- United States

- /

- Biotech

- /

- NasdaqGS:REGN

How Cemdisiran’s Phase 3 Success at Regeneron Pharmaceuticals (REGN) Has Changed Its Investment Story

Reviewed by Simply Wall St

- Regeneron Pharmaceuticals recently announced that its Phase 3 NIMBLE trial evaluating cemdisiran monotherapy in adults with generalized myasthenia gravis met both primary and key secondary endpoints, marking a significant milestone for the company’s pipeline.

- This advancement highlights Regeneron’s ongoing progress in rare disease therapeutics, underscoring the company’s commitment to expanding its portfolio of innovative treatments.

- We’ll examine how these successful Phase 3 results for cemdisiran strengthen Regeneron’s investment narrative and future growth potential.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Regeneron Pharmaceuticals Investment Narrative Recap

To be a Regeneron shareholder today, you have to believe in the company's ability to defend its core franchises against biosimilar competition, offsetting any EYLEA headwinds with advances like its deep rare disease pipeline and ongoing label expansion for existing blockbusters. The recent positive Phase 3 cemdisiran results are encouraging for the pipeline, but do not meaningfully change the fact that the biggest near-term catalyst remains the resolution of EYLEA HD’s regulatory delays. The largest risk continues to center on branded and biosimilar competition for EYLEA, which could erode revenue and margins if sales decline faster than new products ramp up. Among recent announcements, the FDA’s decision to extend target action dates for two EYLEA HD submission reviews to Q4 2025 is the most relevant. Any additional regulatory holdups on EYLEA HD could weigh heavily on Regeneron’s near-term growth prospects and ability to stabilize revenue as biosimilars gain traction. While cemdisiran’s clinical success is a positive, all eyes are still on if and when EYLEA HD can clear regulatory hurdles and reach broader patient populations. Yet, investors should also be aware that unresolved manufacturing issues for EYLEA HD mean continued uncertainty around the timeline for...

Read the full narrative on Regeneron Pharmaceuticals (it's free!)

Regeneron Pharmaceuticals is projected to achieve $16.6 billion in revenue and $5.0 billion in earnings by 2028. This outlook assumes a 5.4% annual revenue growth rate and an increase in earnings of $0.5 billion from the current $4.5 billion.

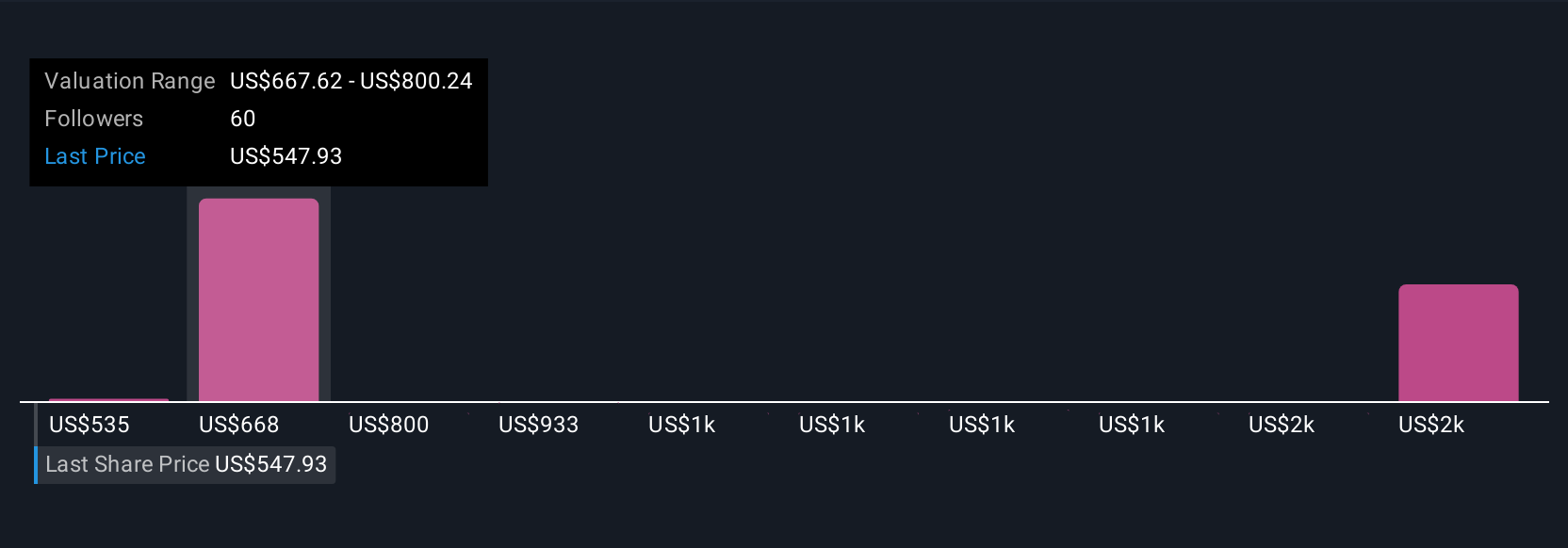

Uncover how Regeneron Pharmaceuticals' forecasts yield a $716.87 fair value, a 25% upside to its current price.

Exploring Other Perspectives

Compared to analyst consensus, bullish analysts expect much more robust earnings and revenue for Regeneron, forecasting US$6.2 billion in profits by 2028 if EYLEA HD overcomes its challenges. Their optimism is rooted in expectations for a faster adoption curve and bigger global share gains, reminding you that opinions vary widely and may shift depending on new data like the latest cemdisiran update.

Explore 9 other fair value estimates on Regeneron Pharmaceuticals - why the stock might be worth over 2x more than the current price!

Build Your Own Regeneron Pharmaceuticals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Regeneron Pharmaceuticals research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Regeneron Pharmaceuticals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Regeneron Pharmaceuticals' overall financial health at a glance.

Want Some Alternatives?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Explore 23 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:REGN

Regeneron Pharmaceuticals

Regeneron Pharmaceuticals, Inc. discovers, invents, develops, manufactures, and commercializes medicines for treating various diseases worldwide.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives