- United States

- /

- Biotech

- /

- NasdaqGS:RVMD

Does Revolution Medicines' Recent 27% Jump Reflect Its Real Value?

Reviewed by Bailey Pemberton

- Ever wondered if Revolution Medicines is trading at an attractive price, or if investors are getting ahead of themselves? Let's take a closer look at what's been powering curiosity around this biotech stock.

- Revolution Medicines has gained 2.3% in the past week and jumped an impressive 27.4% over the last month, with the stock up 34.9% year-to-date and a staggering 212.8% over three years.

- The buzz has only grown following recent reports of successful progress in its cancer drug pipeline, as well as new partnerships and expanded clinical trial programs. These developments have shifted sentiment, fueling both optimism and some caution as investors weigh the long-term potential.

- On our valuation scorecard, Revolution Medicines scores 4 out of 6, reflecting strength in several key measures of undervaluation but with some areas that warrant scrutiny. There may be a smarter way to look beyond these numbers, which we'll get to by the end of the article.

Approach 1: Revolution Medicines Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's value by projecting its future cash flows and discounting them back to today's value. This approach gives investors a sense of what the business might truly be worth, independent of current market emotions.

For Revolution Medicines, the latest reported Free Cash Flow stands at roughly negative $700 million, reflecting ongoing investment in research and development as the company advances its drug pipeline. Analysts forecast continued negative cash flows through 2028, with a swing to positive territory of $598 million by 2029. Looking further out, extrapolations suggest Free Cash Flow could reach $2.54 billion by 2035. These long-term estimates should be viewed with caution given the uncertainties in drug development and commercialization.

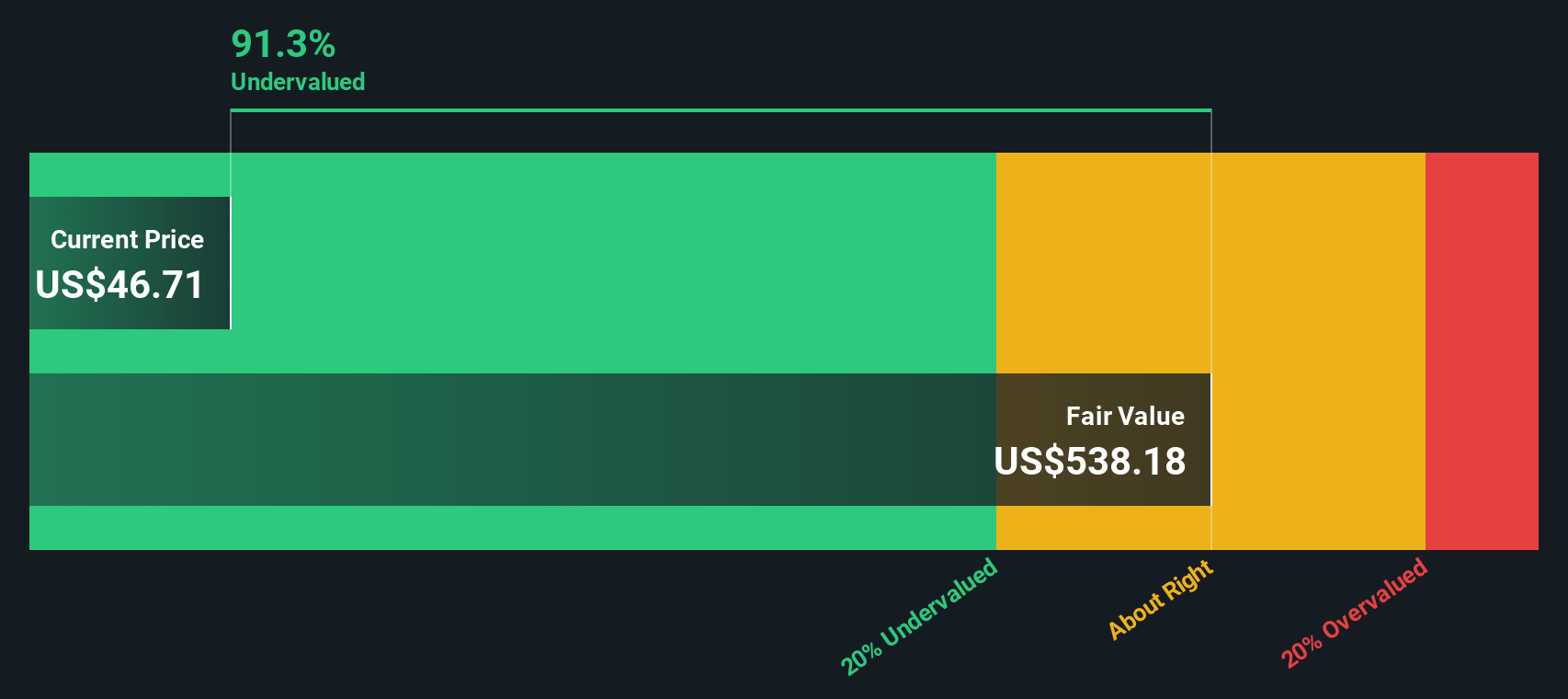

Based on this cash flow profile, the DCF model arrives at an intrinsic value of $217.89 per share. The current share price implies a 72.8% discount to this value, so Revolution Medicines appears significantly undervalued by this approach. However, investors should remember that projections beyond the next few years are highly speculative in biotechnology.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Revolution Medicines is undervalued by 72.8%. Track this in your watchlist or portfolio, or discover 845 more undervalued stocks based on cash flows.

Approach 2: Revolution Medicines Price vs Book

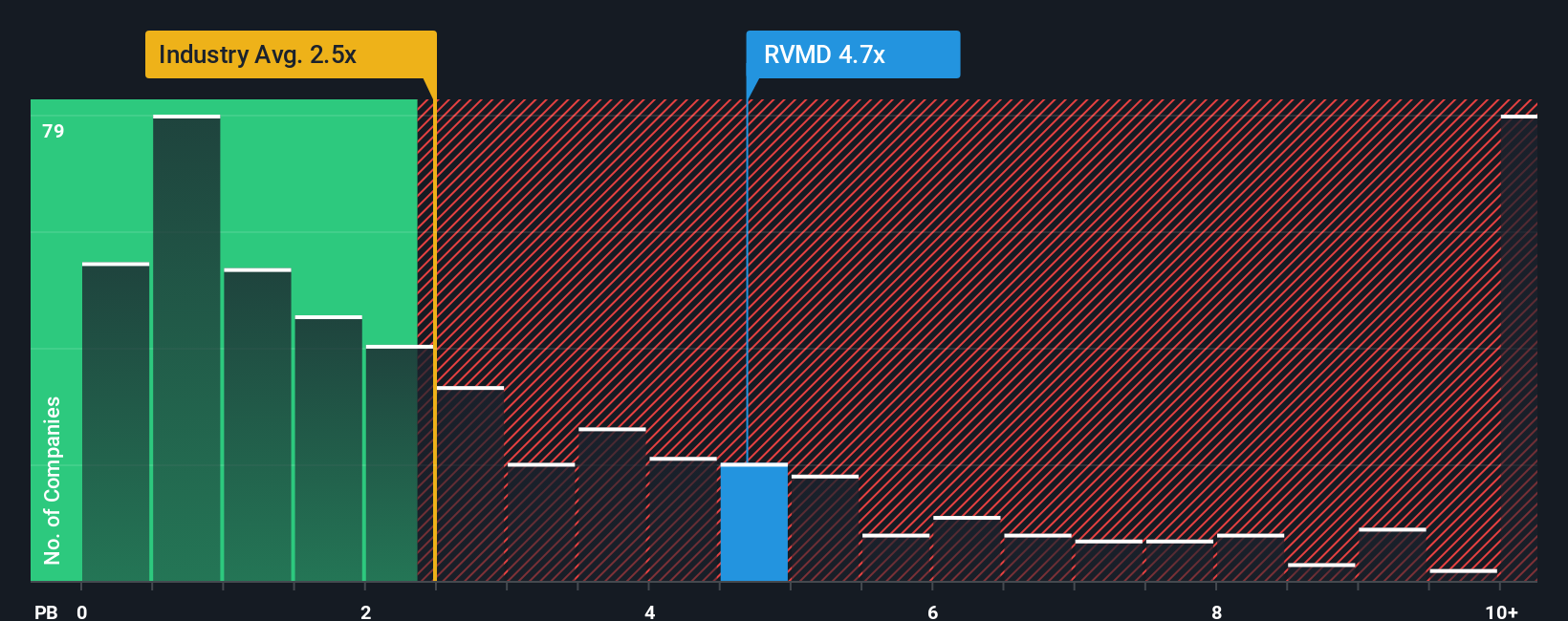

The Price-to-Book (PB) ratio is a useful valuation gauge for companies like Revolution Medicines, especially when they are not yet profitable. This metric compares a company’s market value to its net assets, offering insight into how the market values what the company owns, rather than what it earns. For biotech firms with large research investments and no consistent earnings, PB serves as a more relevant metric than measures like Price-to-Earnings (PE).

Not all PB ratios are created equal. In high-growth or high-risk sectors such as biotech, investors may accept a higher PB ratio, reflecting optimism about innovative pipelines and future breakthroughs. Conversely, for companies with slower growth or higher risk profiles, a lower PB multiple is often justified.

Currently, Revolution Medicines trades at a PB ratio of 5.95x. This is well above the Biotechs industry average of 2.42x, but below the peer average of 19.36x. While industry and peer comparisons are helpful, they do not fully reflect Revolution Medicines’ unique profile and outlook.

This is where Simply Wall St's “Fair Ratio” comes in. Unlike standard benchmarks, the Fair Ratio is tailored to account for Revolution Medicines’ expected growth, risk factors, market cap, margins, and industry dynamics. By integrating all these elements, it gives a more precise sense of what a fair valuation should look like for this company.

In this case, Revolution Medicines’ actual PB ratio is noticeably lower than the peer group and much higher than the industry average. The Fair Ratio is not provided here. Based on these indicators and Revolution Medicines’ growth prospects and risks, its stock could be considered moderately valued. It appears neither strikingly cheap nor unreasonably expensive compared to what investors might expect for a company at this stage.

Result: ABOUT RIGHT

PB ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1407 companies where insiders are betting big on explosive growth.

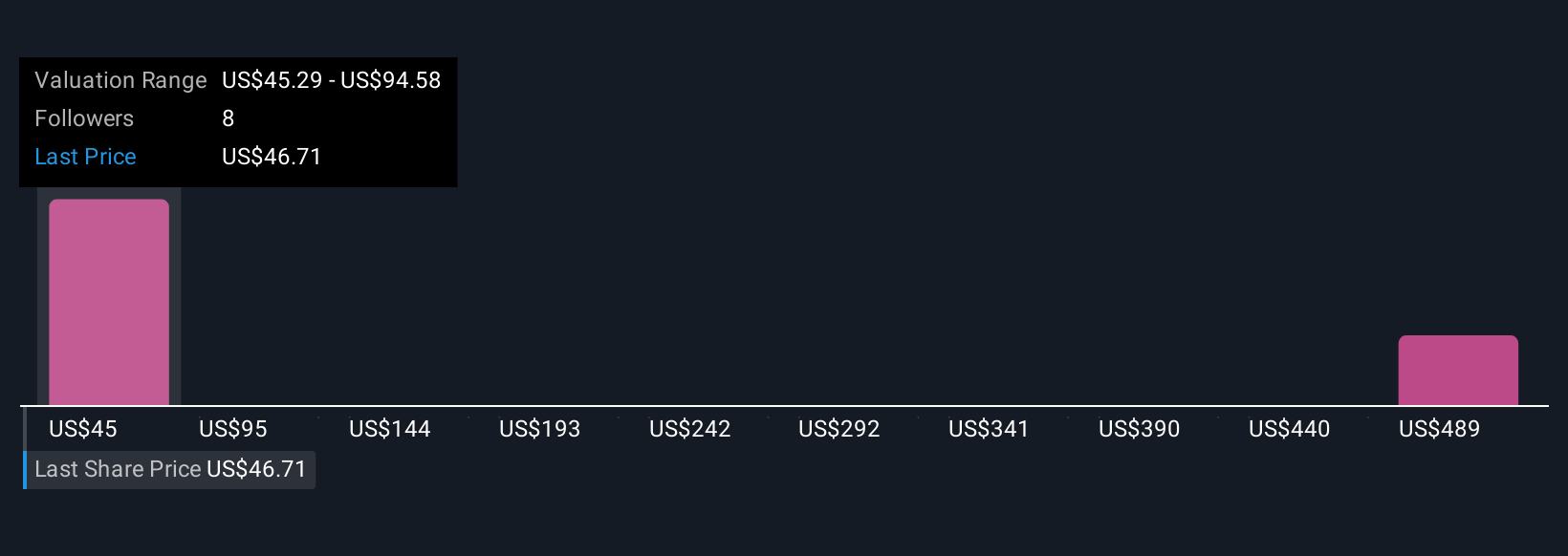

Upgrade Your Decision Making: Choose your Revolution Medicines Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative gives you the power to tell your story about Revolution Medicines by blending your perspective, such as your assumptions for future revenue, margins, or fair value, with the company’s latest numbers. Narratives connect the dots from your outlook to a financial forecast and finally to a clear, actionable fair value. On Simply Wall St’s Community page, used by millions of investors, creating or following Narratives is simple and accessible to everyone.

With Narratives, you can quickly see whether the fair value you believe in matches up with today’s share price, helping you decide when to buy or sell. These Narratives are dynamic and instantly update whenever new developments and earnings come out, so your view is always current. For example, one investor might see Revolution Medicines’ potential and estimate a fair value above $230 per share, while another prefers a more cautious outlook and lands closer to $75. Narratives make it easy to compare different perspectives and upgrade your investing decisions with real-time insights.

Do you think there's more to the story for Revolution Medicines? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RVMD

Revolution Medicines

A clinical-stage precision oncology company, develops novel targeted therapies for RAS-addicted cancers.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives