- United States

- /

- Pharma

- /

- NasdaqGM:RVNC

Revenues Not Telling The Story For Revance Therapeutics, Inc. (NASDAQ:RVNC) After Shares Rise 27%

Revance Therapeutics, Inc. (NASDAQ:RVNC) shareholders are no doubt pleased to see that the share price has bounced 27% in the last month, although it is still struggling to make up recently lost ground. But the last month did very little to improve the 52% share price decline over the last year.

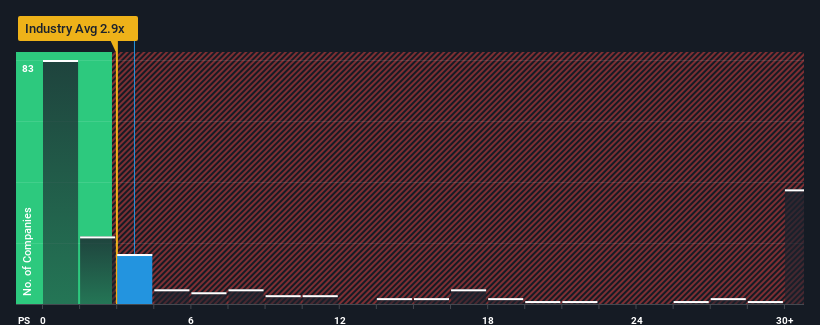

Following the firm bounce in price, Revance Therapeutics may be sending sell signals at present with a price-to-sales (or "P/S") ratio of 3.7x, when you consider almost half of the companies in the Pharmaceuticals industry in the United States have P/S ratios under 2.9x and even P/S lower than 0.7x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

View our latest analysis for Revance Therapeutics

What Does Revance Therapeutics' Recent Performance Look Like?

Recent times have been advantageous for Revance Therapeutics as its revenues have been rising faster than most other companies. The P/S is probably high because investors think this strong revenue performance will continue. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Revance Therapeutics.How Is Revance Therapeutics' Revenue Growth Trending?

Revance Therapeutics' P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

Taking a look back first, we see that the company grew revenue by an impressive 97% last year. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 39% per annum during the coming three years according to the eleven analysts following the company. With the industry predicted to deliver 57% growth per annum, the company is positioned for a weaker revenue result.

With this in consideration, we believe it doesn't make sense that Revance Therapeutics' P/S is outpacing its industry peers. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Key Takeaway

Revance Therapeutics' P/S is on the rise since its shares have risen strongly. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Despite analysts forecasting some poorer-than-industry revenue growth figures for Revance Therapeutics, this doesn't appear to be impacting the P/S in the slightest. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. At these price levels, investors should remain cautious, particularly if things don't improve.

It is also worth noting that we have found 4 warning signs for Revance Therapeutics (1 doesn't sit too well with us!) that you need to take into consideration.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:RVNC

Revance Therapeutics

A biotechnology company, engages in the development, manufacture, and commercialization of neuromodulators for various aesthetic and therapeutic indications in the United States and internationally.

Undervalued moderate.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success