- United States

- /

- Biotech

- /

- NasdaqGS:REGN

How Regeneron’s FDA Approvals and Recent Price Jump Impact Its 2025 Valuation

Reviewed by Bailey Pemberton

- Ever wondered if Regeneron Pharmaceuticals is a steal at its current price, or if there are hidden risks the market is missing? Let's dive right in to see what sets this stock apart from others in the biotech world.

- Regeneron's share price has surged 21.8% over the past month and is up 7.6% in just the last week, although it is still down 7.2% over the past year. Those swings point to shifting investor sentiment and a company that is rapidly moving in and out of favor.

- In recent weeks, headlines have highlighted Regeneron's latest FDA approvals as well as positive results from pipeline drugs, which have fueled renewed investor optimism. These announcements came amid broader industry discussions about breakthroughs in biologics and competition in new therapeutic areas.

- When it comes to valuation, Regeneron scores a strong 5 out of 6 on our checklist for undervaluation, making it a standout in its sector. Next, let's explore what goes into this score and the valuation approaches that matter most. At the end, we will look at an even better way to understand whether Regeneron's price is truly justified.

Approach 1: Regeneron Pharmaceuticals Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model forecasts a company's future free cash flows and then discounts them back to today to estimate what the business is worth at present. The idea is to determine how much value the company can produce for its shareholders over time, adjusting for the time value of money.

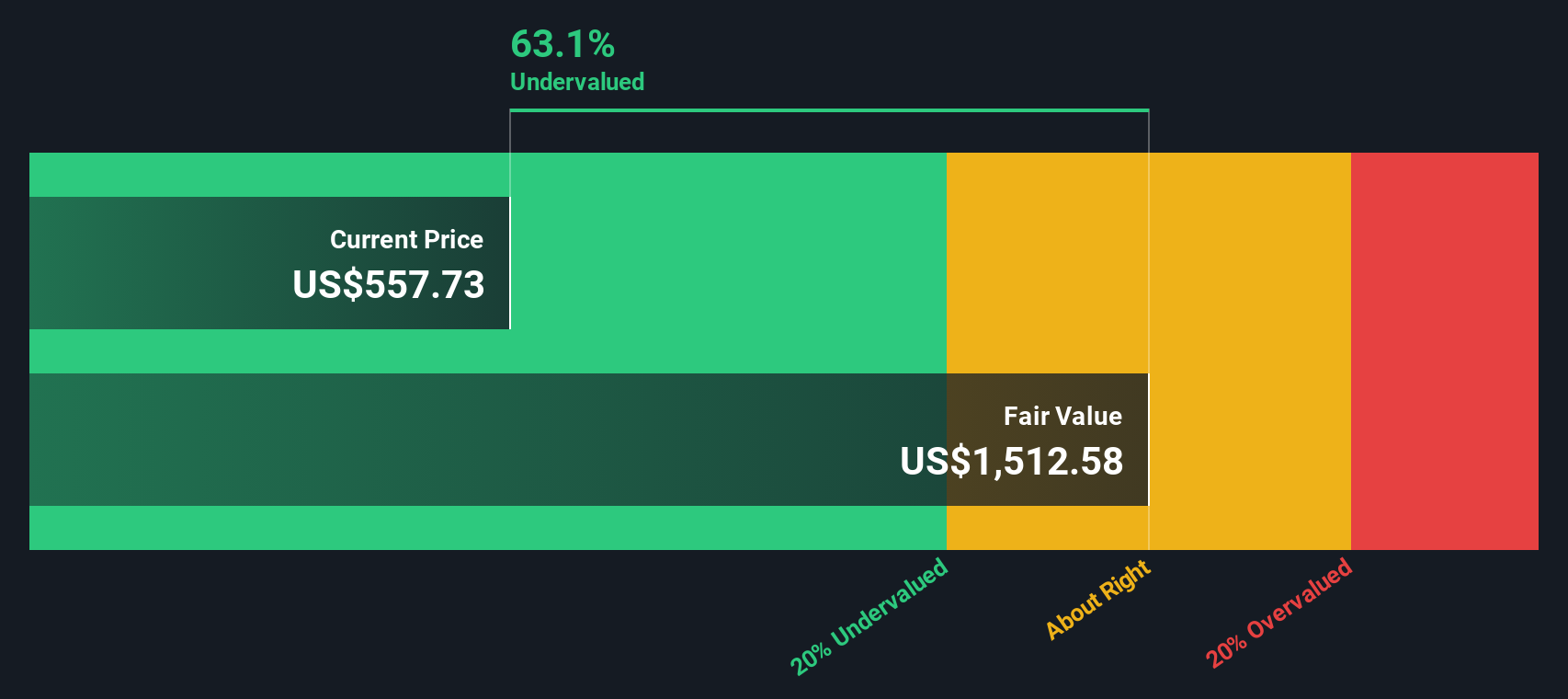

For Regeneron Pharmaceuticals, the most recent twelve months saw free cash flow of $4.0 Billion. Analyst forecasts suggest this figure will grow steadily, reaching approximately $6.1 Billion by the end of 2029. Beyond that, cash flows are extrapolated based on reasonable growth rates, as provided by Simply Wall St.

Applying the 2 Stage Free Cash Flow to Equity model, Regeneron's estimated intrinsic value comes to $1,522.71 per share. This value is notably higher than the current share price, suggesting a DCF-inferred discount of 53.7%. According to this model, Regeneron's stock is trading well below its projected worth.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Regeneron Pharmaceuticals is undervalued by 53.7%. Track this in your watchlist or portfolio, or discover 894 more undervalued stocks based on cash flows.

Approach 2: Regeneron Pharmaceuticals Price vs Earnings (PE)

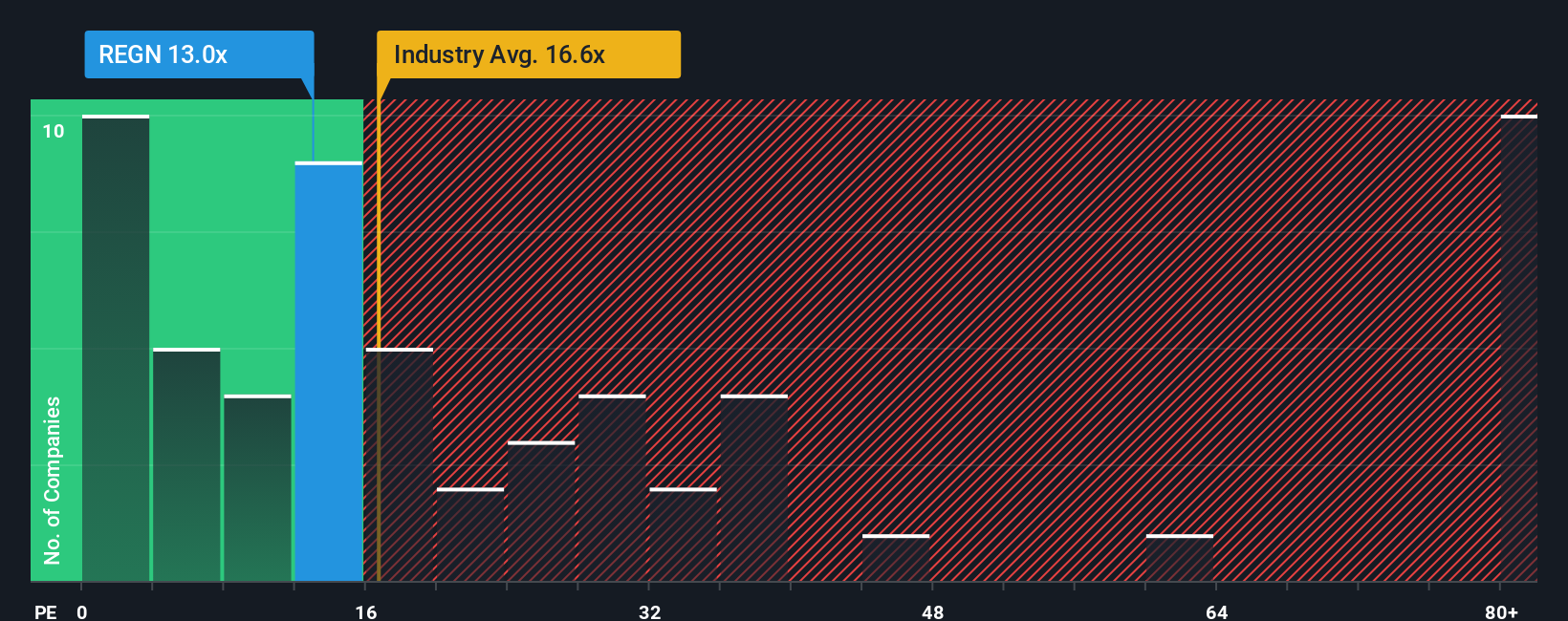

The Price-to-Earnings (PE) ratio is one of the most widely used metrics for valuing profitable companies like Regeneron Pharmaceuticals. By comparing the company’s current share price to its earnings per share, the PE ratio gives investors a snapshot of how much they are paying for each dollar of earnings.

The “right” PE ratio is influenced by several factors, including a company’s expected growth rate, risk profile, and overall industry conditions. Higher anticipated growth and lower risk typically justify a higher PE multiple, while slower growth and greater uncertainty can push the ratio down.

Currently, Regeneron is trading at a PE of 15.8x. This is below both the Biotechs industry average of 17.4x and the average of its closest peers at 22.6x. At first glance, this might suggest the stock is attractively priced compared to others in the sector.

However, the Simply Wall St “Fair Ratio” offers a more nuanced perspective. Instead of just comparing to industry averages or peers, the Fair Ratio incorporates Regeneron’s earnings growth potential, profit margins, risk factors, industry classification, and market capitalization. This proprietary approach aims to deliver a more tailored estimate of what the company’s multiple should be based on its specific circumstances.

Regeneron’s Fair Ratio is calculated at 26.4x, which is notably higher than its current PE of 15.8x. This significant gap suggests the stock is undervalued even after factoring in its unique growth and risk profile, not merely relative to peers but on its own merits.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1417 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Regeneron Pharmaceuticals Narrative

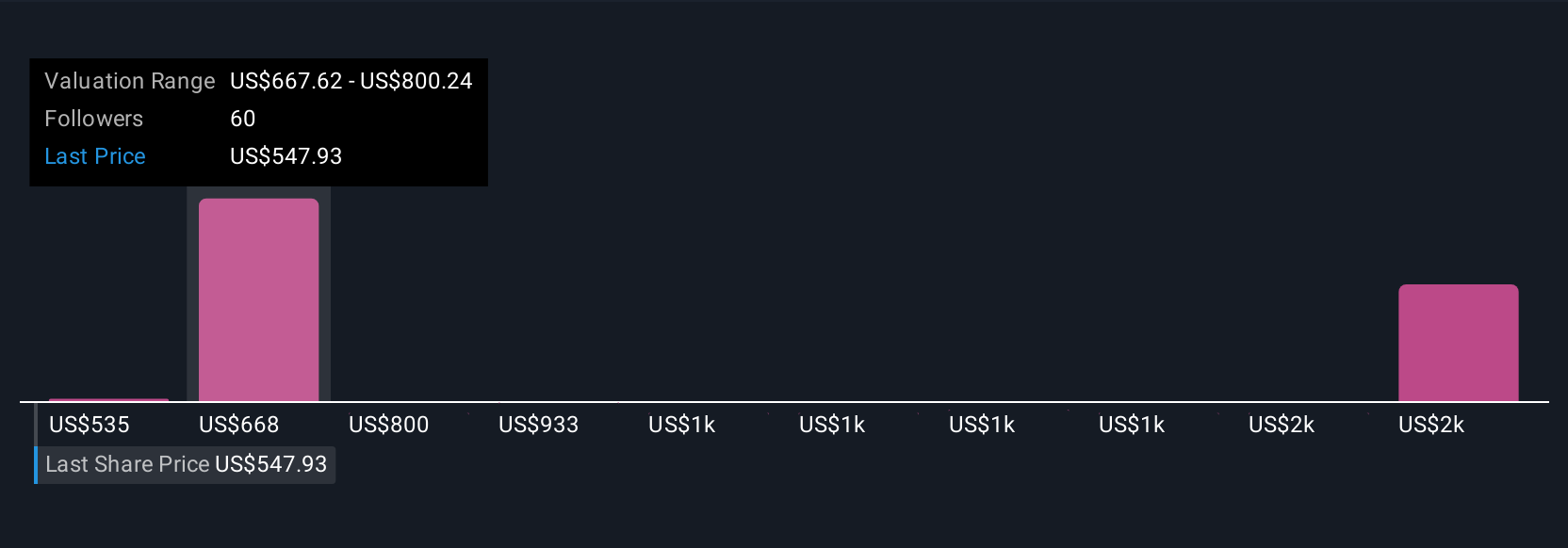

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is simply your story about a company’s outlook, connecting your view of its future (such as where revenue, margins, and earnings are headed) to what you believe the stock is actually worth. On Simply Wall St’s popular Community page, millions of investors use Narratives to lay out their assumptions, forecast financials, and link these directly to a fair value estimate in a way that is much more transparent and interactive than traditional metrics alone.

With Narratives, you can quickly see how your investment thesis stacks up: compare your Fair Value against the current share price to decide if now is the right time to buy or sell. Since Narratives are updated dynamically when news breaks or earnings are announced, you will always have a living view of what is driving Regeneron’s outlook, not just what was true last quarter. For example, one investor might see major pipeline launches and global expansion justifying a Fair Value of $890.00, while another, more cautious, may assign just $543.00 based on concerns about competition and regulatory risks.

Do you think there's more to the story for Regeneron Pharmaceuticals? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:REGN

Regeneron Pharmaceuticals

Regeneron Pharmaceuticals, Inc. discovers, invents, develops, manufactures, and commercializes medicines for treating various diseases worldwide.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives