- United States

- /

- Life Sciences

- /

- NasdaqGS:RGEN

A Look at Repligen’s (RGEN) Valuation Following Recent Share Price Gains

Reviewed by Simply Wall St

See our latest analysis for Repligen.

Following its swift rebound, Repligen’s share price has surged over 34% in the last three months. Momentum appears to be on the rise, despite only modest gains in total shareholder return over the past year. Investors seem optimistic that this positive swing signals improving sentiment amid evolving industry dynamics.

If you’re curious where else biotech momentum is building, why not check out our healthcare stocks screener for more discovery opportunities? See the full list for free.

Given the brisk rally and ongoing optimism, investors are left to ask whether Repligen remains undervalued at current levels or if the recent surge means the market is already factoring in the company’s future growth prospects.

Most Popular Narrative: 13% Undervalued

With Repligen's fair value pegged at $187 and a last close of $162.51, the narrative suggests notable upside remains for the stock. The storyline fueling this view leans heavily on sector recovery and improving margins as catalysts for further gains.

Record multi-quarter book-to-bill ratios and robust funnel positions the company for above-market revenue increases as therapy pipelines expand and demand for advanced bioprocessing solutions rises. Repligen is investing in expanding dual manufacturing (U.S. and Europe) and increasing APAC presence to address growing customer demand for greater supply chain security and regionalization, which should drive resilient sales globally and reduce revenue concentration risk.

Curious what powers this bullish calculation? Hints: Breakneck growth, innovative new launches and ambitious margin targets set the tone, but the real story lies in the ambitious earnings turnaround and a projected future profit multiple rarely seen outside high-flying growth stocks. Unlock the numbers behind the price. Click to explore how analysts justify the fair value for Repligen.

Result: Fair Value of $187 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained weak biotech funding or prolonged regulatory uncertainty could still challenge Repligen’s growth outlook and test the durability of this renewed momentum.

Find out about the key risks to this Repligen narrative.

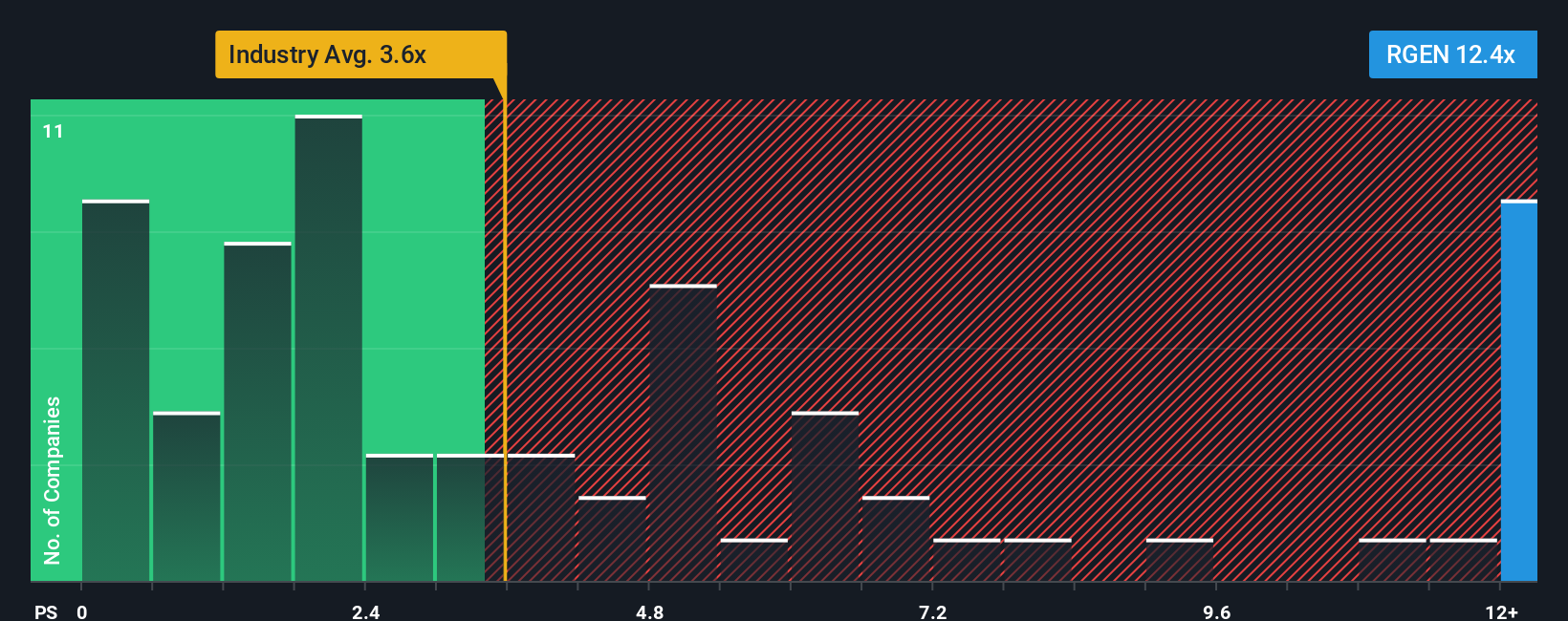

Another View: Expensive by Sales Ratio

While fair value estimates point to Repligen being undervalued, a glance at its price-to-sales ratio tells a different story. Shares trade at 12.9x sales, much higher than both the US Life Sciences industry average of 3.7x and peer average of 3.3x. The market's current appetite is well above what our fair ratio of 5.3x suggests is healthy, raising a yellow flag about valuation risk if momentum fades. Could patient investors face headwinds if sentiment shifts?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Repligen Narrative

If you have a different perspective or want to dig into Repligen’s figures for yourself, it only takes a few minutes to explore and build your own viewpoint. Do it your way

A great starting point for your Repligen research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let other promising stocks pass you by. The Simply Wall Street Screener brings you fresh opportunities that could reshape your investment strategy for the better.

- Capture hidden potential with these 922 undervalued stocks based on cash flows, offering attractive entry points based on discounted future cash flows and solid fundamentals.

- Turbocharge your portfolio returns by targeting strong returns from these 15 dividend stocks with yields > 3%, with yields above 3% and steady payout histories.

- Ride the wave of technological change by checking out these 26 AI penny stocks, accelerating growth in AI-driven innovation and automation advancements.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RGEN

Repligen

A life sciences company, develops and commercializes bioprocessing technologies and systems in North America, Europe, the Asia Pacific, and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives