- United States

- /

- Biotech

- /

- NasdaqGS:REGN

Is Regeneron a Value Opportunity After Fresh FDA Approvals and 24% Price Drop?

Reviewed by Bailey Pemberton

- Curious about whether Regeneron Pharmaceuticals is a bargain or overpriced right now? You are not alone, and we are about to dig deep into what makes the stock compelling (or not) for investors looking at value.

- After starting the year with a 12.2% drop and falling 24.0% over the past year, Regeneron's shares have shown signs of a rebound with a 4.7% climb in the last month. However, this past week saw a slight 4.0% dip.

- Recent headlines point to new FDA approvals for Regeneron's latest products, as well as progress in its pipeline partnerships with major pharmaceutical firms. These news items are driving fresh interest and may be changing the market's outlook on Regeneron's growth versus its risks.

- The company's current valuation checks result in a score of 5 out of 6, making it one of the stronger names in the sector on value. Next, we will break down the standard ways investors assess worth. Keep reading, as we will also highlight a smarter way to spot true value before we wrap up.

Approach 1: Regeneron Pharmaceuticals Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's value by projecting its future cash flows and then discounting those future amounts back to today's dollars. This approach aims to calculate what the business is intrinsically worth, based on how much cash it can generate for its shareholders over time.

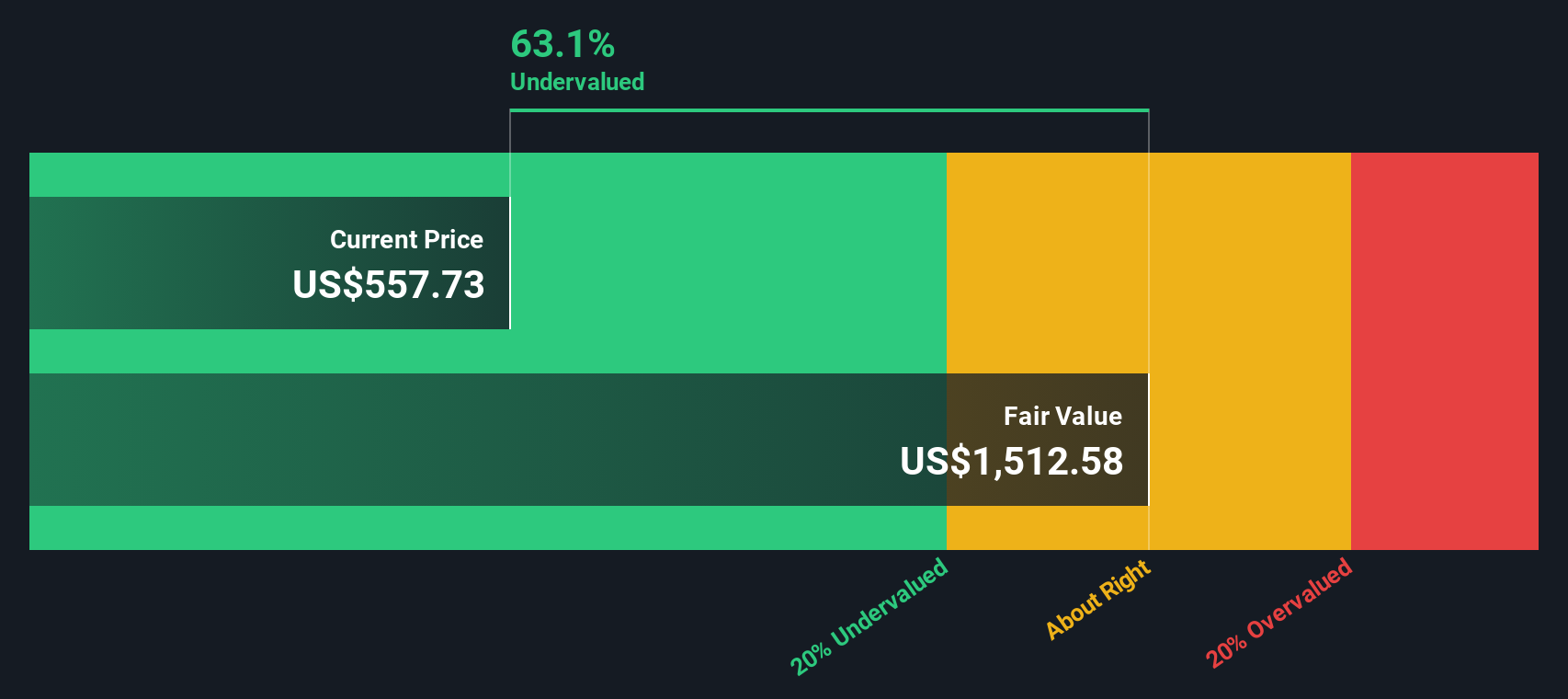

For Regeneron Pharmaceuticals, the most recent Free Cash Flow is $4.0 Billion, and analysts forecast this cash flow to grow each year, reaching $6.2 Billion by 2029. Although analyst projections extend for about five years, Simply Wall St also extrapolates further into the future to estimate Free Cash Flows up to 2035 for a comprehensive long-term outlook.

Based on the 2 Stage Free Cash Flow to Equity model, the DCF analysis calculates a fair value of $1,553.79 per share. This suggests Regeneron is currently trading at a 59.6% discount to its intrinsic value, which may point to substantial undervaluation relative to what the DCF model indicates.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Regeneron Pharmaceuticals is undervalued by 59.6%. Track this in your watchlist or portfolio, or discover 840 more undervalued stocks based on cash flows.

Approach 2: Regeneron Pharmaceuticals Price vs Earnings

For companies like Regeneron Pharmaceuticals that are consistently profitable, the Price-to-Earnings (PE) ratio is a go-to metric for understanding valuation. The PE ratio helps investors see how much they are paying for each dollar of current earnings, making it especially useful for comparing established, earnings-generating firms.

Generally, a "normal" or fair PE ratio takes expected earnings growth and risk into account. Faster-growing, less risky companies tend to trade at higher PE multiples, while slower or riskier businesses command lower ones. Beyond simple comparisons, it is important to consider what drives these numbers.

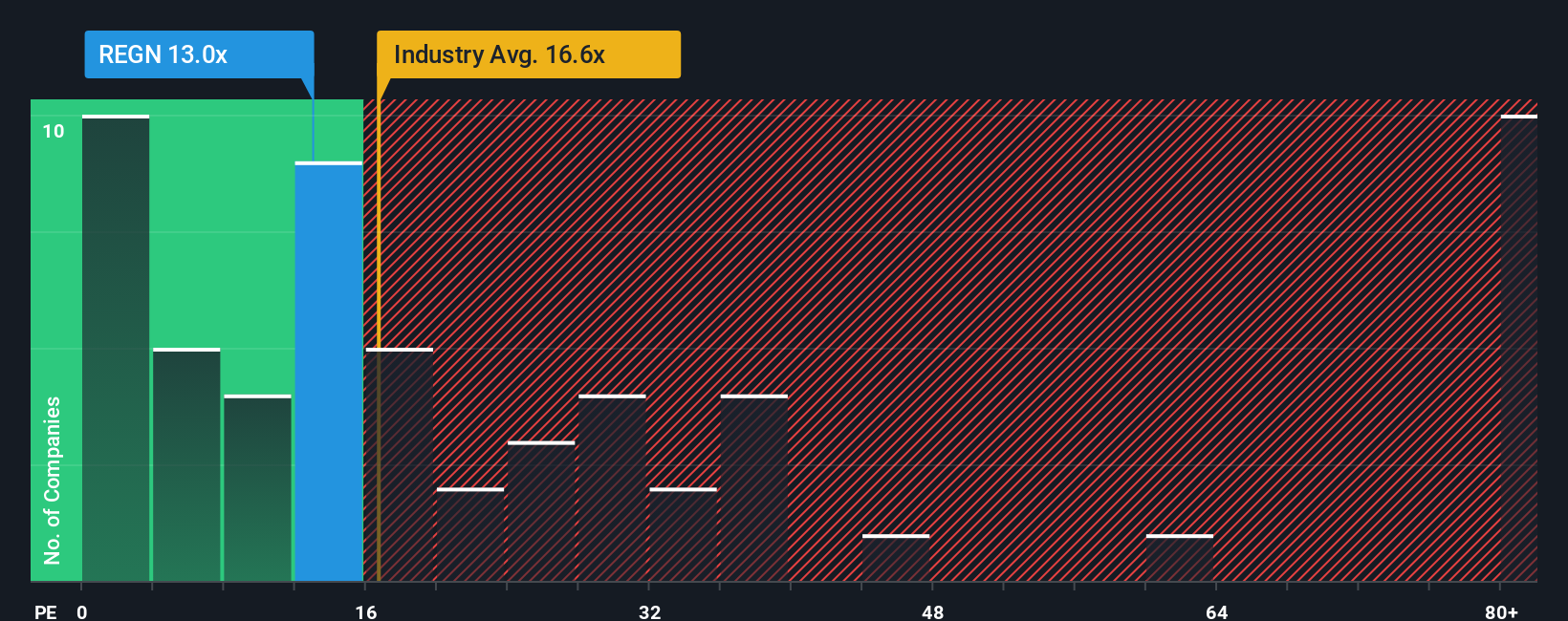

As of now, Regeneron trades at a PE ratio of 14.1x. This sits below both the Biotechs industry average of 16.9x and the peer average of 21.4x. At first glance, this suggests Regeneron may be undervalued based on standard benchmarks.

Simply Wall St's proprietary "Fair Ratio" takes things a step further. Unlike basic peer or industry comparisons, the Fair Ratio factors in earnings growth, company-specific risks, profit margins, and market cap. For Regeneron, the Fair Ratio is 26.1x, significantly above the company’s current 14.1x. This higher Fair Ratio reflects Regeneron's strong profit growth and healthy margins, showing that traditional comparisons might undervalue the stock’s true potential.

Since Regeneron's actual PE is significantly below its Fair Ratio, this points to meaningful undervaluation.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1411 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Regeneron Pharmaceuticals Narrative

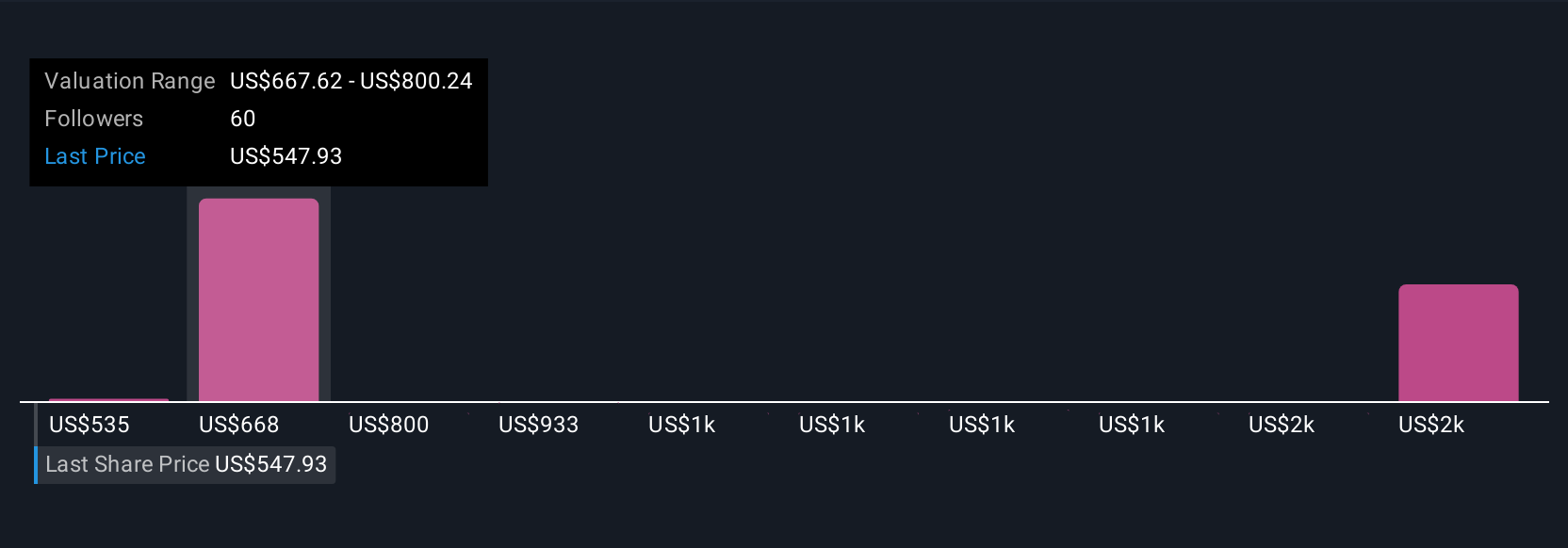

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a personalized story you create about a company, linking together your views about its future business prospects, estimated financial performance, and a fair value for its shares. Instead of just relying on standard models and ratios, Narratives give context to the numbers by connecting your expectations for Regeneron's revenues, margins, and risks to a concrete price target.

This approach helps transform investment decisions. Narratives make it easy for you to see how a company’s story shapes its numbers and thus its real worth. On Simply Wall St’s Community page, millions of investors now use Narratives as an accessible, intuitive tool to express their outlook and instantly see whether the stock is undervalued or overvalued. Importantly, Narratives update dynamically as new information such as fresh earnings, product launches, or regulatory news hits the market, ensuring your view remains current and relevant.

For example, some investors currently see Regeneron’s fair value as high as $890 if rapid drug adoption continues, while others set it as low as $543 if competition intensifies and margins shrink. Narratives help you quickly compare these perspectives, challenge your own assumptions, and decide with confidence when to buy, hold, or sell.

Do you think there's more to the story for Regeneron Pharmaceuticals? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:REGN

Regeneron Pharmaceuticals

Regeneron Pharmaceuticals, Inc. discovers, invents, develops, manufactures, and commercializes medicines for treating various diseases worldwide.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives