- United States

- /

- Pharma

- /

- NasdaqGM:RAPP

Could RAP-219’s Upcoming Data Reveal a Turning Point for Rapport Therapeutics’ Pipeline Strategy (RAPP)?

Reviewed by Sasha Jovanovic

- Rapport Therapeutics announced it will present new efficacy and safety data from its Phase 2a trial of RAP-219 in focal onset seizures at the 2025 American Epilepsy Society Annual Meeting in December, including detailed analysis on treatment effects and baseline disease severity.

- This upcoming scientific meeting offers the first in-depth look at RAP-219's potential impact in focal onset seizures, with multiple presentations and a dedicated exhibit planned to engage clinicians and researchers.

- We'll explore how anticipation for updated RAP-219 trial results is shaping Rapport Therapeutics' investment narrative and scientific visibility.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Rapport Therapeutics' Investment Narrative?

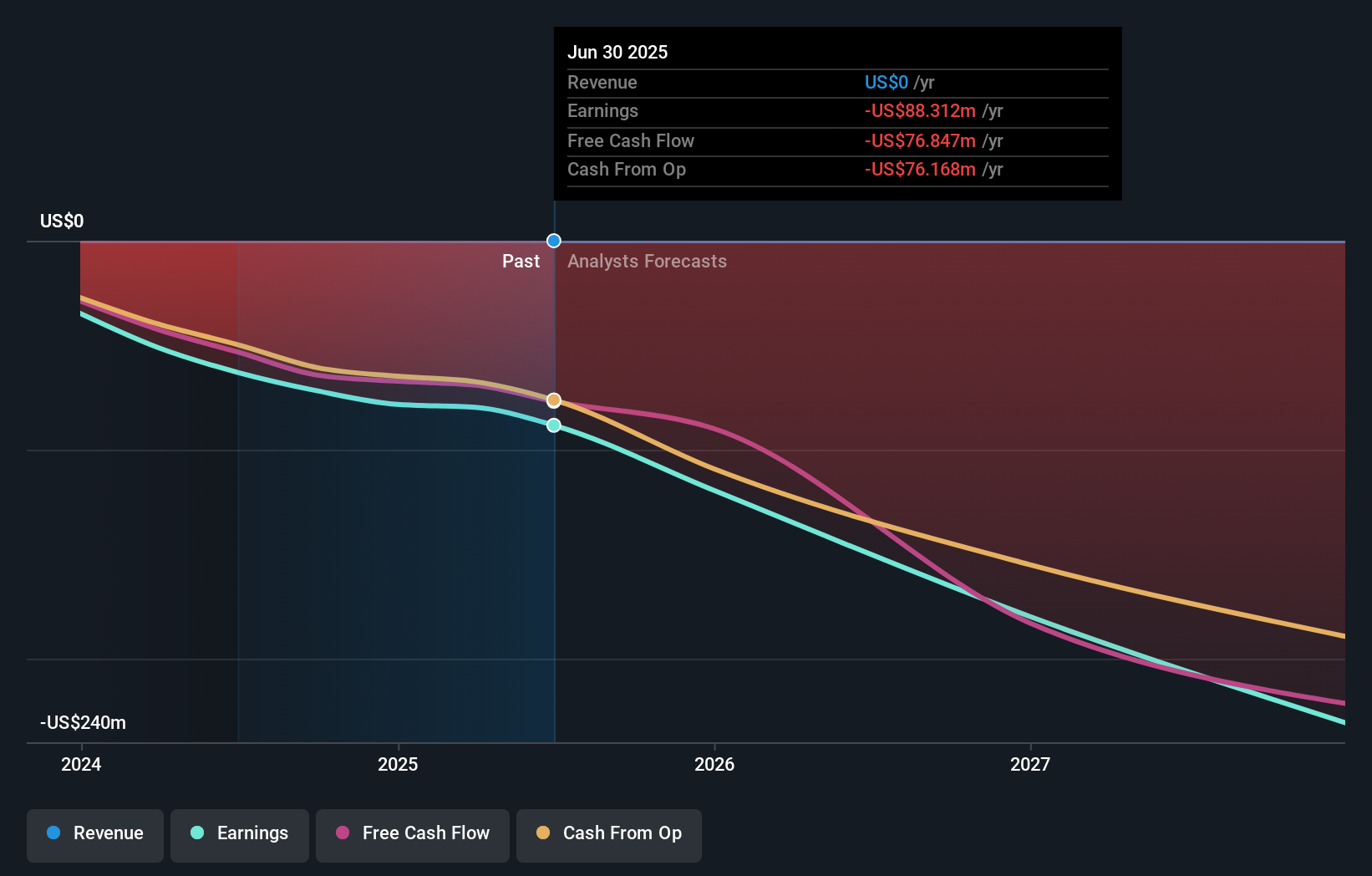

For anyone considering Rapport Therapeutics as an investment, the big picture centers on its ability to advance RAP-219 through clinical development while managing steep financial losses and a lack of current revenue. The company's most important near-term catalyst has been the anticipation for new, detailed Phase 2a trial data for RAP-219, a moment that has now arrived with the upcoming AES meeting announcement. This event provides fresh insights into the drug's performance, which could influence scientific sentiment and possibly shape future regulatory or partnership opportunities, both crucial levers for value creation in a pre-revenue biotech like Rapport. Notably, the heightened awareness surrounding this data may also affect the timing or perception of other risk factors, such as future dilution risk, given recent equity raises and a volatile share price. However, despite the scientific excitement, the business remains in a high-risk phase with persistent quarterly losses, no profits expected for years, and a relatively young board overseeing rapid change.

Yet, investors should keep in mind that significant share dilution and a lack of near-term profits could outweigh recent enthusiasm.

Exploring Other Perspectives

Explore another fair value estimate on Rapport Therapeutics - why the stock might be worth as much as 82% more than the current price!

Build Your Own Rapport Therapeutics Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Rapport Therapeutics research is our analysis highlighting 5 important warning signs that could impact your investment decision.

- Our free Rapport Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Rapport Therapeutics' overall financial health at a glance.

Interested In Other Possibilities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:RAPP

Rapport Therapeutics

Operates as a clinical-stage biopharmaceutical company that focuses on the discovery and development of transformational small molecule medicines for patients suffering from central nervous system (CNS) disorders.

Flawless balance sheet with moderate risk.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success