- United States

- /

- Biotech

- /

- NasdaqGS:PTCT

Shareholders Are Raving About How The Therapeutics (NASDAQ:PTCT) Share Price Increased 515%

Generally speaking, investors are inspired to be stock pickers by the potential to find the big winners. Not every pick can be a winner, but when you pick the right stock, you can win big. One such superstar is PTC Therapeutics, Inc. (NASDAQ:PTCT), which saw its share price soar 515% in three years. In more good news, the share price has risen -0.5% in thirty days. We note that Therapeutics reported its financial results recently; luckily, you can catch up on the latest revenue and profit numbers in our company report.

It really delights us to see such great share price performance for investors.

Check out our latest analysis for Therapeutics

Therapeutics isn't a profitable company, so it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over the last three years Therapeutics has grown its revenue at 61% annually. That's much better than most loss-making companies. In light of this attractive revenue growth, it seems somewhat appropriate that the share price has been rocketing, boasting a gain of 83% per year, over the same period. It's always tempting to take profits after a share price gain like that, but high-growth companies like Therapeutics can sometimes sustain strong growth for many years. So we'd recommend you take a closer look at this one, or even put it on your watchlist.

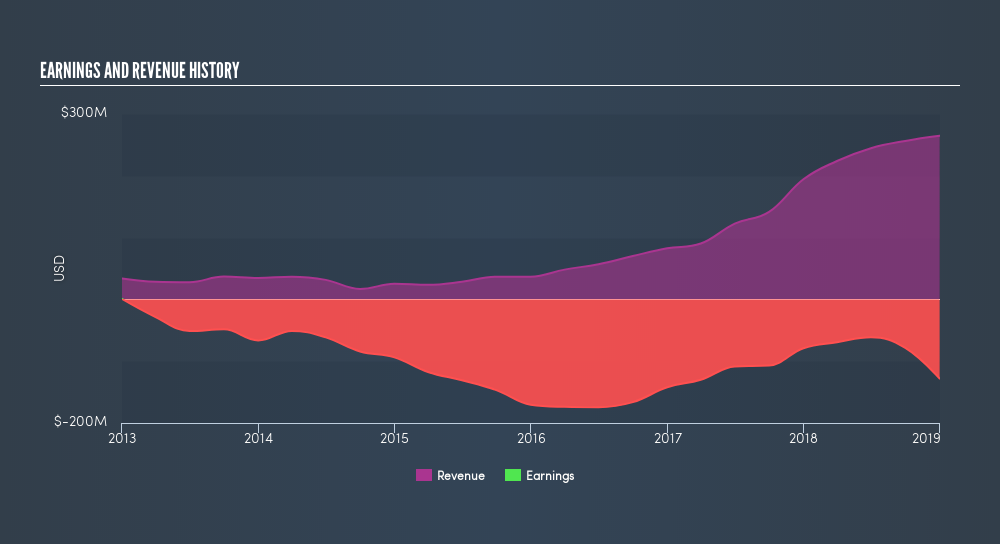

You can see how revenue and earnings have changed over time in the image below, (click on the chart to see cashflow).

You can see how its balance sheet has strengthened (or weakened) over time in this freeinteractive graphic.

A Different Perspective

We're pleased to report that Therapeutics shareholders have received a total shareholder return of 16% over one year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 1.9% per year), it would seem that the stock's performance has improved in recent times. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

Of course Therapeutics may not be the best stock to buy. So you may wish to see this freecollection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqGS:PTCT

PTC Therapeutics

A biopharmaceutical company, focuses on the discovery, development, and commercialization of medicines to children and adults living with rare disorders in the United States and internationally.

Good value with acceptable track record.

Similar Companies

Market Insights

Community Narratives