- United States

- /

- Biotech

- /

- NasdaqGS:REGN

A Fresh Look at Regeneron Pharmaceuticals (REGN) Valuation After FDA Approval Expands Eylea HD’s Market Potential

Reviewed by Simply Wall St

Regeneron Pharmaceuticals (REGN) just received FDA approval for its Eylea HD 8 mg injection to treat macular edema following retinal vein occlusion. This approval offers patients the possibility of fewer required treatments compared to previous options.

See our latest analysis for Regeneron Pharmaceuticals.

The FDA’s green light for Eylea HD comes after a burst of momentum for Regeneron. The company has seen a 30.8% share price return over the last month alone and several promising clinical updates making headlines. While the stock’s long-term total shareholder returns have been modest in recent years, recent momentum suggests investors are warming up again as new product approvals highlight the company’s growth potential.

If you’re interested in other healthcare stocks making headlines with breakthrough treatments, see the full list for free: See the full list for free.

With shares already rallying over 30% in the past month, are investors looking at a fresh buying opportunity in Regeneron, or has the latest FDA approval already been priced into the stock’s future growth?

Most Popular Narrative: Fairly Valued

With Regeneron's fair value estimate at $753, just a whisker below its last close of $755.90, the dominant narrative sees the stock priced almost precisely in line with expectations. The valuation hinges on catalysts and projected financial trends that justify a premium above recent trading levels.

The successful ramp of EYLEA HD, which is gaining physician adoption due to its clinical profile and durability, along with anticipated regulatory approvals for label enhancements (pending resolution of manufacturing site issues), could help offset patent/biosimilar pressures on legacy EYLEA, supporting stabilization and potential growth in core revenue and sustaining healthy margins over the next several years.

Curious why this price is no accident? Analysts pack their narrative with optimistic growth levers, volume expansion, margin defense, and a mix of bold financial assumptions that might surprise even the seasoned investor. Interested in what pricing power, profit targets, and future multiples really drive this valuation math? Find out what could tip the balance.

Result: Fair Value of $753 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing regulatory delays and mounting competition for Eylea could quickly challenge the current growth story. This introduces uncertainty into Regeneron’s outlook.

Find out about the key risks to this Regeneron Pharmaceuticals narrative.

Another View: Sizing Up Peer Comparisons

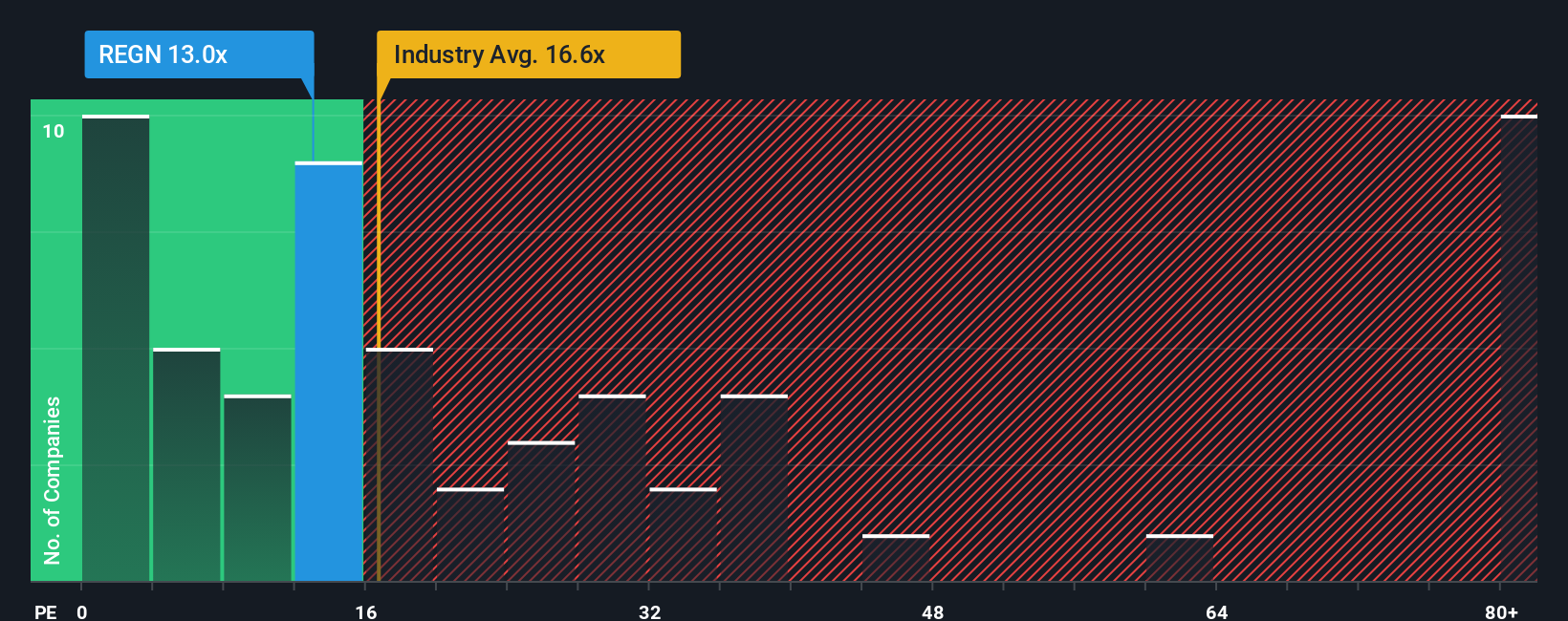

While the fair value narrative puts Regeneron right at its current price, a look at the price-to-earnings ratio tells a different story. At 16.9x, it trades below both the US Biotechs industry average (18.2x) and its peers (22.7x), and far below its fair ratio of 26.8x. This suggests the market could be underappreciating the company's fundamentals, which may offer more room for upside, or there could be a reason for caution.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Regeneron Pharmaceuticals Narrative

If you see things differently or want a deeper look into the numbers, you can assemble your personal take on Regeneron in just a few minutes, and Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Regeneron Pharmaceuticals.

Looking for More Smart Investment Ideas?

Don't let opportunity pass you by. Uncover cutting-edge possibilities with handpicked stock screens that reveal big potential. The next breakthrough could be yours to spot first.

- Target new frontiers in technology when you sift through these 26 quantum computing stocks for early-stage companies pushing quantum innovation toward real-world impact.

- Boost your income strategy by checking out these 16 dividend stocks with yields > 3%, where you’ll spot stocks with higher yields that may offer long-term growth and stability.

- Ride the AI wave and get ahead of industry trends by tapping into these 26 AI penny stocks which are transforming business with intelligent solutions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:REGN

Regeneron Pharmaceuticals

Regeneron Pharmaceuticals, Inc. discovers, invents, develops, manufactures, and commercializes medicines for treating various diseases worldwide.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives