- United States

- /

- Pharma

- /

- NasdaqGS:RPRX

Royalty Pharma (RPRX): Assessing Valuation After Bold $4 Billion in New Deals and Funding Moves

Reviewed by Kshitija Bhandaru

Royalty Pharma (RPRX) just made some bold moves that have investors leaning in a little closer. In September, the company completed a $2 billion senior notes offering, giving it more firepower to go after long-term royalty assets and sign new deals. In addition, Royalty Pharma announced a $2 billion synthetic royalty agreement with Revolution Medicines, targeting a late-stage oncology drug. Together, these headline acts signal that Royalty Pharma is betting big on future growth through an expanded portfolio, and the market is watching closely.

These deals land during a year when the company’s momentum has been steady, despite a dip over the past month. Looking at the bigger picture, Royalty Pharma has delivered a 34% return over the past year, with year-to-date performance up 40%. While its three- and five-year returns are negative, the recent string of strategic investments hints at a push for a turnaround. With ongoing adoption of royalties in biotech and a growing focus on data-driven dealmaking, Royalty Pharma is setting itself up for long-term portfolio expansion.

After these two game-changing moves and a strong run this year, does Royalty Pharma still offer investors meaningful upside, or has the market already factored in future growth?

Most Popular Narrative: 19.2% Undervalued

According to the most widely followed narrative, Royalty Pharma is currently undervalued by about 19% based on future earnings growth, profit margins, and other risk factors.

The emergence of new, capital-intensive therapies for chronic and life-threatening conditions (notably oncology and rare diseases), combined with an aging population and the growing prevalence of chronic illness, is creating sustained demand for innovative drugs. This expanding R&D pipeline increases the number and value of potential royalty deals for Royalty Pharma, supporting long-term revenue and earnings growth.

What is the real engine behind this confident valuation? Analysts are betting on a surge in future revenues, a portfolio fueled by medical innovation, and a financial model designed to rival industry heavyweights. Want to discover what bold assumptions about future earnings, growth rates, and margins could push Royalty Pharma’s fair value higher? The story is deeper than the latest deals. See how consensus views may surprise you.

Result: Fair Value of $44.86 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing legal disputes and increased competition in the royalty space could jeopardize revenue growth and challenge assumptions behind Royalty Pharma's current valuation.

Find out about the key risks to this Royalty Pharma narrative.Another View: What Does Our DCF Model Say?

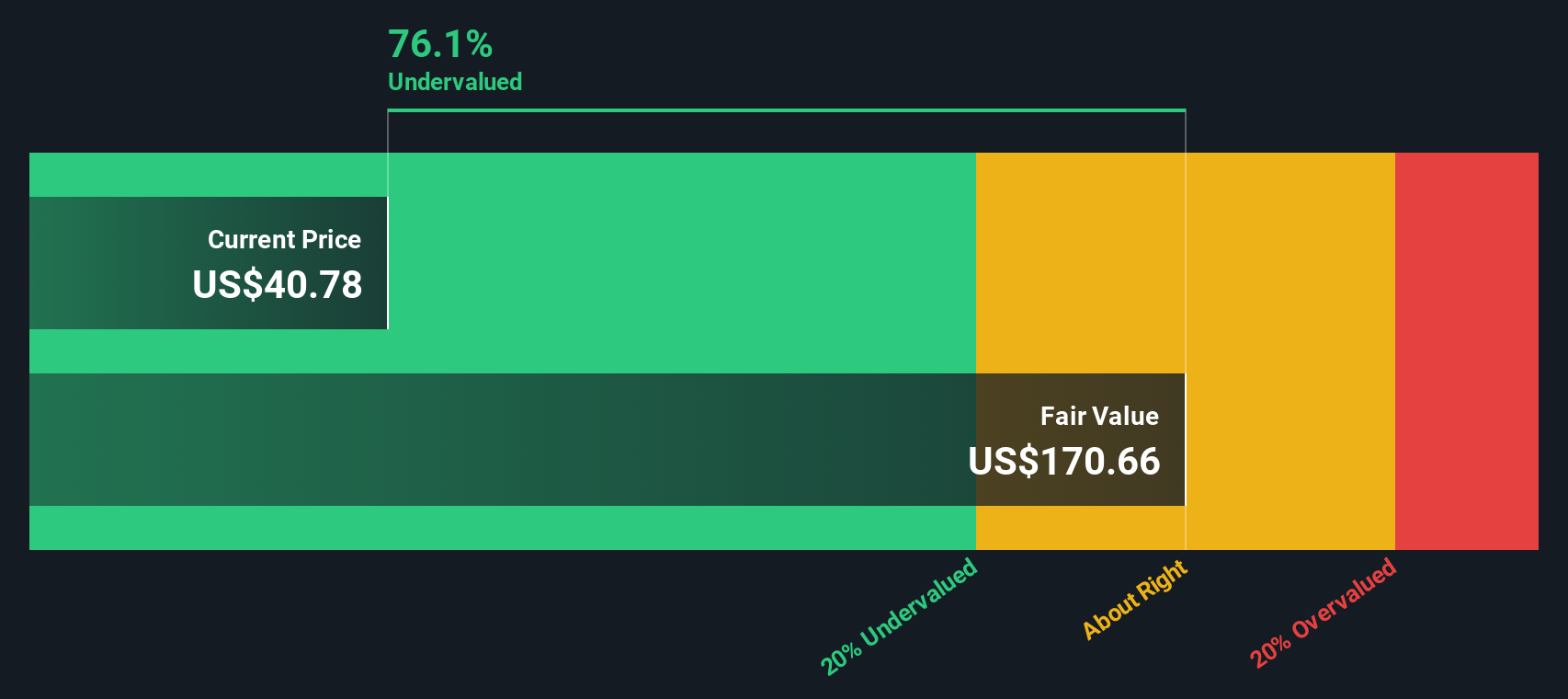

Looking at Royalty Pharma from a different angle, the SWS DCF model also finds the company's shares to be undervalued. However, it is important to consider whether both methods rely on the same optimistic assumptions or if one might be overlooking deeper risks.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Royalty Pharma Narrative

If you have a different perspective or want to dig into the details yourself, it takes just a few minutes to shape your own view. Do it your way

A great starting point for your Royalty Pharma research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don’t just watch from the sidelines while others snap up tomorrow’s winners. Expand your strategy with unique ideas that could reshape your portfolio this year.

- Secure stronger returns by targeting companies with robust financials and consistent cash flows with our list of undervalued stocks based on cash flows.

- Tap into the boom of innovative healthcare solutions by finding firms pioneering AI-driven breakthroughs with our handpicked lineup of healthcare AI stocks.

- Enhance your income stream with resilient choices offering attractive payouts in today's market through our selection of dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RPRX

Royalty Pharma

Operates as a buyer of biopharmaceutical royalties and a funder of innovation in the biopharmaceutical industry in the United States.

Undervalued with solid track record.

Market Insights

Community Narratives