- United States

- /

- Biotech

- /

- NasdaqGS:RVMD

How Investors Are Reacting To Revolution Medicines (RVMD) Appointing New Leaders Ahead of Key Drug Launches

Reviewed by Sasha Jovanovic

- Revolution Medicines recently named Dr. Alan Sandler as chief development officer and appointed new regional general managers for the U.S. and Europe, strengthening its executive and commercial teams ahead of potential new drug launches.

- These leadership changes emphasize the company’s drive to advance targeted therapies for RAS-driven cancers and expand its global market presence.

- Let's explore how bringing in seasoned leaders for development and commercialization could reshape Revolution Medicines' investment narrative as its pipeline matures.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

What Is Revolution Medicines' Investment Narrative?

For anyone considering Revolution Medicines as an investment, the main story has always revolved around the scientific potential of its pipeline, but the stakes are shifting. The recent appointments, including Dr. Alan Sandler as chief development officer and experienced regional GMs for the US and Europe, signal a stronger push toward late-stage development and eventual commercialization. This is timely, as the company’s short-term catalysts, like Phase 3 trial progress for daraxonrasib and FDA designations, demand tight operational execution and commercial planning. While these new leaders bring needed expertise just as pivotal studies ramp up, Revolution Medicines remains firmly pre-revenue and is reporting mounting losses, projected to exceed US$1 billion this year. The risk of resource strain and execution missteps remains high, but stronger leadership could smooth the path to possible regulatory and market milestones if they can deliver results quickly enough.

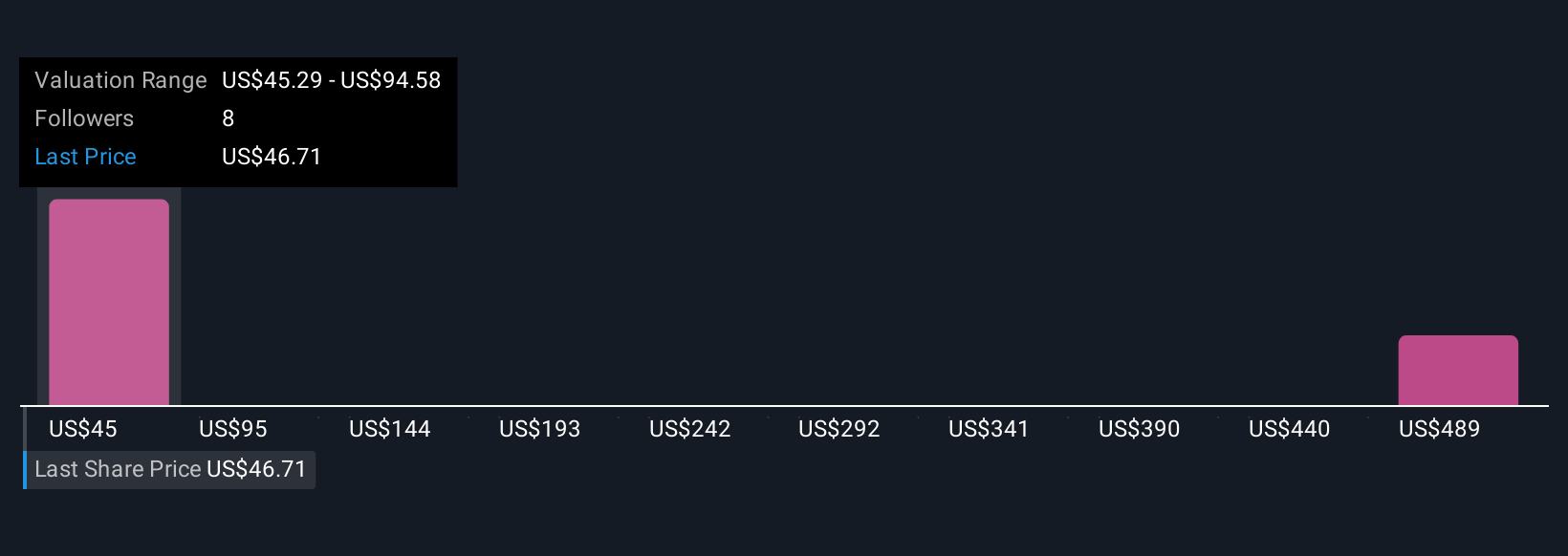

But, execution risk could weigh heavily as spending accelerates and profitability remains distant. Revolution Medicines' shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 4 other fair value estimates on Revolution Medicines - why the stock might be worth 6% less than the current price!

Build Your Own Revolution Medicines Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Revolution Medicines research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Revolution Medicines research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Revolution Medicines' overall financial health at a glance.

Want Some Alternatives?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RVMD

Revolution Medicines

A clinical-stage precision oncology company, develops novel targeted therapies for RAS-addicted cancers.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives