- United States

- /

- Biotech

- /

- NasdaqGS:PRTA

Unpleasant Surprises Could Be In Store For Prothena Corporation plc's (NASDAQ:PRTA) Shares

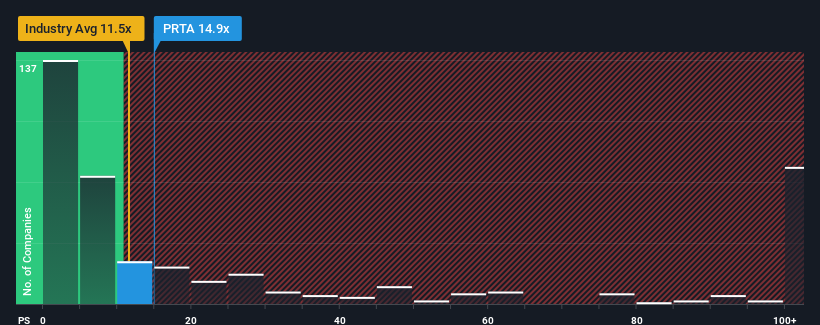

You may think that with a price-to-sales (or "P/S") ratio of 14.9x Prothena Corporation plc (NASDAQ:PRTA) is a stock to potentially avoid, seeing as almost half of all the Biotechs companies in the United States have P/S ratios under 11.5x and even P/S lower than 4x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

Check out our latest analysis for Prothena

How Prothena Has Been Performing

With revenue growth that's inferior to most other companies of late, Prothena has been relatively sluggish. It might be that many expect the uninspiring revenue performance to recover significantly, which has kept the P/S ratio from collapsing. If not, then existing shareholders may be very nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Prothena.How Is Prothena's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as high as Prothena's is when the company's growth is on track to outshine the industry.

Retrospectively, the last year delivered an exceptional 63% gain to the company's top line. This great performance means it was also able to deliver immense revenue growth over the last three years. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Shifting to the future, estimates from the nine analysts covering the company suggest revenue should grow by 40% each year over the next three years. Meanwhile, the rest of the industry is forecast to expand by 193% per annum, which is noticeably more attractive.

With this in consideration, we believe it doesn't make sense that Prothena's P/S is outpacing its industry peers. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Bottom Line On Prothena's P/S

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Despite analysts forecasting some poorer-than-industry revenue growth figures for Prothena, this doesn't appear to be impacting the P/S in the slightest. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. At these price levels, investors should remain cautious, particularly if things don't improve.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Prothena you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PRTA

Prothena

A late-stage clinical biotechnology company, focuses on discovery and development of novel therapies to treat diseases caused by protein dysregulation in the United States.

Excellent balance sheet with limited growth.

Market Insights

Community Narratives

Recently Updated Narratives

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026