- United States

- /

- Biotech

- /

- NasdaqGM:RYTM

Rhythm Pharmaceuticals (RYTM): Evaluating Valuation as Shares Hold Near Recent Highs

Reviewed by Kshitija Bhandaru

See our latest analysis for Rhythm Pharmaceuticals.

Zooming out, Rhythm Pharmaceuticals' share price has steadily built momentum so far this year, reflecting a broader confidence in the company's growth prospects despite only minor moves in the past week. Over the longer run, its 1-year total shareholder return of just over 1% suggests patient investors have seen modest gains. Recent price action hints at a shift in sentiment as markets reassess the risk-reward balance.

If you’re keen to spot more opportunities in the healthcare space, now’s the perfect moment to browse our handpicked selection with the See the full list for free.

With shares hovering near their recent highs, investors are left to weigh whether Rhythm Pharmaceuticals still represents an undervalued play or if the market is already factoring in all the company's future growth prospects.

Most Popular Narrative: 13.8% Undervalued

Rhythm Pharmaceuticals currently trades below the most widely followed fair value estimate, offering a potential margin versus the last close price. This presents an opportunity to examine one of the major drivers behind that valuation perspective.

Extension of intellectual property protection to 2034 for the lead asset and to 2040+ for next-generation compounds, along with orphan drug exclusivity incentives in the U.S. and EU, create a multi-year window of strong pricing power and high net margins. These factors help protect earnings from generic or biosimilar erosion. Accelerated regulatory pathways and strong reimbursement environments for rare disease therapies, as shown by early access programs and favorable payor positioning in multiple countries, enhance Rhythm's ability to rapidly scale international sales and diversify revenue streams. This supports long-term earnings resiliency.

Want to know what’s fueling these ambitious value targets? The narrative includes game-changing profit assumptions and a financial roadmap usually reserved for the market’s top disruptors. Curious about the bullish projections and aggressive underlying numbers? The catalyst behind this fair value might surprise you.

Result: Fair Value of $114.86 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing operating losses and overreliance on a single lead drug could quickly challenge the current optimism that is fueling recent price targets.

Find out about the key risks to this Rhythm Pharmaceuticals narrative.

Another View: Is the Valuation Too Rich?

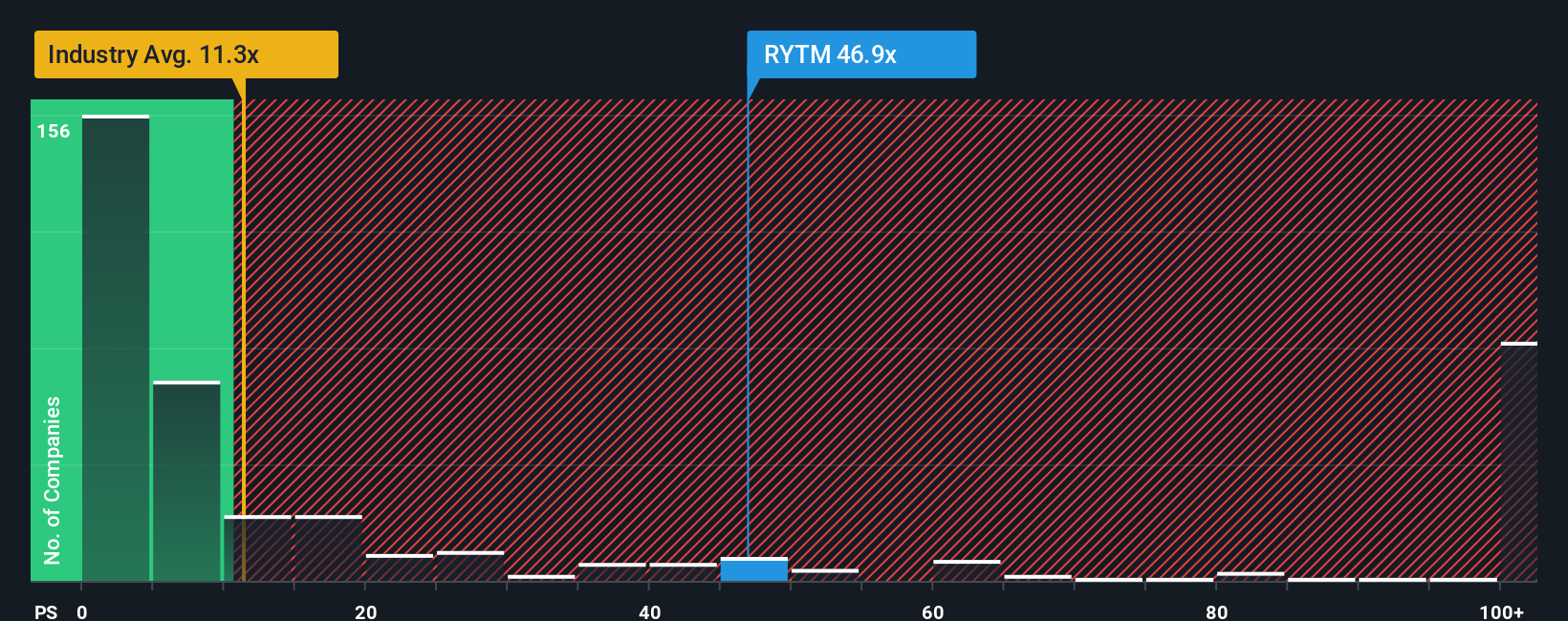

While Rhythm Pharmaceuticals looks undervalued on some fair value estimates, its price-to-sales ratio stands at 42.1 times. This is sharply higher than both the industry average of 10.5 and the peer group at 12.3, and it is well above the fair ratio of 21.5. This steep premium suggests the market is extremely optimistic about future growth, leaving little room for slipups. Does a price tag this elevated signal real opportunity or heightened risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Rhythm Pharmaceuticals Narrative

If you see things differently or want to dive into the data your own way, you can put together a personalized view in just a few minutes with the Do it your way.

A great starting point for your Rhythm Pharmaceuticals research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investing Ideas?

Don’t sit on the sidelines while others seize what’s next, especially when the market is loaded with fresh possibilities outside of Rhythm Pharmaceuticals. Get ahead of the curve today with these powerful screeners and avoid missing out on your next great move.

- Boost your potential for high returns by targeting these 3568 penny stocks with strong financials that have strong financials and promising growth trajectories.

- Accelerate your search for tomorrow’s leaders by checking out these 25 AI penny stocks making real strides with advanced artificial intelligence breakthroughs.

- Snap up value opportunities quickly by reviewing these 887 undervalued stocks based on cash flows where strong cash flows could point to the market’s best bargains.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:RYTM

Rhythm Pharmaceuticals

A commercial-stage biopharmaceutical company, focuses on the rare neuroendocrine diseases.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives