- United States

- /

- Biotech

- /

- NasdaqGS:ROIV

Roivant Sciences (ROIV): Evaluating Valuation After Pipeline Milestones in Graves’ Disease and Pulmonary Hypertension

Reviewed by Simply Wall St

Roivant Sciences (ROIV) has landed firmly on the radar this week, thanks to two attention-grabbing developments that could reshape its long-term outlook. First, its subsidiary Immunovant announced promising proof-of-concept results for batoclimab in treating uncontrolled Graves’ Disease, hinting at a fresh approach to a tricky autoimmune condition. Not long after, Japan’s Ministry of Health granted orphan drug designation to Roivant’s mosliciguat for pulmonary hypertension, marking another step forward in the company’s drive to tackle unmet medical needs. These dual headlines spotlight Roivant’s capacity to move the needle in drug innovation and potentially set up a new chapter for investors to assess.

The market’s reaction has been swift, but not overblown. Roivant’s shares are up 14% for the year and have gained 23% this past month, building on momentum from a series of scientific advancements and strategic milestones across its portfolio. While last week also saw a significant shareholder sell a sizable stake, the underlying business trends such as annual revenue growth at 56% and improving net income help anchor investor sentiment in fundamentals. Altogether, the recent jump suggests that sentiment is strengthening as the pipeline delivers early signals of progress.

With these breakthroughs now reflected in the price, the big question lingers: Is Roivant Sciences at an inflection point for outsized returns, or are investors already pricing in its future potential?

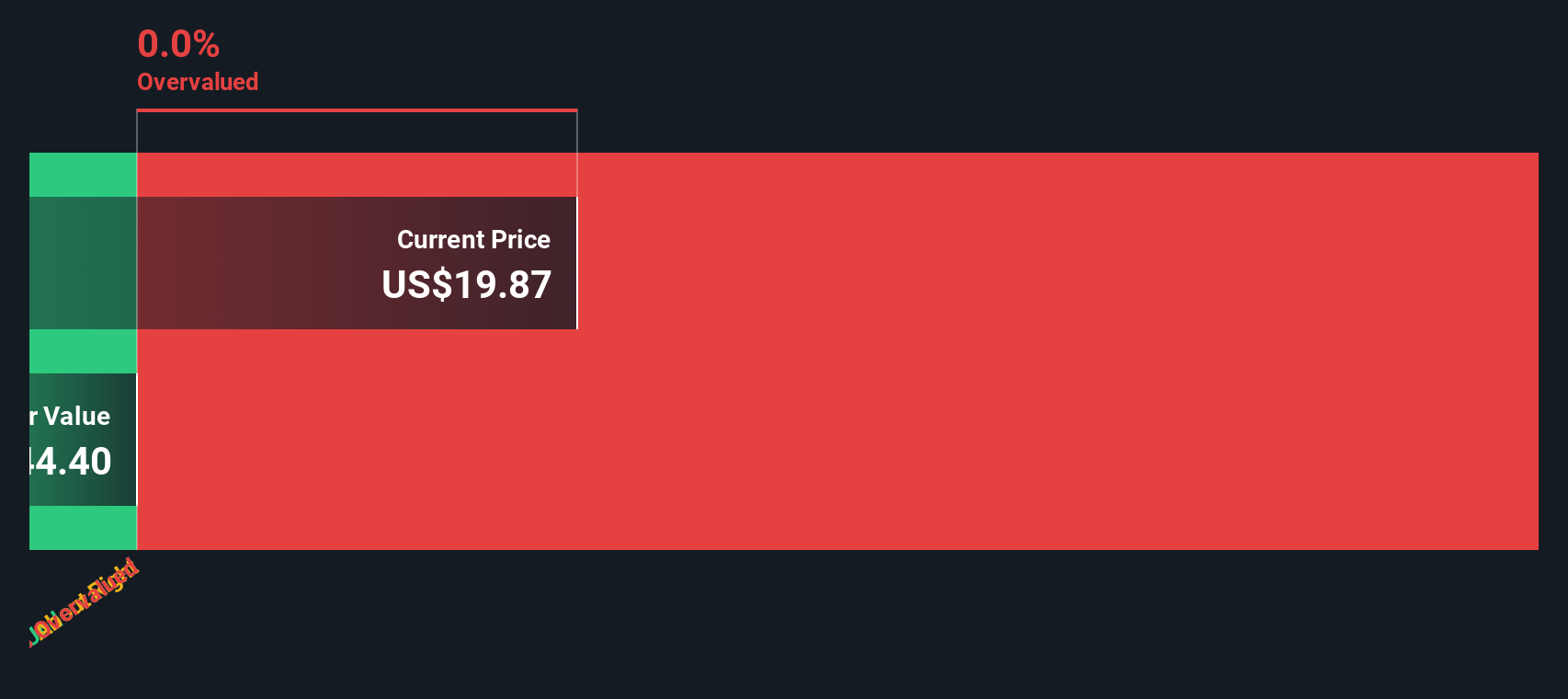

Most Popular Narrative: 19% Undervalued

The current narrative suggests Roivant Sciences is undervalued by nearly 20%, supported by optimism around upcoming clinical catalysts and strategic execution. Analysts anticipate that recent momentum and future milestones are not fully reflected in the current price.

The mechanism of action for brepocitinib is viewed as partially de-risked based on off-label use and prior JAK inhibitor trials. The upcoming dermatomyositis catalyst is not fully reflected in the current share price.

This story is gaining traction for a reason. The narrative is bold, projecting not just high growth, but a re-rating based on future industry-level margins and aggressive earnings improvement. The real intrigue lies in unlocking which ambitious numbers drive the analysts' higher price target and why they believe Roivant’s revenue engine could power well beyond usual expectations.

Result: Fair Value of $17 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent execution risks, including clinical trial setbacks and fierce competition, could quickly dampen sentiment and challenge the current valuation narrative.

Find out about the key risks to this Roivant Sciences narrative.Another View: What Does Our DCF Model Say?

While analyst optimism points to upside, our DCF model takes a more measured approach by weighing Roivant’s risks, high costs, and future growth against its current valuation. Could the market be overlooking some downside?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Roivant Sciences Narrative

If you see things differently or want to dig into the details on your own terms, you can shape your own analysis in just a few minutes. Do it your way.

A great starting point for your Roivant Sciences research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more smart investment opportunities?

Stay ahead of the curve by checking out innovative stock themes and fresh opportunities. Don’t let the next big winner slip through your fingers. Take action with these powerful strategies:

- Spot value gems set to surprise the market by tapping into undervalued stocks based on cash flows and see which companies are trading below their potential.

- Uncover tomorrow’s tech disruptors shaping the AI revolution through AI penny stocks to find those poised for explosive growth in artificial intelligence.

- Secure steady returns and reliable income with dividend stocks with yields > 3% as you look for stocks yielding above 3% for your portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ROIV

Roivant Sciences

A clinical-stage biopharmaceutical company, focuses on the discovery, development, and commercialization of medicines and technologies.

Flawless balance sheet with limited growth.

Market Insights

Community Narratives