- United States

- /

- Pharma

- /

- NasdaqCM:RGC

Regencell Bioscience Holdings (RGC) Is Up 13.2% After Index Addition and Positive Trial Results—Has the Story Changed?

Reviewed by Sasha Jovanovic

- In September 2025, Regencell Bioscience Holdings was added to the S&P Global BMI Index and reported positive results from its second efficacy trial for ADHD and autism spectrum disorder, with no adverse side effects observed.

- This combination of index inclusion and promising trial data has elevated investor attention, even as the company has yet to generate revenue or secure regulatory approvals.

- We'll explore how the company's index inclusion and clinical progress shape Regencell's investment narrative moving forward.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

What Is Regencell Bioscience Holdings' Investment Narrative?

For anyone watching Regencell Bioscience Holdings, the investment story comes down to belief in successful commercialization of its Traditional Chinese Medicine treatments for ADHD and autism spectrum disorder. The September 2025 news, index inclusion and strong Phase II trial results, might look like inflection points, especially as the company reported mean symptom improvement of 37% with no adverse effects. These updates have likely amplified near-term interest and seem to have driven a very large surge in the share price over recent months, implying material short-term impact as institutional and passive flows respond to the index addition. Still, the fundamental risks remain: Regencell has yet to record any revenue, is unprofitable, and faces an uncertain regulatory path before any approved product can hit the market. While its financials are showing gradual improvement in terms of narrowing losses, the critical catalysts now are regulatory approvals and evidence of revenue traction, both of which remain unproven. The recent news has moved one key risk, financing and liquidity, further into the background, but the company’s long-term story still hinges on clinical and commercial milestones.

However, regulatory uncertainty remains a critical factor investors should be aware of.

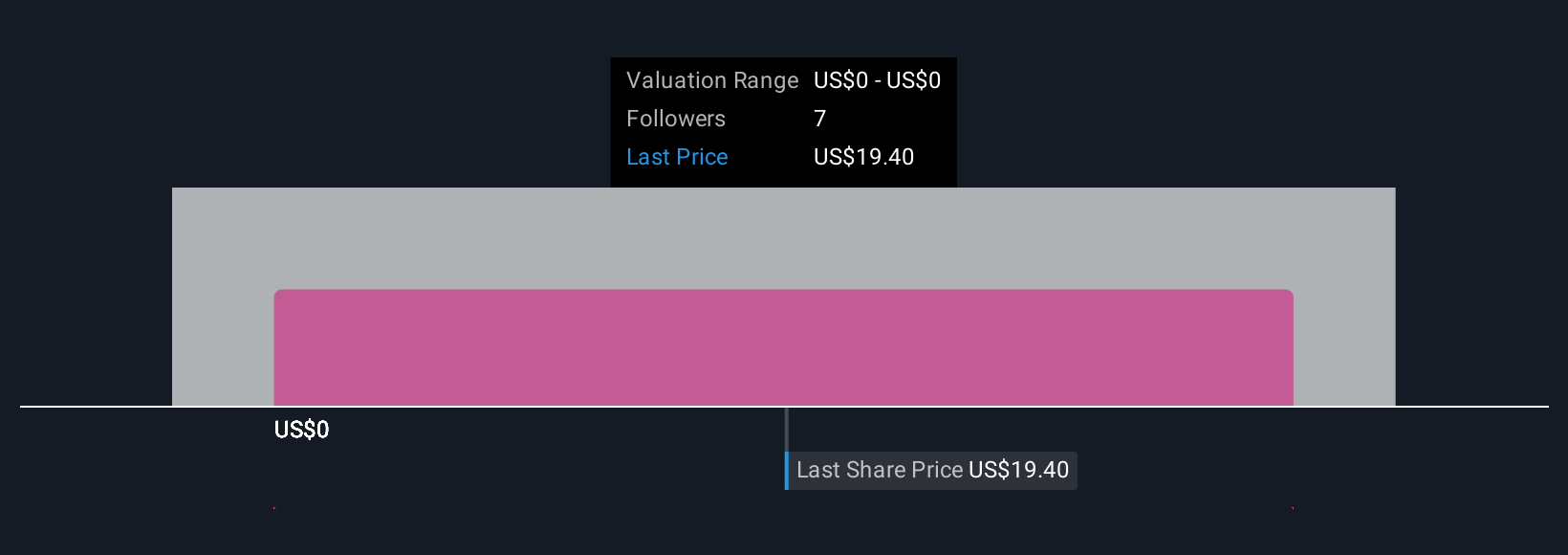

According our valuation report, there's an indication that Regencell Bioscience Holdings' share price might be on the expensive side.Exploring Other Perspectives

Build Your Own Regencell Bioscience Holdings Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Regencell Bioscience Holdings research is our analysis highlighting 3 important warning signs that could impact your investment decision.

- Our free Regencell Bioscience Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Regencell Bioscience Holdings' overall financial health at a glance.

Searching For A Fresh Perspective?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:RGC

Regencell Bioscience Holdings

Operates as a Traditional Chinese medicine (TCM) bioscience company in Hong Kong.

Flawless balance sheet with low risk.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026