- United States

- /

- Pharma

- /

- NasdaqGM:RANI

Why Rani Therapeutics (RANI) Is Up 23.6% After Promising Oral Semaglutide Preclinical Data Release

Reviewed by Sasha Jovanovic

- Rani Therapeutics Holdings announced it would present preclinical data on its RaniPill® oral delivery platform at ObesityWeek® 2025, highlighting that oral semaglutide (RT-116) in dogs is bioequivalent to subcutaneous injections and produces similar weight loss.

- This research could generate interest, as it demonstrates the potential for the RaniPill to enable oral delivery of peptide drugs traditionally administered via injection.

- We'll examine how these promising preclinical results for oral semaglutide could impact Rani Therapeutics' long-term investment narrative.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 38 best rare earth metal stocks of the very few that mine this essential strategic resource.

Rani Therapeutics Holdings Investment Narrative Recap

To be a shareholder in Rani Therapeutics Holdings, you need to believe in the potential of its RaniPill® platform to transform oral delivery of biologics, especially in high-value markets like obesity. While the latest preclinical data on oral semaglutide show strong science, the most important near-term catalyst remains progress toward clinical trials and commercialization; however, the news does not materially alter the biggest risk, which is Rani’s need for additional funding as cash reserves are projected to last only into Q3 2025.

Among the recent developments, the closure of an approximately US$60.3 million private placement on October 23, 2025, is particularly relevant. This funding temporarily eases immediate capital constraints and may support continued R&D on programs like RT-116, but securing a long-term financial runway remains closely tied to how catalysts like preclinical milestones translate into clinical success.

In contrast, it’s important for investors to remain aware of ongoing cash flow risks as the company’s updated guidance indicates reserves may only extend to...

Read the full narrative on Rani Therapeutics Holdings (it's free!)

Rani Therapeutics Holdings is projected to reach $38.2 million in revenue and $8.9 million in earnings by 2028. This outlook assumes a 217.0% annual revenue growth rate and an earnings increase of about $38.6 million from the current -$29.7 million.

Uncover how Rani Therapeutics Holdings' forecasts yield a $9.50 fair value, a 332% upside to its current price.

Exploring Other Perspectives

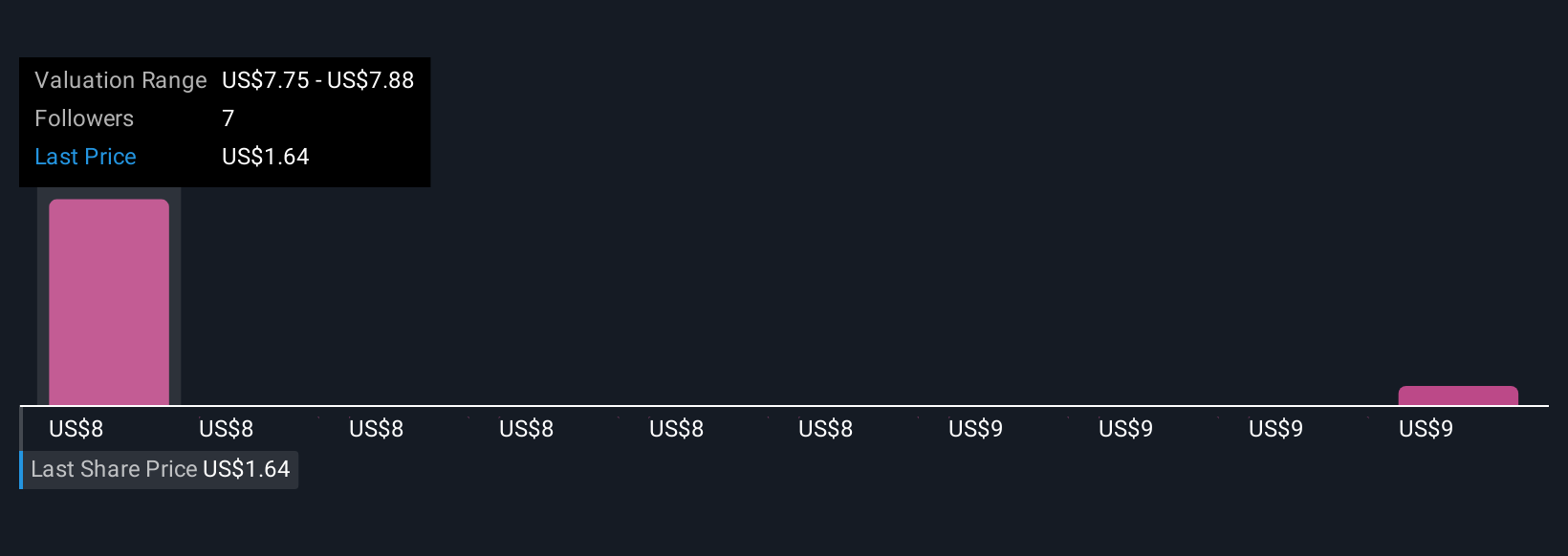

Three fair value estimates from the Simply Wall St Community cluster between US$9 and US$9.50 per share, suggesting some consensus before accounting for recent news. However, given Rani’s track record of operating losses and persistent funding needs, you may want to compare these views with your own expectations for future milestones and risks.

Explore 3 other fair value estimates on Rani Therapeutics Holdings - why the stock might be worth over 4x more than the current price!

Build Your Own Rani Therapeutics Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Rani Therapeutics Holdings research is our analysis highlighting 2 key rewards and 5 important warning signs that could impact your investment decision.

- Our free Rani Therapeutics Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Rani Therapeutics Holdings' overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Find companies with promising cash flow potential yet trading below their fair value.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:RANI

Rani Therapeutics Holdings

Operates as a clinical stage biotherapeutics company, focusing on technologies to enable the administration of biologics and drugs orally for patients, physicians, and healthcare systems with a alternative to painful injections in the United States.

Moderate risk with limited growth.

Market Insights

Community Narratives