- United States

- /

- Biotech

- /

- NasdaqGS:SLDB

Analysts Have Lowered Expectations For Solid Biosciences Inc. (NASDAQ:SLDB) After Its Latest Results

It's shaping up to be a tough period for Solid Biosciences Inc. (NASDAQ:SLDB), which a week ago released some disappointing quarterly results that could have a notable impact on how the market views the stock. It was not a great statutory result, with revenues coming in 28% lower than the analysts predicted. Unsurprisingly, earnings also fell seriously short of forecasts, turning into a per-share loss of US$0.22. Earnings are an important time for investors, as they can track a company's performance, look at what the analysts are forecasting for next year, and see if there's been a change in sentiment towards the company. We thought readers would find it interesting to see the analysts latest (statutory) post-earnings forecasts for next year.

See our latest analysis for Solid Biosciences

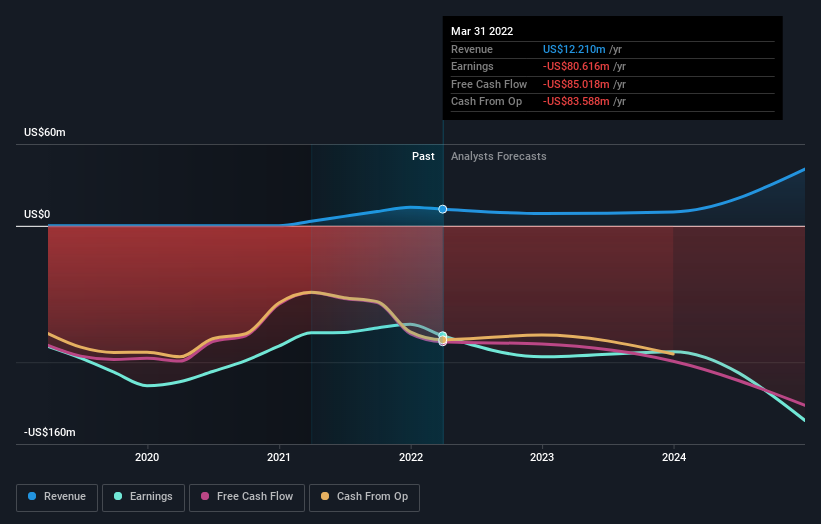

Following the recent earnings report, the consensus from four analysts covering Solid Biosciences is for revenues of US$9.01m in 2022, implying a concerning 26% decline in sales compared to the last 12 months. Per-share losses are supposed to see a sharp uptick, reaching US$0.81. Before this latest report, the consensus had been expecting revenues of US$10.2m and US$0.76 per share in losses. So there's been quite a change-up of views after the recent consensus updates, withthe analysts making a serious cut to their revenue outlook while also expecting losses per share to increase.

The consensus price target fell 27% to US$6.33, with the analysts clearly concerned about the company following the weaker revenue and earnings outlook. Fixating on a single price target can be unwise though, since the consensus target is effectively the average of analyst price targets. As a result, some investors like to look at the range of estimates to see if there are any diverging opinions on the company's valuation. There are some variant perceptions on Solid Biosciences, with the most bullish analyst valuing it at US$12.00 and the most bearish at US$2.00 per share. So we wouldn't be assigning too much credibility to analyst price targets in this case, because there are clearly some widely different views on what kind of performance this business can generate. As a result it might not be a great idea to make decisions based on the consensus price target, which is after all just an average of this wide range of estimates.

Looking at the bigger picture now, one of the ways we can make sense of these forecasts is to see how they measure up against both past performance and industry growth estimates. We would highlight that sales are expected to reverse, with a forecast 33% annualised revenue decline to the end of 2022. That is a notable change from historical growth of 129% over the last three years. By contrast, our data suggests that other companies (with analyst coverage) in the same industry are forecast to see their revenue grow 11% annually for the foreseeable future. It's pretty clear that Solid Biosciences' revenues are expected to perform substantially worse than the wider industry.

The Bottom Line

The most important thing to note is the forecast of increased losses next year, suggesting all may not be well at Solid Biosciences. On the negative side, they also downgraded their revenue estimates, and forecasts imply revenues will perform worse than the wider industry. The consensus price target fell measurably, with the analysts seemingly not reassured by the latest results, leading to a lower estimate of Solid Biosciences' future valuation.

Keeping that in mind, we still think that the longer term trajectory of the business is much more important for investors to consider. We have estimates - from multiple Solid Biosciences analysts - going out to 2024, and you can see them free on our platform here.

And what about risks? Every company has them, and we've spotted 5 warning signs for Solid Biosciences (of which 1 is concerning!) you should know about.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:SLDB

Solid Biosciences

Develops therapies for neuromuscular and cardiac diseases in the United States.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

Is this the AI replacing marketing professionals?

Pro Medicus: The Market Is Confusing a Lumpy Quarter With a Broken Business

The Rising Deal Risk That Helped Sink Netflix’s $72 Billion Bid for Warner Bros. Discovery

The Infrastructure AI Cannot Be Built Without

Recently Updated Narratives

Alphabet Inc. (GOOG): The Gemini Era – Consolidating AI Dominance in 2026.

Meta Platforms Inc (META): The AI Infrastructure Pivot – Monetizing the Next Frontier in 2026.

Enlight Renewable Energy Ltd. (ENLT): Scaling the Global Green Grid – A 2026 Powerhouse.

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks