificial intelligence advances are shaping entire industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:SLNO

Soleno Therapeutics

A clinical-stage biopharmaceutical company, focuses on the development and commercialization of novel therapeutics for the treatment of rare diseases.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success