- United States

- /

- Biotech

- /

- NasdaqGM:RYTM

Rhythm Pharmaceuticals (RYTM): Losses Widen, But 45.8% Revenue Growth Sets Up Profitability Narrative

Reviewed by Simply Wall St

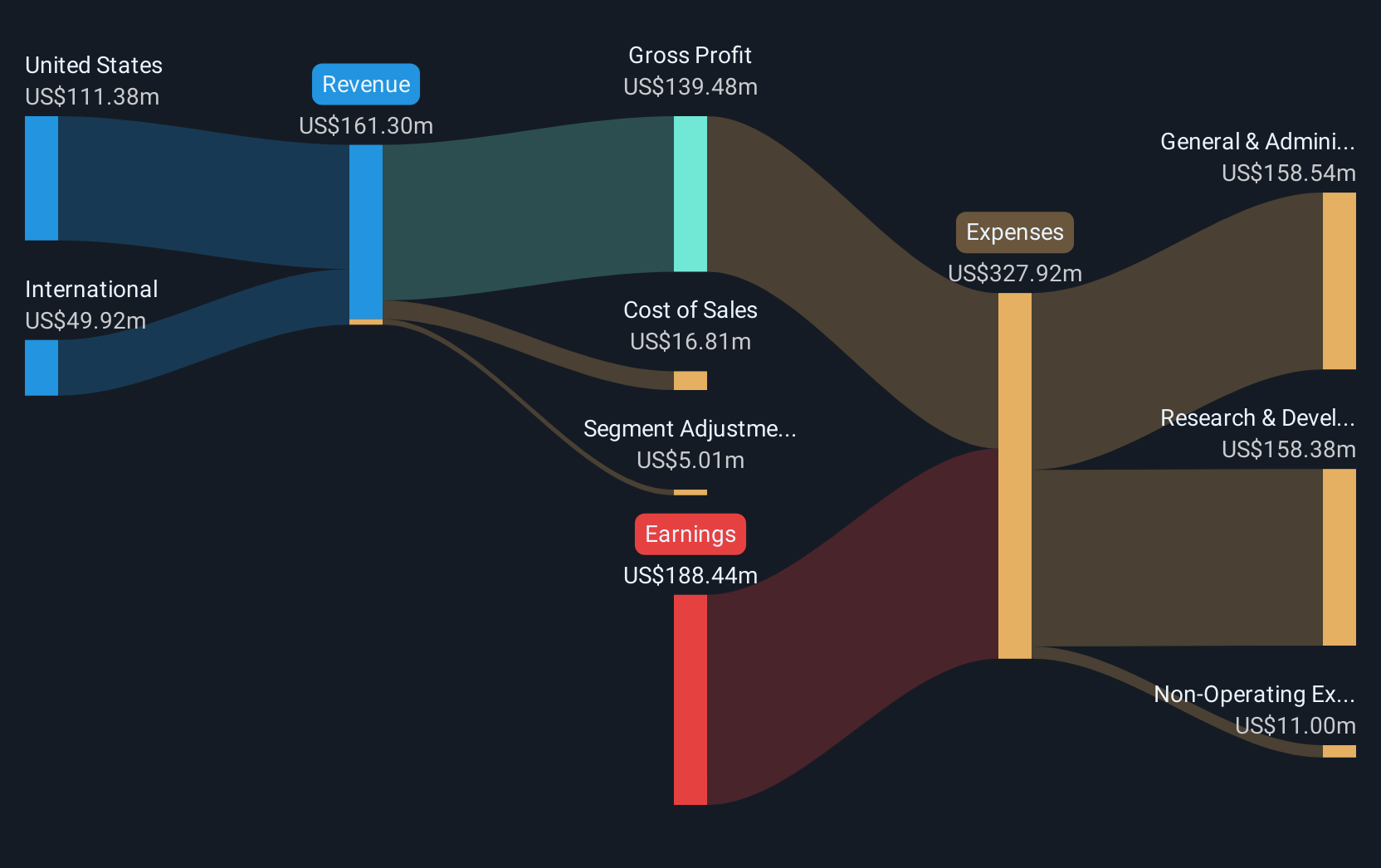

Rhythm Pharmaceuticals (RYTM) reported widening losses, with net losses having grown at a rate of 18.8% per year over the past five years. Despite being unprofitable, the company commands a Price-To-Sales Ratio of 40x, outpacing both the US Biotechs industry average of 10.8x and the peer average of 17.9x, positioning its stock as highly valued on these multiples. On the growth front, forecasts point to revenue expanding at 45.8% per year and earnings projected to grow 70.56% per year, with the company expected to reach profitability within three years.

See our full analysis for Rhythm Pharmaceuticals.The next section weighs these numbers against the most widely followed narratives in the market. This offers a clear look at where consensus may get confirmed and where expectations might be challenged.

See what the community is saying about Rhythm Pharmaceuticals

Profit Margins Poised to Swing

- Analysts expect margins to shift dramatically, moving from the current -120.6% net margin to a positive 33.8% within three years. If achieved, this would mark one of the largest margin turnarounds in the sector.

- According to the analysts' consensus view, this improvement depends on three critical drivers:

- Upcoming regulatory approvals for setmelanotide in new indications and age groups are forecast to materially increase both topline and scale. This supports margin expansion as fixed costs are absorbed.

- Extension of intellectual property protections through 2034 and beyond supports sustained pricing power and margin resilience. Rare disease exclusivity incentives limit near-term competitive threats.

- Consensus narrative links the margin swing to expanding the addressable patient base and maintaining strong pricing, both seen as necessary for achieving projected profitability shifts within the forecasted window. See how analysts put these margin leaps into context and what could challenge the turnaround in the full consensus narrative. 📊 Read the full Rhythm Pharmaceuticals Consensus Narrative.

Share Dilution Paces Growth Ambitions

- Share count is projected to rise 7.0% annually over the next three years, highlighting the tradeoff between funding rapid expansion and the risk of dilution for current shareholders.

- Analysts' consensus view identifies this as a tension point:

- Heavy R&D and SG&A outlays may require further equity raises if revenues do not ramp quickly enough, risking additional dilution beyond current estimates.

- Bears argue that while new financing fuels growth, ongoing operating losses and reliance on secondary offerings may limit net margin improvement and suppress shareholder returns if market conditions tighten.

Analyst Price Target Holds Modest Premium

- Current share price stands at $104.99, notably below both the DCF fair value of $173.75 and the analyst price target of $121.43. This implies a 15.7% potential upside to consensus but still a premium valuation compared to peers and the sector.

- Consensus narrative weighs this as follows:

- To reach the $121.43 target, the market would need to credit Rhythm with achieving $742.1 million in revenue and $250.7 million in earnings by 2028, justifying a lofty 44.3x future PE.

- Even with strong top-line momentum, Rhythm still trades well above US Biotech averages on a price-to-sales basis. This serves as a reminder that execution risks remain priced in.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Rhythm Pharmaceuticals on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have your own interpretation of the data? Share your perspective and shape your own take on Rhythm in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Rhythm Pharmaceuticals.

See What Else Is Out There

Despite rapid top-line gains and improving margin forecasts, Rhythm’s hefty valuation and ongoing operating losses highlight execution risks and uncertain value for new investors.

If you want to focus on more attractively valued opportunities, uncover companies with stronger financial upside using these 843 undervalued stocks based on cash flows before making your next move.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:RYTM

Rhythm Pharmaceuticals

A commercial-stage biopharmaceutical company, focuses on the rare neuroendocrine diseases.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives