- United States

- /

- Life Sciences

- /

- NasdaqGS:RGEN

Repligen (RGEN): Assessing Valuation After Q3 Revenue Beat and Lower Profit Guidance

Reviewed by Simply Wall St

Repligen (RGEN) delivered third-quarter results that grabbed investor attention, with revenues jumping well ahead of forecasts thanks to double-digit growth across multiple business lines and regions. Still, the company signaled some caution by trimming its full-year adjusted earnings outlook, citing higher operating costs and strategic investments.

See our latest analysis for Repligen.

Repligen's share price has shown plenty of volatility this year, with a particularly sharp 25% rally over the past three months that coincided with upbeat quarterly sales. However, recent guidance cuts for profitability have weighed on sentiment. In the bigger picture, the stock’s one-year total shareholder return of 7.5% signals modest long-term progress. Returns over three and five years remain negative, reflecting past challenges and a market that is still recalibrating its growth expectations.

If new leadership or financial momentum inspires you, now is a great moment to broaden your search and discover See the full list for free.

With strong sales growth and guidance that sits above Wall Street expectations, yet a more cautious profit outlook, investors now face a familiar dilemma: is Repligen undervalued at current levels, or is the market fully pricing in future gains?

Most Popular Narrative: 19.3% Undervalued

With Repligen closing last session at $149.06 and the most widely cited narrative setting its fair value at $184.76, there is a sizeable gap between price and expectation. This sets the stage for contrasting opinions about future growth and market sentiment.

Strategic push into fast-growing modalities like cell therapy and ADCs, combined with continued innovation in filtration and PAT-enabled systems, is expected to enhance product mix toward higher-margin offerings and drive gross margin expansion over the next several years.

Curious why this narrative points to a fair value well above today’s price? There is one ambitious assumption here—a projected leap in recurring revenues and margin expansion that breaks with recent trends. Intrigued to see which core business bets shape this bold calculation? There is more than meets the eye behind these numbers.

Result: Fair Value of $184.76 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained weakness in biotech funding or prolonged revenue slowdowns could quickly undermine these optimistic projections. This could trigger renewed volatility for Repligen’s shares.

Find out about the key risks to this Repligen narrative.

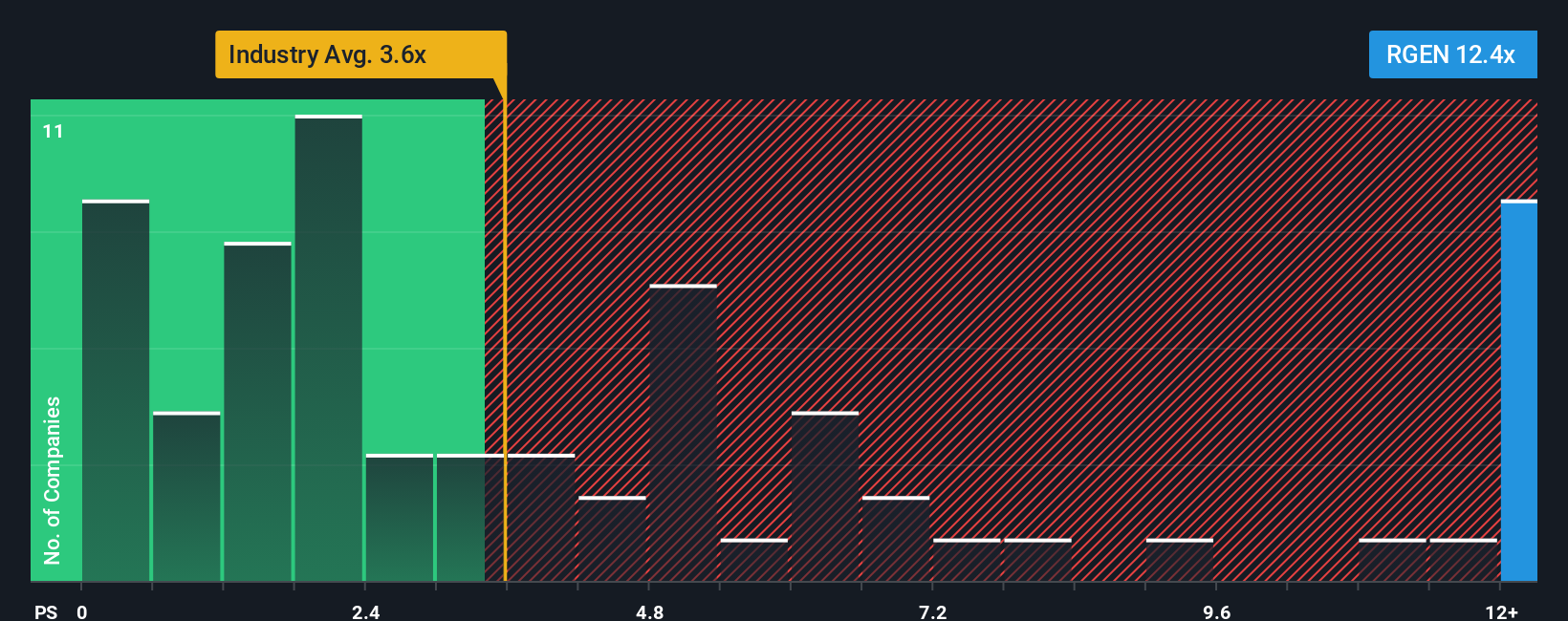

Another View: Multiples Tell a Different Story

While our fair value models see upside for Repligen, a quick look at the price-to-sales multiple raises eyebrows. The company trades at 11.8x sales, which is much pricier than both the US Life Sciences industry average of 3.4x and the fair ratio of 5.2x. This significant gap may suggest the shares are at risk of being overvalued if the company’s sales growth slows or if market sentiment changes. Can Repligen justify this premium, or will the market bring its valuation back down to earth?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Repligen Narrative

If you see things differently, or want to dive deeper into Repligen’s numbers yourself, it only takes a few minutes to craft your own perspective. Do it your way

A great starting point for your Repligen research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let your next winning stock slip by. Now is the time to broaden your horizons and secure fresh opportunities using our proven screeners.

- Capitalize on tomorrow’s technology by checking out these 26 AI penny stocks quietly making headlines in artificial intelligence innovation.

- Lock in steady income as you uncover companies offering exceptional yields with these 22 dividend stocks with yields > 3% and turn dividends into lasting financial growth.

- Ride the momentum of market trends as you tap into these 81 cryptocurrency and blockchain stocks leading the charge in digital assets and blockchain breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RGEN

Repligen

A life sciences company, develops and commercializes bioprocessing technologies and systems in North America, Europe, the Asia Pacific, and internationally.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives