- United States

- /

- Biotech

- /

- NasdaqGS:SANA

How Sana Biotechnology’s (SANA) Autoimmune Cell Therapy Trial Update Has Changed Its Investment Story

Reviewed by Sasha Jovanovic

- In late October 2025, Sana Biotechnology announced an update on its Phase 1 trial assessing SC291, a hypoimmune, allogeneic CD19-directed CAR T cell therapy, in patients with severe relapsed or refractory autoimmune diseases such as Lupus and Vasculitis.

- This trial could open new possibilities for cell therapies in autoimmune disease, broadening Sana's reach beyond its traditional oncology pipeline.

- We'll assess how the SC291 trial update could shift Sana Biotechnology’s investment narrative by highlighting its innovative approach to autoimmune disease treatment.

AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Sana Biotechnology's Investment Narrative?

For investors considering Sana Biotechnology, the real draw is its bold vision to develop transformative cell and gene therapies, not just for cancer but now for complex autoimmune conditions like lupus and vasculitis. The recent SC291 trial update positions Sana more squarely in the autoimmune disease arena, which could meaningfully alter the company’s risk-reward profile over the short term. Until now, key catalysts for the stock were mainly tied to its oncology pipeline and ongoing need for capital, against a backdrop of continuing financial losses, board turnover, executive changes, and a class action lawsuit. This Phase 1 readout for SC291 may refocus some investor attention: it could accelerate interest if early safety and efficacy data are supportive, but it also brings execution risks and potentially higher R&D spend. With these factors at play, the latest news might signal a more material shift than previous developments, given limited near-term revenue and the recent jump in share price. On the other hand, legal challenges could still cast a shadow as the story unfolds.

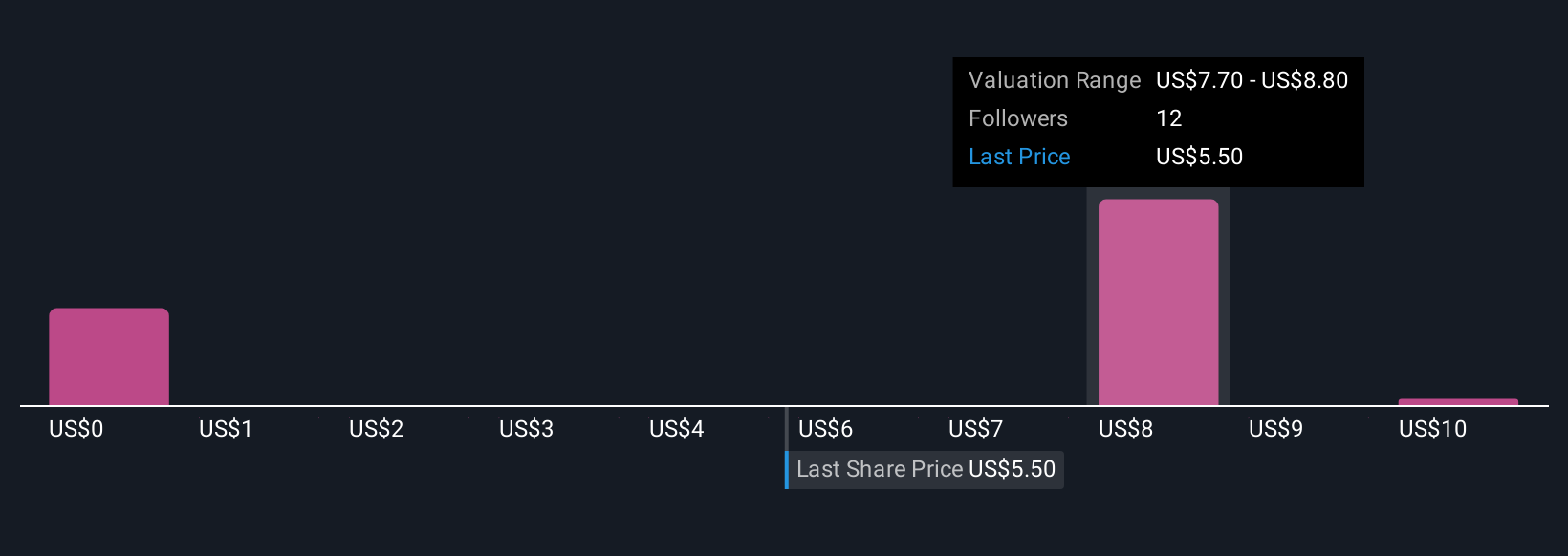

The analysis detailed in our Sana Biotechnology valuation report hints at an inflated share price compared to its estimated value.Exploring Other Perspectives

Explore 8 other fair value estimates on Sana Biotechnology - why the stock might be worth less than half the current price!

Build Your Own Sana Biotechnology Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sana Biotechnology research is our analysis highlighting 5 important warning signs that could impact your investment decision.

- Our free Sana Biotechnology research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sana Biotechnology's overall financial health at a glance.

Ready For A Different Approach?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SANA

Sana Biotechnology

A biotechnology company, focuses on utilizing engineered cells as medicines in the United States.

Excellent balance sheet with moderate risk.

Similar Companies

Market Insights

Community Narratives