- United States

- /

- Pharma

- /

- NasdaqGS:RPRX

What Recent Royalty Deals Mean for Royalty Pharma Shares After a 56.7% Rally in 2025

Reviewed by Bailey Pemberton

- Curious whether Royalty Pharma is trading at a bargain, or if its recent performance signals something more? You are not alone. Valuation-focused investors have been eyeing this stock closely.

- After a strong run, Royalty Pharma’s shares are up 10.2% in the last week and 11.9% this month, racking up an impressive 56.7% gain year-to-date.

- Recent headlines have highlighted Royalty Pharma's aggressive moves in acquiring new royalty interests and expanding its biopharma portfolio. Both of these actions appear to have boosted investor sentiment. Analysts and news outlets are noting that this activity could position the company for even broader growth opportunities moving forward.

- On our valuation checks, Royalty Pharma racks up a solid 5 out of 6 score, which suggests it might be notably undervalued. We will break down what this means with several approaches, but stick around for an even smarter way to think about the company’s fair value.

Approach 1: Royalty Pharma Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and then discounting those cash flows to today's dollars. This helps investors gauge what a business is truly worth today, based on its ability to generate future cash.

For Royalty Pharma, the most recent Free Cash Flow sits at $339 million. Analyst estimates project that by 2029, annual free cash flow will climb to $3.82 billion, with growth continuing through 2035 by extrapolation. These projections mean that Royalty Pharma’s cash generation is expected to multiply rapidly over the coming decade. Importantly, only the first five years are based on direct analyst estimates. The longer-term numbers represent derived expectations.

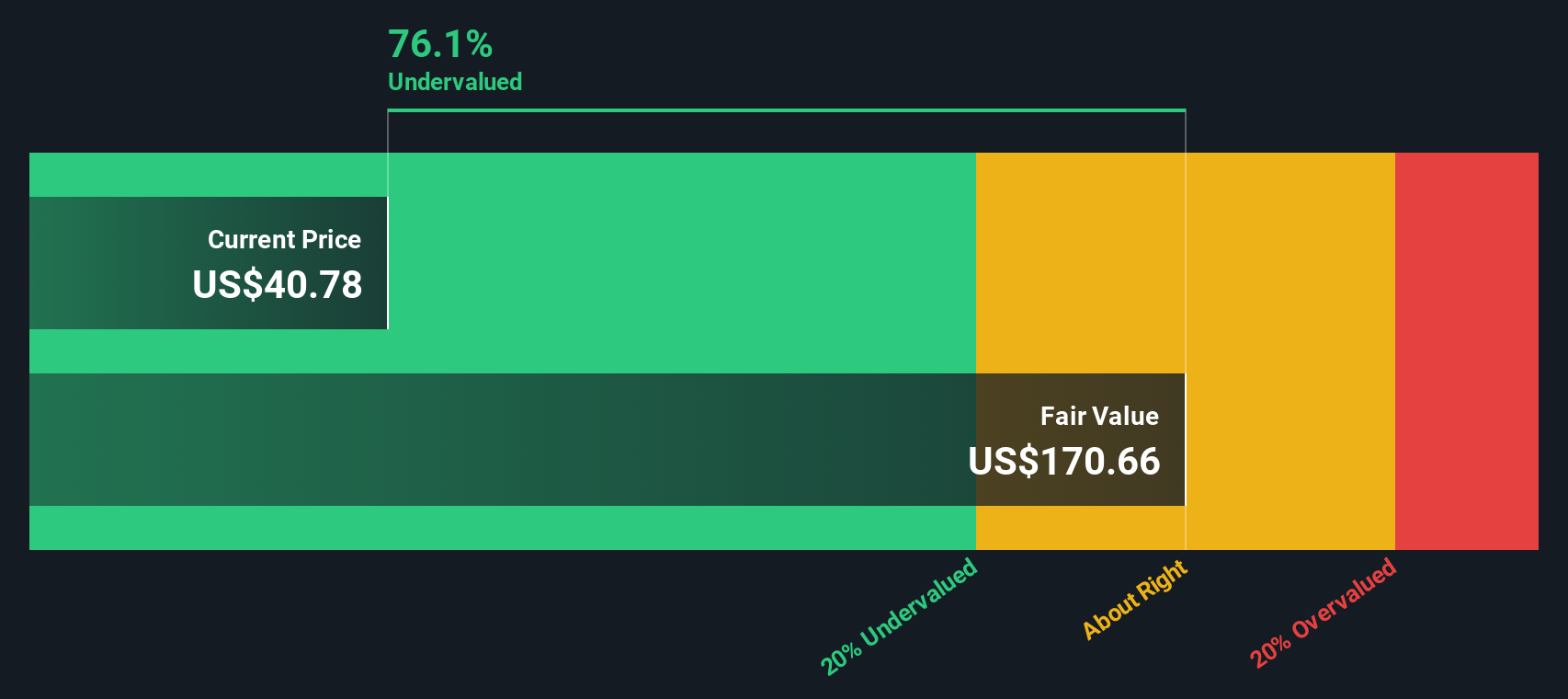

Based on these cash flow forecasts, the DCF model calculates an intrinsic fair value for Royalty Pharma of $172.03 per share. When compared with its current trading level, the analysis finds the stock is trading at a 76.5% discount to its estimated fair value.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Royalty Pharma is undervalued by 76.5%. Track this in your watchlist or portfolio, or discover 836 more undervalued stocks based on cash flows.

Approach 2: Royalty Pharma Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely trusted valuation tool for profitable companies because it compares a company's share price to its earnings, providing a clear gauge of what investors are willing to pay for each dollar of profit today. For stable and established businesses like Royalty Pharma, the PE ratio is especially useful as it helps capture market sentiment around both growth prospects and risks.

Growth expectations play a big role in determining what a "normal" or "fair" PE should be. Companies with faster earnings growth and lower risk profiles generally command higher PE ratios, while those with slower growth or more uncertainty trade at lower PE levels. It is important to compare Royalty Pharma's PE ratio not just in isolation but also against industry averages and peers for a clearer benchmark.

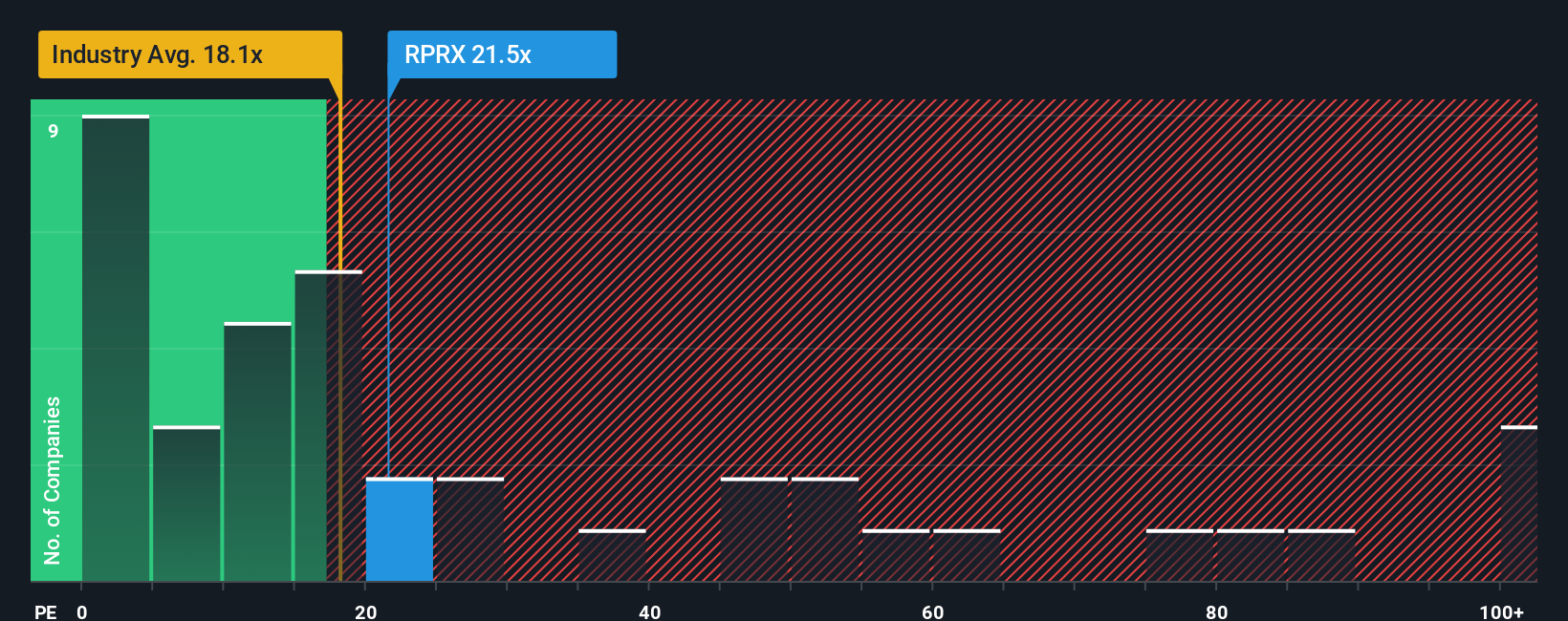

Currently, Royalty Pharma trades at a PE ratio of 17.1x. This is closely in line with the Pharmaceuticals industry average of 17.7x, and lower than its peer average of 30.4x. However, Simply Wall St’s proprietary "Fair Ratio" model sets Royalty Pharma's Fair PE ratio at 17.8x. This Fair Ratio accounts for context such as the company's expected earnings growth, profit margins, industry positioning, and overall risk profile, making it a more tailored benchmark than the blunt industry or peer averages.

Comparing the Fair Ratio of 17.8x with the actual PE of 17.1x, the difference is less than 0.1x, which suggests Royalty Pharma is valued almost exactly where it should be based on these fundamentals.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1402 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Royalty Pharma Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple, powerful tool that lets you add your own story to the numbers by stating your view on Royalty Pharma’s drivers, future revenue, earnings, and fair value. This helps you see how your unique perspective changes what the company is actually worth.

Unlike traditional analysis, Narratives directly link your view of Royalty Pharma’s business story to financial forecasts, then translate those into a fair value estimate. Available on Simply Wall St’s Community page, trusted by millions of investors, Narratives are easy to build, compare, or update at any time as the facts change. This empowers you to make active, research-backed decisions.

They help you decide whether to buy, hold, or sell by comparing your Fair Value (based on your narrative) against the real-time share price. Because Narratives update automatically when relevant news or earnings break, they keep your thinking agile and data-driven.

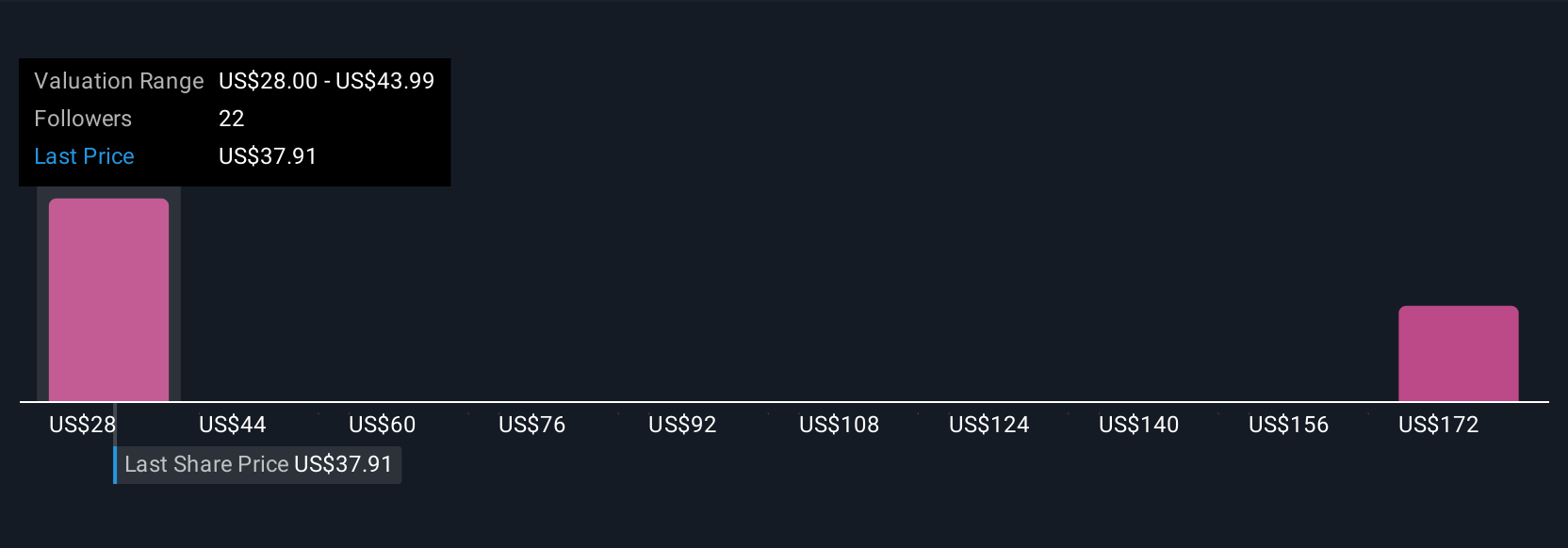

For example, some Royalty Pharma investors have crafted bullish Narratives around its rapid royalty deal expansion and see a fair value as high as $55.00 per share, while more cautious investors, pointing to regulatory and patent risks, see it closer to $37.00. This proves there is no single story or price target, just better-informed decisions.

Do you think there's more to the story for Royalty Pharma? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RPRX

Royalty Pharma

Operates as a buyer of biopharmaceutical royalties and a funder of innovation in the biopharmaceutical industry in the United States.

Undervalued with solid track record.

Market Insights

Community Narratives