- United States

- /

- Biotech

- /

- NasdaqGS:REGN

Is Regeneron’s (REGN) ModeX Collaboration and Strong Q3 Earnings Shifting Its Antibody Growth Story?

Reviewed by Sasha Jovanovic

- Regeneron Pharmaceuticals recently reported strong third-quarter earnings and engaged in new collaborations, including a license and development agreement with ModeX Therapeutics and an amended partnership with JW Therapeutics, as announced by its partners in the days leading up to November 6, 2025.

- These developments highlight Regeneron's ongoing efforts to expand its antibody pipeline and reinforce its role in advancing multispecific therapies with significant commercial potential.

- We'll now explore how Regeneron's ModeX Therapeutics partnership and robust results may further strengthen its investment narrative and growth outlook.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Regeneron Pharmaceuticals Investment Narrative Recap

Regeneron’s investment story rests on confidence in its ability to offset patent and pricing pressure on key drugs like EYLEA with pipeline-driven growth, notably from advances in immunology and oncology. The recently announced ModeX collaboration, expanded JW Therapeutics agreement, and strong quarterly earnings demonstrate continued progress, but do not materially change the immediate key catalyst: the successful ramp and regulatory expansion of EYLEA HD. However, the biggest risk remains competitive headwinds and pricing pressures on EYLEA, which these developments do little to reduce.

Of the recent announcements, the ModeX Therapeutics partnership stands out. By combining ModeX’s multispecific antibody technology with Regeneron’s platforms, the collaboration is directly relevant to Regeneron’s need to strengthen its pipeline and address skepticism about long-term earnings sources beyond EYLEA and Dupixent, a crucial point given persistent concerns over future margin compression.

Yet, investors should not overlook the ongoing risk from accelerating biosimilar competition in EYLEA’s core market, which...

Read the full narrative on Regeneron Pharmaceuticals (it's free!)

Regeneron Pharmaceuticals' outlook projects $16.6 billion in revenue and $5.0 billion in earnings by 2028. This implies a 5.4% annual revenue growth rate and a $0.5 billion earnings increase from $4.5 billion currently.

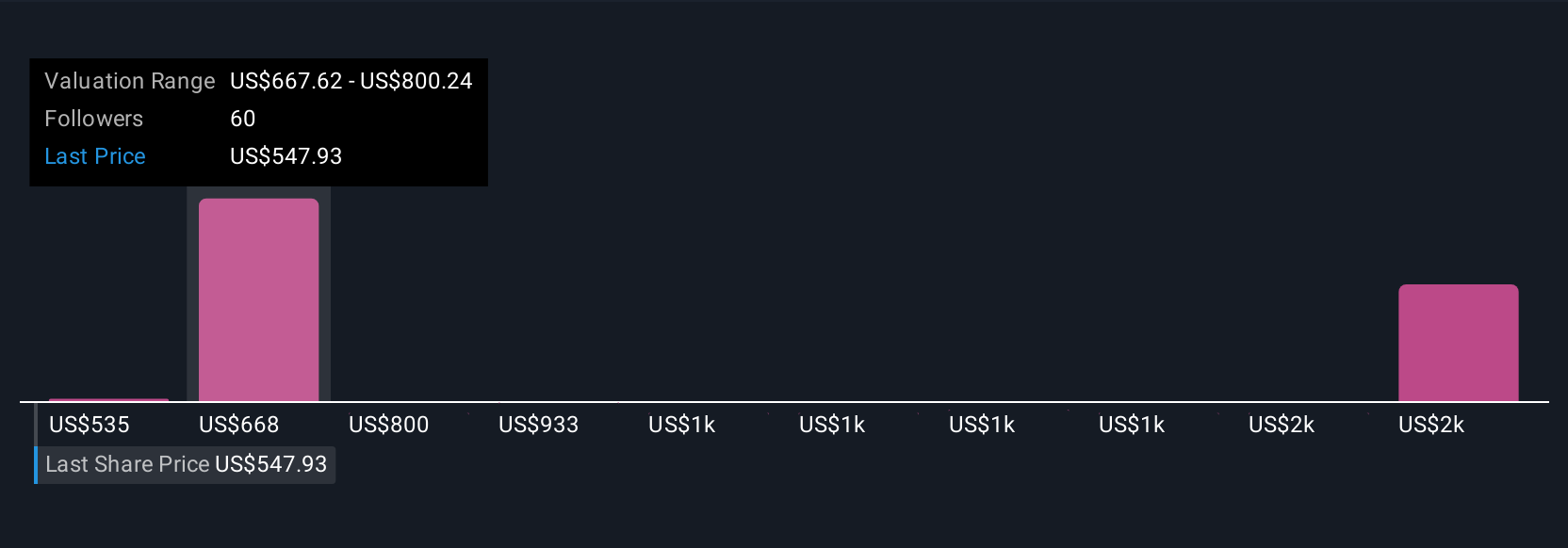

Uncover how Regeneron Pharmaceuticals' forecasts yield a $735.72 fair value, a 14% upside to its current price.

Exploring Other Perspectives

While consensus expectations are measured, the most optimistic analysts forecast Regeneron’s revenues rising to US$17,800,000,000 and earnings reaching US$6,200,000,000 by 2028, driven by best-in-class drug launches and rapid global growth. If you’re considering how robust partnerships and new product candidates could reshape forecasts, remember that views on risks like biosimilar threats can differ widely, so it’s worth exploring several different scenarios.

Explore 10 other fair value estimates on Regeneron Pharmaceuticals - why the stock might be worth over 2x more than the current price!

Build Your Own Regeneron Pharmaceuticals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Regeneron Pharmaceuticals research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Regeneron Pharmaceuticals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Regeneron Pharmaceuticals' overall financial health at a glance.

Searching For A Fresh Perspective?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:REGN

Regeneron Pharmaceuticals

Regeneron Pharmaceuticals, Inc. discovers, invents, develops, manufactures, and commercializes medicines for treating various diseases worldwide.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives