- United States

- /

- Biotech

- /

- NasdaqGS:RGNX

Investors Don't See Light At End Of REGENXBIO Inc.'s (NASDAQ:RGNX) Tunnel

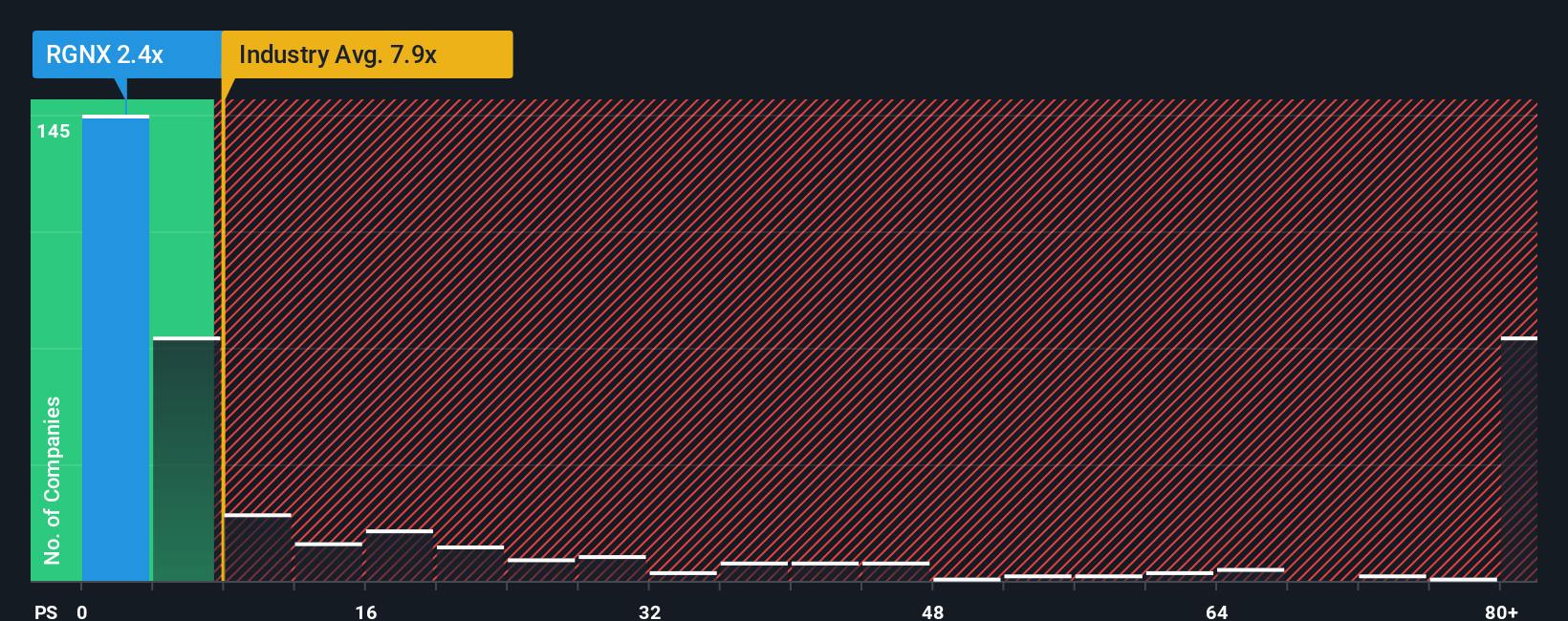

With a price-to-sales (or "P/S") ratio of 2.4x REGENXBIO Inc. (NASDAQ:RGNX) may be sending very bullish signals at the moment, given that almost half of all the Biotechs companies in the United States have P/S ratios greater than 7.9x and even P/S higher than 61x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

View our latest analysis for REGENXBIO

What Does REGENXBIO's Recent Performance Look Like?

REGENXBIO could be doing better as it's been growing revenue less than most other companies lately. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on REGENXBIO.Is There Any Revenue Growth Forecasted For REGENXBIO?

The only time you'd be truly comfortable seeing a P/S as depressed as REGENXBIO's is when the company's growth is on track to lag the industry decidedly.

If we review the last year of revenue growth, the company posted a terrific increase of 75%. Despite this strong recent growth, it's still struggling to catch up as its three-year revenue frustratingly shrank by 68% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Shifting to the future, estimates from the eleven analysts covering the company suggest revenue should grow by 37% each year over the next three years. Meanwhile, the rest of the industry is forecast to expand by 101% per year, which is noticeably more attractive.

In light of this, it's understandable that REGENXBIO's P/S sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Bottom Line On REGENXBIO's P/S

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As expected, our analysis of REGENXBIO's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. The company will need a change of fortune to justify the P/S rising higher in the future.

We don't want to rain on the parade too much, but we did also find 2 warning signs for REGENXBIO that you need to be mindful of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:RGNX

REGENXBIO

A clinical-stage biotechnology company, provides gene therapies that deliver functional genes to cells with genetic defects in the United States.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives